Form Mw-5 Instructions - Withholding Tax Deposit/payment Voucher

ADVERTISEMENT

When to deposit

You must make monthly deposits by the 15th day of

the following month. If the due date is not a bank-

ing day, deposits will be considered on time if

Generally, you will make deposits at the same time as

deposited on the next banking day.

you make your federal deposits. Toward the end of the

Quarterly payment of tax. If you are not required to

year, the IRS will let you know what your federal

deposit schedule will be for the next year.

make deposits under the semiweekly or monthly

rules, you must pay the entire amount of your

There are two exceptions for which you can deposit

withholding tax by the last day of the month follow-

Minnesota tax on a different schedule from the

ing the end of the quarter.

federal schedule.

If you deposit by mail, deposits must be postmarked

1. $1,500 or less. If you withheld $1,500 or less in

Minnesota tax in the previous quarter, you may

by the U.S. Post Office (not by a postage meter) or

send the entire Minnesota tax withheld for the

received by us on or before the due date. When the

current quarter by the due date of your quarterly

due date falls on a Saturday, Sunday or legal holi-

return.

day, deposits postmarked on the next business day

are considered on time.

2. One-day rule. Minnesota did not adopt the federal

“one-day rule” for federal liabilities over $100,000.

If you are required to deposit your federal tax the

Form MW-5 instructions

next day, deposit the Minnesota tax withheld at the

same time it would have been required to be

If you make deposits by mail, be sure to use your

deposited if you had not exceeded the federal limit

customized MW-5 deposit form. Keep track of your

of $100,000.

deposits on the back of Form MW-1. Note: If you or

If you don’t fall under one of the exceptions, use the

your payroll service deposit by EFT, don’t send in

following federal guidelines to determine when to

the paper form. Follow the EFT instructions.

deposit your Minnesota tax.

Semiweekly depositing. If you withheld more than

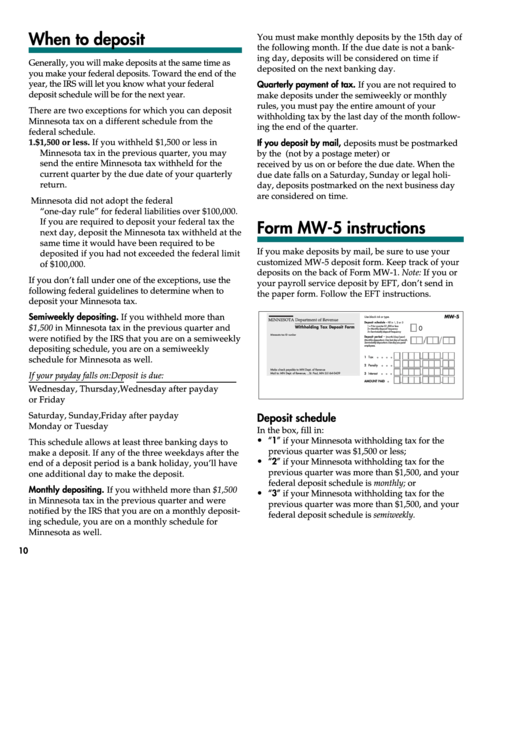

MW-5

Use black ink or type.

MINNESOTA Department of Revenue

Deposit schedule

– Fill in 1, 2 or 3

$1,500 in Minnesota tax in the previous quarter and

Withholding Tax Deposit Form

1 = Prior quarter $1,500 or less

0

2 = Monthly deposit frequency

3 = Semiweekly deposit frequency

Minnesota tax ID number

were notified by the IRS that you are on a semiweekly

Deposit period –

(month/day/year)

Monthly depositors: Use last day of month.

Semiweekly depositors: Use day you paid

employees.

depositing schedule, you are on a semiweekly

. . . .

.

,

,

1 Tax

schedule for Minnesota as well.

. . .

,

,

.

2 Penalty

. . .

Make check payable to MN Dept. of Revenue

.

,

,

Mail to: MN Dept. of Revenue, P.O. Box 64439, St. Paul, MN 55164-0439

3 Interest

If your payday falls on:

Deposit is due:

.

.

,

,

AMOUNT PAID

Wednesday, Thursday,

Wednesday after payday

or Friday

Saturday, Sunday,

Friday after payday

Deposit schedule

Monday or Tuesday

In the box, fill in:

• “1” if your Minnesota withholding tax for the

This schedule allows at least three banking days to

previous quarter was $1,500 or less;

make a deposit. If any of the three weekdays after the

• “2” if your Minnesota withholding tax for the

end of a deposit period is a bank holiday, you’ll have

previous quarter was more than $1,500, and your

one additional day to make the deposit.

federal deposit schedule is monthly; or

Monthly depositing. If you withheld more than $1,500

• “3” if your Minnesota withholding tax for the

in Minnesota tax in the previous quarter and were

previous quarter was more than $1,500, and your

notified by the IRS that you are on a monthly deposit-

federal deposit schedule is semiweekly.

ing schedule, you are on a monthly schedule for

Minnesota as well.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2