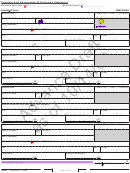

California Form 592 Draft - Resident And Nonresident Withholding Statement 2010 -

ADVERTISEMENT

TAXABLE YEAR

CALIFORNIA FORM

Resident and Nonresident Withholding Statement

2010

592

m

m

Amended

Prior Year Distribution

m

m

m

m

April 15, 2010

June 15, 2010

September 15, 2010

January 15, 2011

Payment Due Date:

Part I Withholding Agent

m

m

m

Business name

SSN or ITIN

FEIN

CA Corp no.

Withholding agent’s first name

Initial Last name

Address (suite, room, PO Box, or PMB no.)

City

State

ZIP Code

Total Number of Payees Included

Part II Type of Income

Check types.

m

m

m

A

C

E

Payment to Independent Contractor

Rents or Royalties

Estate Distributions

m

m

m

B

D

F

Trust Distributions

Distributions to Domestic Nonresident

Elective Withholding

m

G

Partners/Members/Beneficiaries/

Elective Withholding/Indian Tribe

m

H

S Corporation Shareholders

Other______________________

.

00

,

,

1 Total Tax Withheld (Side 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

.

,

,

00

2 Total Tax Withheld (Side 2 and any additional pages) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.

00

,

,

3 Add line 1 and line 2. This is the total Tax Withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

00

,

,

4 Enter amounts of prior payments not previously distributed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

00

,

,

5 Enter amount withheld by another entity and being distributed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

00

,

,

6 Add line 4 and line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Total Withholding Amount Due. Subtract line 6 from line 3. Remit the withholding payment with

.

00

,

,

Form 592-V, Payment Voucher for Resident and Nonresident Withholding, along with Form 592.. . . . . . . . . .

7

Part III Perjury Statement

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

(

)

Withholding agent’s name ______________________________________________

Withholding agent’s daytime phone number ______________________

Withholding agent’s signature ______________________________________________________________________________________________________

Preparer’s name ______________________________________________________

Preparer’s signature ________________________________________

Preparer’s address _______________________________________________________________________________________________________________

(

)

Preparer’s SSN/PTIN __________________________________________________

Preparer’s phone daytime phone number_________________________

Form 592

2009 Side 1

7081103

For Privacy Notice, get form FTB 1131.

C3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2