Instructions For Form It-253 - Alternative Fuels Credit Carryover And Credit Recapture - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

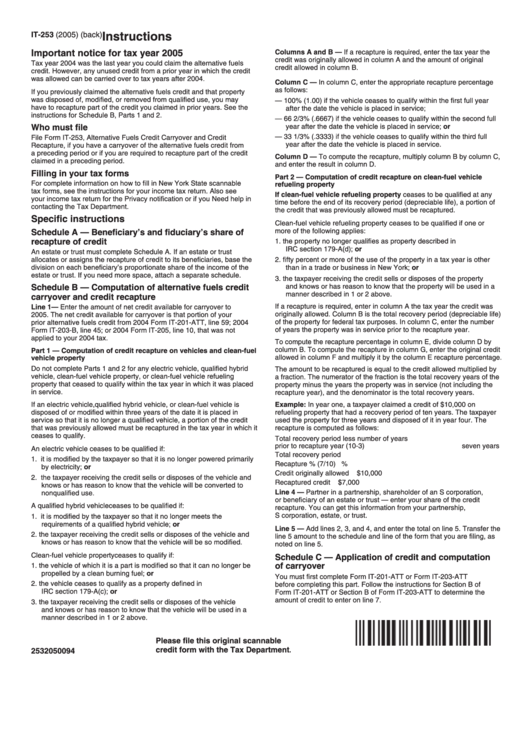

Instructions

IT-253 (2005) (back)

Important notice for tax year 2005

Columns A and B — If a recapture is required, enter the tax year the

credit was originally allowed in column A and the amount of original

Tax year 2004 was the last year you could claim the alternative fuels

credit allowed in column B.

credit. However, any unused credit from a prior year in which the credit

was allowed can be carried over to tax years after 2004.

Column C — In column C, enter the appropriate recapture percentage

as follows:

If you previously claimed the alternative fuels credit and that property

was disposed of, modified, or removed from qualified use, you may

— 100% (1.00) if the vehicle ceases to qualify within the first full year

have to recapture part of the credit you claimed in prior years. See the

after the date the vehicle is placed in service;

instructions for Schedule B, Parts 1 and 2.

— 66 2/3% (.6667) if the vehicle ceases to qualify within the second full

Who must file

year after the date the vehicle is placed in service; or

— 33 1/3% (.3333) if the vehicle ceases to qualify within the third full

File Form IT-253, Alternative Fuels Credit Carryover and Credit

year after the date the vehicle is placed in service.

Recapture, if you have a carryover of the alternative fuels credit from

a preceding period or if you are required to recapture part of the credit

Column D — To compute the recapture, multiply column B by column C,

claimed in a preceding period.

and enter the result in column D.

Filling in your tax forms

Part 2 — Computation of credit recapture on clean-fuel vehicle

For complete information on how to fill in New York State scannable

refueling property

tax forms, see the instructions for your income tax return. Also see

If clean-fuel vehicle refueling property ceases to be qualified at any

your income tax return for the Privacy notification or if you Need help in

time before the end of its recovery period (depreciable life), a portion of

contacting the Tax Department.

the credit that was previously allowed must be recaptured.

Specific instructions

Clean-fuel vehicle refueling property ceases to be qualified if one or

Schedule A — Beneficiary’s and fiduciary’s share of

more of the following applies:

recapture of credit

1. the property no longer qualifies as property described in

IRC section 179-A(d); or

An estate or trust must complete Schedule A. If an estate or trust

allocates or assigns the recapture of credit to its beneficiaries, base the

2. fifty percent or more of the use of the property in a tax year is other

than in a trade or business in New York; or

division on each beneficiary’s proportionate share of the income of the

estate or trust. If you need more space, attach a separate schedule.

3. the taxpayer receiving the credit sells or disposes of the property

Schedule B — Computation of alternative fuels credit

and knows or has reason to know that the property will be used in a

manner described in 1 or 2 above.

carryover and credit recapture

If a recapture is required, enter in column A the tax year the credit was

Line 1 — Enter the amount of net credit available for carryover to

originally allowed. Column B is the total recovery period (depreciable life)

2005. The net credit available for carryover is that portion of your

of the property for federal tax purposes. In column C, enter the number

prior alternative fuels credit from 2004 Form IT-201-ATT, line 59; 2004

of years the property was in service prior to the recapture year.

Form IT-203-B, line 45; or 2004 Form IT-205, line 10, that was not

applied to your 2004 tax.

To compute the recapture percentage in column E, divide column D by

column B. To compute the recapture in column G, enter the original credit

Part 1 — Computation of credit recapture on vehicles and clean-fuel

allowed in column F and multiply it by the column E recapture percentage.

vehicle property

Do not complete Parts 1 and 2 for any electric vehicle, qualified hybrid

The amount to be recaptured is equal to the credit allowed multiplied by

vehicle, clean-fuel vehicle property, or clean-fuel vehicle refueling

a fraction. The numerator of the fraction is the total recovery years of the

property that ceased to qualify within the tax year in which it was placed

property minus the years the property was in service (not including the

in service.

recapture year), and the denominator is the total recovery years.

If an electric vehicle, qualified hybrid vehicle, or clean-fuel vehicle is

Example: In year one, a taxpayer claimed a credit of $10,000 on

disposed of or modified within three years of the date it is placed in

refueling property that had a recovery period of ten years. The taxpayer

service so that it is no longer a qualified vehicle, a portion of the credit

used the property for three years and disposed of it in year four. The

that was previously allowed must be recaptured in the tax year in which it

recapture is computed as follows:

ceases to qualify.

Total recovery period less number of years

prior to recapture year (10-3) ........................................... seven years

An electric vehicle ceases to be qualified if:

Total recovery period

...........................................

ten years

1. it is modified by the taxpayer so that it is no longer powered primarily

Recapture % (7/10)

...........................................

70%

by electricity; or

Credit originally allowed

...........................................

$10,000

2. the taxpayer receiving the credit sells or disposes of the vehicle and

Recaptured credit

...........................................

$7,000

knows or has reason to know that the vehicle will be converted to

Line 4 — Partner in a partnership, shareholder of an S corporation,

nonqualified use.

or beneficiary of an estate or trust — enter your share of the credit

A qualified hybrid vehicle ceases to be qualified if:

recapture. You can get this information from your partnership,

S corporation, estate, or trust.

1. it is modified by the taxpayer so that it no longer meets the

requirements of a qualified hybrid vehicle; or

Line 5 — Add lines 2, 3, and 4, and enter the total on line 5. Transfer the

2. the taxpayer receiving the credit sells or disposes of the vehicle and

line 5 amount to the schedule and line of the form that you are filing, as

knows or has reason to know that the vehicle will be so modified.

noted on line 5.

Clean-fuel vehicle property ceases to qualify if:

Schedule C — Application of credit and computation

of carryover

1. the vehicle of which it is a part is modified so that it can no longer be

propelled by a clean burning fuel; or

You must first complete Form IT-201-ATT or Form IT-203-ATT

2. the vehicle ceases to qualify as a property defined in

before completing this part. Follow the instructions for Section B of

IRC section 179-A(c); or

Form IT-201-ATT or Section B of Form IT-203-ATT to determine the

amount of credit to enter on line 7.

3. the taxpayer receiving the credit sells or disposes of the vehicle

and knows or has reason to know that the vehicle will be used in a

manner described in 1 or 2 above.

Please file this original scannable

credit form with the Tax Department.

2532050094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1