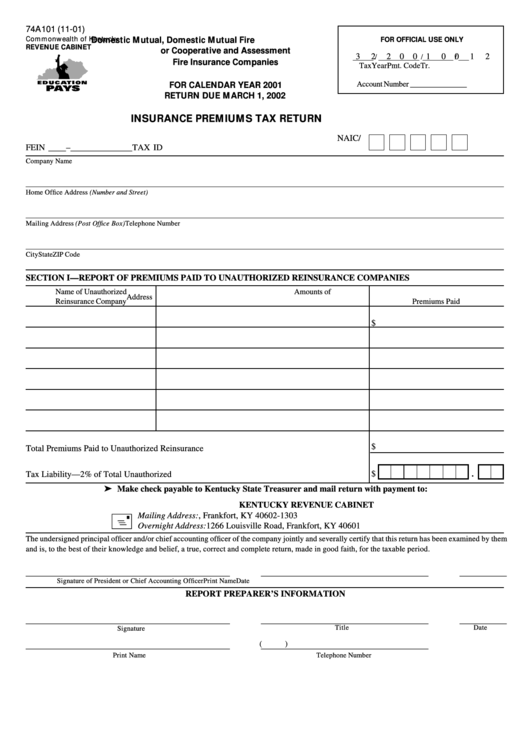

Form 74a101 - Insurance Premiums Tax Return - Commonwealth Of Kentucky - 2001

ADVERTISEMENT

74A101 (11-01)

Commonwealth of Kentucky

Domestic Mutual, Domestic Mutual Fire

FOR OFFICIAL USE ONLY

REVENUE CABINET

or Cooperative and Assessment

3

2

2 0 0 1

0 0

1

2

___ ___ / ___ ___ ___ ___ / ___ ___ ___ / ___

Fire Insurance Companies

Tax

Year

Pmt. Code

Tr.

Account Number ___ ___ ___ ___ ___

FOR CALENDAR YEAR 2001

RETURN DUE MARCH 1, 2002

INSURANCE PREMIUMS TAX RETURN

NAIC/

FEIN __ __ – __ __ __ __ __ __ __

TAX ID

Company Name

Home Office Address (Number and Street)

Mailing Address (Post Office Box)

Telephone Number

City

State

ZIP Code

SECTION I—REPORT OF PREMIUMS PAID TO UNAUTHORIZED REINSURANCE COMPANIES

Name of Unauthorized

Amounts of

Address

Reinsurance Company

Premiums Paid

$

$

Total Premiums Paid to Unauthorized Reinsurance Companies ......................................................

.

$

Tax Liability—2% of Total Unauthorized Premiums .......................................................................

Make check payable to Kentucky State Treasurer and mail return with payment to:

KENTUCKY REVENUE CABINET

+

Mailing Address:

P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

1266 Louisville Road, Frankfort, KY 40601

The undersigned principal officer and/or chief accounting officer of the company jointly and severally certify that this return has been examined by them

and is, to the best of their knowledge and belief, a true, correct and complete return, made in good faith, for the taxable period.

_______________________________________

________________________________

_________

Signature of President or Chief Accounting Officer

Print Name

Date

REPORT PREPARER’S INFORMATION

_______________________________________

________________________________

_________

Title

Date

Signature

_______________________________________

________________________________

(

)

Print Name

Telephone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2