Form Ks-8453 - Kansas Individual Income Tax Declaration For Electronic Filing - 1999

ADVERTISEMENT

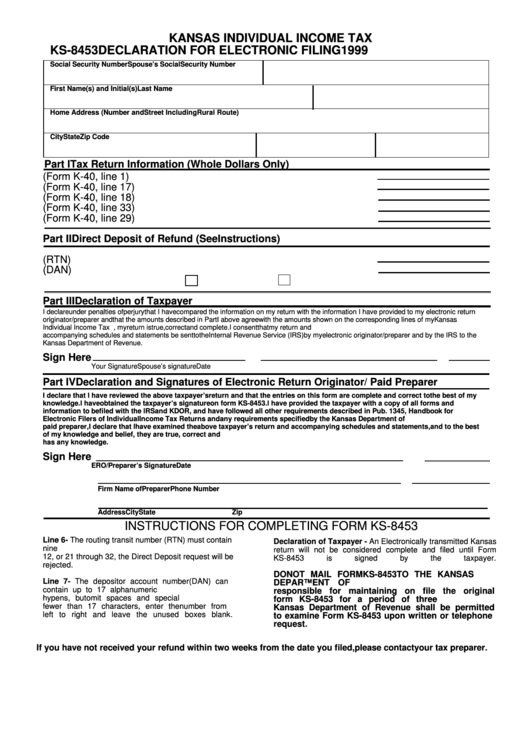

KANSAS INDIVIDUAL INCOME TAX

KS-8453

DECLARATION FOR ELECTRONIC FILING

1999

Social Security Number

Spouse’s Social Security Number

First Name(s) and Initial(s)

Last Name

Home Address (Number and Street Including Rural Route)

City

State

Zip Code

Part I Tax Return Information (Whole Dollars Only)

1. Total federal adjusted gross income (Form K-40, line 1)......................

2. Kansas tax balance (Form K-40, line 17).............................................

3. Kansas income tax withheld (Form K-40, line 18)................................

4. Refund (Form K-40, line 33).................................................................

5. Amount you owe (Form K-40, line 29)..................................................

Part II Direct Deposit of Refund (See Instructions)

6. Routing transit number (RTN)..............................................................

7. Depositor account number (DAN)........................................................

8. Type of account

Checking

Savings

Part III Declaration of Taxpayer

I declare under penalties of perjury that I have compared the information on my return with the information I have provided to my electronic return

originator/preparer and that the amounts described in Part I above agree with the amounts shown on the corresponding lines of my Kansas

Individual Income Tax Return. To the best of my knowledge and belief, my return is true, correct and complete. I consent that my return and

accompanying schedules and statements be sent to the Internal Revenue Service (IRS) by my electronic originator/preparer and by the IRS to the

Kansas Department of Revenue.

Sign Here

Your Signature

Spouse’s signature

Date

Part IV Declaration and Signatures of Electronic Return Originator/ Paid Preparer

I declare that I have reviewed the above taxpayer’s return and that the entries on this form are complete and correct to the best of my

knowledge. I have obtained the taxpayer’s signature on form KS-8453. I have provided the taxpayer with a copy of all forms and

information to be filed with the IRS and KDOR, and have followed all other requirements described in Pub. 1345, Handbook for

Electronic Filers of Individual Income Tax Returns and any requirements specified by the Kansas Department of Revenue. If I am the

paid preparer, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best

of my knowledge and belief, they are true, correct and complete. Declaration of preparer is based on all information of which preparer

has any knowledge.

Sign Here

ERO/Preparer’s Signature

Date

Firm Name of Preparer

Phone Number

Address

City

State

Zip

INSTRUCTIONS FOR COMPLETING FORM KS-8453

Line 6- The routing transit number (RTN) must contain

Declaration of Taxpayer - An Electronically transmitted Kansas

nine digits. If the RTN does not begin with 01 through

return will not be considered complete and filed until Form

12, or 21 through 32, the Direct Deposit request will be

KS-8453

is

signed

by

the

taxpayer.

rejected.

DO NOT MAIL FORM KS-8453 TO THE KANSAS

Line 7- The depositor account number (DAN) can

DEPARTMENT OF REVENUE.

The taxpayer is

contain up to 17 alphanumeric characters. Include

responsible for maintaining on file the original

hypens, but omit spaces and special symbols. If

form KS-8453 for a period of three years. The

fewer than 17 characters, enter the number from

Kansas Department of Revenue shall be permitted

left to right and leave the unused boxes blank.

to examine Form KS-8453 upon written or telephone

request.

If you have not received your refund within two weeks from the date you filed, please contact your tax preparer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1