Form Nys 100 - New York State Employer Registration For Unemployment Insurance, Withholding, And Wage Reporting Page 2

ADVERTISEMENT

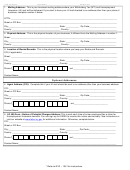

NYS 100 Page 2

Legal Name: __________________________________ER Number: _________________________

4. Are you registering for Unemployment Insurance?

Yes

No

• If yes, enter the first calendar quarter and the year you paid (or expect to pay) total remuneration of $300 or more. This

includes every form of compensation, including payments to employees or to corporate and Sub-Chapter S officers for

services.

Jan 1 – Mar 31 (1st)

Apr 1 – Jun 30 (2nd)

Jul 1 – Sep 30 (3rd)

Oct 1 – Dec 31 (4th)

Year

• If no, explain why you are not liable under the NYS Unemployment Insurance law.

________________________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

5. Total number of covered employees:_____________________

6. Are you registering to remit withholding tax only?

Yes

No

7. Have you acquired the business of another employer liable for NYS Unemployment Insurance?

Yes*

No

/

/

*If Yes, did you acquire

All or

Part? Date of acquisition:

(mm/dd/yyyy)

-

Prior Owner’s Registration Number:

-

Prior Owners FEIN:

Legal Name of Business: ____________________________________________________________________

Address: _________________________________________________________________________________

8. Have you changed legal entity?

Yes*

No

/

/

*If yes, date of legal entity change:

(mm/dd/yyyy)

-

Prior Employer’s Registration Number:

-

Prior Employer’s FEIN:

Part C – Household Employer of Domestic Services

1. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total cash wages of $500 or more:

Jan 1 – Mar 31 (1st)

Apr 1 – Jun 30 (2nd)

Jul 1 – Sep 30 (3rd)

Oct 1 – Dec 31 (4th)

Year

2. Enter the total number of persons employed in your home: ________________________

3. Will you withhold New York State income tax from these employees?

Yes

No

Part D – Required Addresses

* Refer to NYS – 100 I for instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4