Instructions For Form Pt-202 - Tax On Kero-Jet Fuel - New York State Department Of Taxation And Finance

ADVERTISEMENT

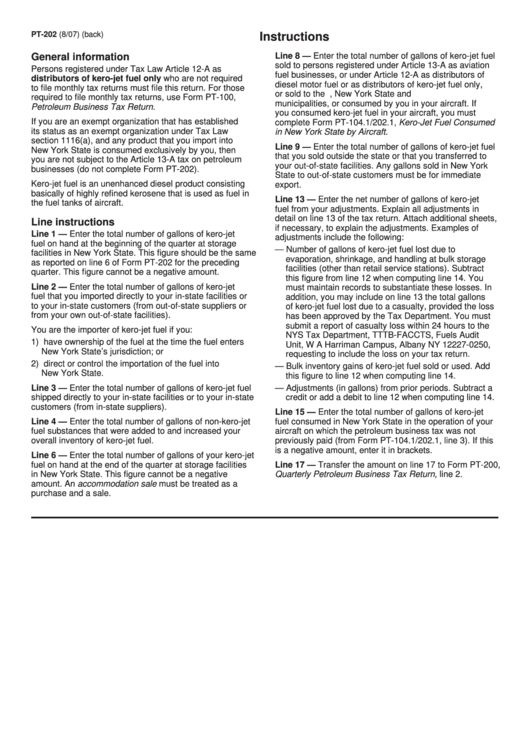

PT-202 (8/07) (back)

Instructions

Line 8 — Enter the total number of gallons of kero-jet fuel

General information

sold to persons registered under Article 13-A as aviation

Persons registered under Tax Law Article 12-A as

fuel businesses, or under Article 12-A as distributors of

distributors of kero-jet fuel only who are not required

diesel motor fuel or as distributors of kero-jet fuel only,

to file monthly tax returns must file this return. For those

or sold to the U.S. government, New York State and

required to file monthly tax returns, use Form PT-100,

municipalities, or consumed by you in your aircraft. If

Petroleum Business Tax Return.

you consumed kero-jet fuel in your aircraft, you must

If you are an exempt organization that has established

complete Form PT-104.1/202.1, Kero-Jet Fuel Consumed

its status as an exempt organization under Tax Law

in New York State by Aircraft.

section 1116(a), and any product that you import into

Line 9 — Enter the total number of gallons of kero-jet fuel

New York State is consumed exclusively by you, then

that you sold outside the state or that you transferred to

you are not subject to the Article 13-A tax on petroleum

your out-of-state facilities. Any gallons sold in New York

businesses (do not complete Form PT-202).

State to out-of-state customers must be for immediate

Kero-jet fuel is an unenhanced diesel product consisting

export.

basically of highly refined kerosene that is used as fuel in

Line 13 — Enter the net number of gallons of kero-jet

the fuel tanks of aircraft.

fuel from your adjustments. Explain all adjustments in

detail on line 13 of the tax return. Attach additional sheets,

Line instructions

if necessary, to explain the adjustments. Examples of

Line 1 — Enter the total number of gallons of kero-jet

adjustments include the following:

fuel on hand at the beginning of the quarter at storage

— Number of gallons of kero-jet fuel lost due to

facilities in New York State. This figure should be the same

evaporation, shrinkage, and handling at bulk storage

as reported on line 6 of Form PT-202 for the preceding

facilities (other than retail service stations). Subtract

quarter. This figure cannot be a negative amount.

this figure from line 12 when computing line 14. You

Line 2 — Enter the total number of gallons of kero-jet

must maintain records to substantiate these losses. In

fuel that you imported directly to your in-state facilities or

addition, you may include on line 13 the total gallons

to your in-state customers (from out-of-state suppliers or

of kero-jet fuel lost due to a casualty, provided the loss

from your own out-of-state facilities).

has been approved by the Tax Department. You must

submit a report of casualty loss within 24 hours to the

You are the importer of kero-jet fuel if you:

NYS Tax Department, TTTB-FACCTS, Fuels Audit

1) have ownership of the fuel at the time the fuel enters

Unit, W A Harriman Campus, Albany NY 12227-0250,

New York State’s jurisdiction; or

requesting to include the loss on your tax return.

2) direct or control the importation of the fuel into

— Bulk inventory gains of kero-jet fuel sold or used. Add

New York State.

this figure to line 12 when computing line 14.

Line 3 — Enter the total number of gallons of kero-jet fuel

— Adjustments (in gallons) from prior periods. Subtract a

shipped directly to your in-state facilities or to your in-state

credit or add a debit to line 12 when computing line 14.

customers (from in-state suppliers).

Line 15 — Enter the total number of gallons of kero-jet

Line 4 — Enter the total number of gallons of non-kero-jet

fuel consumed in New York State in the operation of your

fuel substances that were added to and increased your

aircraft on which the petroleum business tax was not

overall inventory of kero-jet fuel.

previously paid (from Form PT-104.1/202.1, line 3). If this

is a negative amount, enter it in brackets.

Line 6 — Enter the total number of gallons of your kero-jet

fuel on hand at the end of the quarter at storage facilities

Line 17 — Transfer the amount on line 17 to Form PT-200,

in New York State. This figure cannot be a negative

Quarterly Petroleum Business Tax Return, line 2.

amount. An accommodation sale must be treated as a

purchase and a sale.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1