Instructions For Kentucky Taxable Income

ADVERTISEMENT

INSTRUCTIONS

th

GENERAL

– No refund can be made on a request that extends three (3) years beyond the 15

day of the

fourth month following the close of the applicable tax year.

W-2 must be attached to the refund request. A separate refund request must be made by the employee for each

different employer.

Section A - LINE BY LINE INSTRUCTIONS

Line 1 - Enter amount of all subject wages, salaries, commissions and other employee earnings. Subject

earnings include, but are not limited to:

a) Federal Taxable Wages

b) Deferred compensations under Section 403(d), 401(k), 414(h) or 457 of the Internal

Revenue Code.

c) Cash and non-cash fringe benefits not otherwise exempt.

d) Vacation and/or holiday benefits.

e) Separation payment including employer unemployment benefit plan.

Line 2 - Enter total number of days worked during the year.

Line 3 - Enter the total number of days worked inside the city.

Line 4 - Divide line 3 by line 2 to determine the percentage of earnings subject to the occupational fee.

Line 5 - Multiply line 4 by line 1 to determine the amount of compensation subject to the license fee.

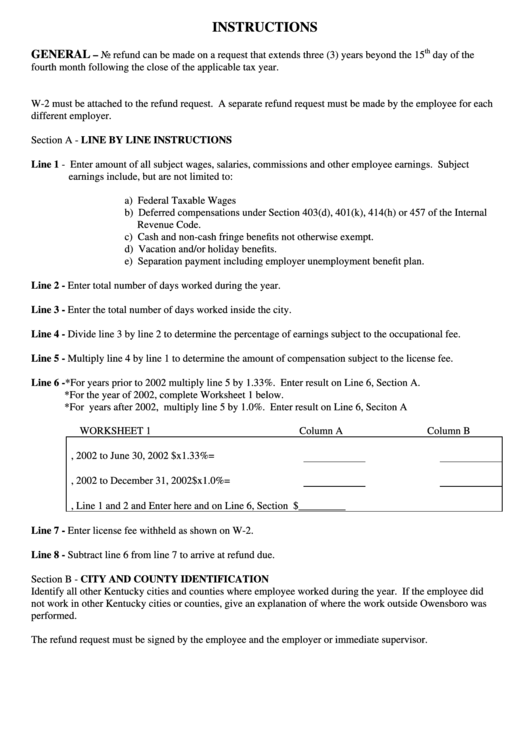

Line 6 -*For years prior to 2002 multiply line 5 by 1.33%. Enter result on Line 6, Section A.

*For the year of 2002, complete Worksheet 1 below.

*For years after 2002, multiply line 5 by 1.0%. Enter result on Line 6, Seciton A

WORKSHEET 1

Column A

Column B

1.

Earnings from January 1, 2002 to June 30, 2002

$

x

1.33%

=

2.

Earnings from July 1, 2002 to December 31, 2002 $

x

1.0%

=

3.

Add Column B, Line 1 and 2 and Enter here and on Line 6, Section A....................

$_________

Line 7 - Enter license fee withheld as shown on W-2.

Line 8 - Subtract line 6 from line 7 to arrive at refund due.

Section B - CITY AND COUNTY IDENTIFICATION

Identify all other Kentucky cities and counties where employee worked during the year. If the employee did

not work in other Kentucky cities or counties, give an explanation of where the work outside Owensboro was

performed.

The refund request must be signed by the employee and the employer or immediate supervisor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1