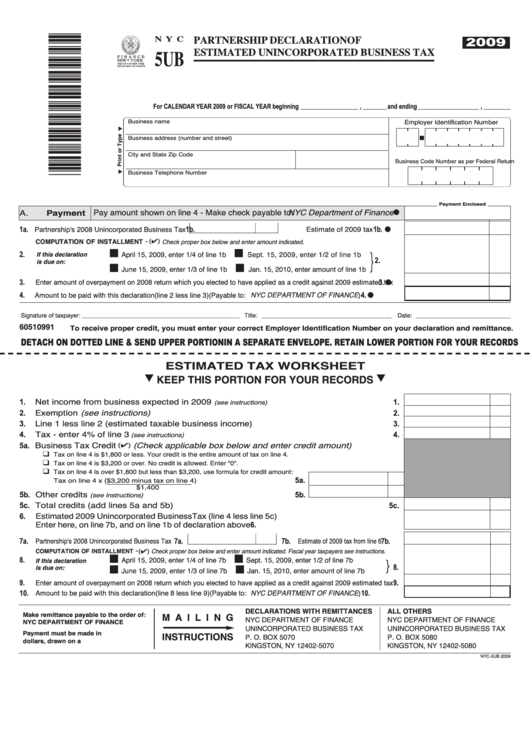

Form Nyc-5ub - Partnership Declaration Of Estimated Unincorporated Business Tax - 2009

ADVERTISEMENT

5UB

PARTNERSHIP DECLARATION OF

N Y C

2009

ESTIMATED UNINCORPORATED BUSINESS TAX

F I N A N C E

NEW

YORK

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

For CALENDAR YEAR 2009 or FISCAL YEAR beginning _________________ , _______ and ending __________________ , ________

Employer Identification Number

Business name

Business address (number and street)

City and State

Zip Code

Business Code Number as per Federal Return

Business Telephone Number

Payment Enclosed

Payment

Pay amount shown on line 4 - Make check payable to: NYC Department of Finance G

A.

}

Partnership's 2008 Unincorporated Business Tax

Estimate of 2009 tax

1a.

1b.

1b. G

.........

-

COMPUTATION OF INSTALLMENT

() Check proper box below and enter amount indicated.

I I

I I

April 15, 2009, enter 1/4 of line 1b

Sept. 15, 2009, enter 1/2 of line 1b

If this declaration

2.

is due on:

2.

.................

I I

I I

June 15, 2009, enter 1/3 of line 1b

Jan. 15, 2010, enter amount of line 1b

Enter amount of overpayment on 2008 return which you elected to have applied as a credit against 2009 estimated tax

3.

3. G

........

Amount to be paid with this declaration (line 2 less line 3) (Payable to: NYC DEPARTMENT OF FINANCE )

4.

4. G

......................

Title: _________________________________________ Date: ____________________________

Signature of taxpayer:

_________________________________________________________________________________

60510991

To receive proper credit, you must enter your correct Employer Identification Number on your declaration and remittance.

DETACH ON DOTTED LINE & SEND UPPER PORTION IN A SEPARATE ENVELOPE. RETAIN LOWER PORTION FOR YOUR RECORDS

ESTIMATED TAX WORKSHEET

M KEEP THIS PORTION FOR YOUR RECORDS M

Net income from business expected in 2009

(see instructions)

1.

1.

.......................................................................................

Exemption (see instructions)

2.

2.

............................................................................................................................................................................

Line 1 less line 2 (estimated taxable business income)

3.

3.

..................................................................................................

Tax - enter 4% of line 3

(see instructions)

4.

4.

...................................................................................................................................................

(Check applicable box below and enter credit amount)

5a. Business Tax Credit

()

Tax on line 4 is $1,800 or less. Your credit is the entire amount of tax on line 4.

K

Tax on line 4 is $3,200 or over. No credit is allowed. Enter "0".

K

Tax on line 4 is over $1,800 but less than $3,200, use formula for credit amount:

K

Tax on line 4 x ($3,200 minus tax on line 4)

5a.

.......................................................................

$1,400

5b. Other credits

(see instructions)

5b.

...........................................................................................................

5c. Total credits (add lines 5a and 5b)

5c.

.........................................................................................................................................................

Estimated 2009 Unincorporated Business Tax (line 4 less line 5c)

6.

Enter here, on line 7b, and on line 1b of declaration above

6.

...........................................................................................................................

Partnership's 2008 Unincorporated Business Tax

Estimate of 2009 tax from line 6

7a.

7a.

7b.

7b.

.......

-

}

COMPUTATION OF INSTALLMENT

() Check proper box below and enter amount indicated. Fiscal year taxpayers see instructions.

I I

I I

April 15, 2009, enter 1/4 of line 7b

Sept. 15, 2009, enter 1/2 of line 7b

If this declaration

8.

..................

is due on:

I I

I I

8.

June 15, 2009, enter 1/3 of line 7b

Jan. 15, 2010, enter amount of line 7b

.........

Enter amount of overpayment on 2008 return which you elected to have applied as a credit against 2009 estimated tax

9.

9.

.

Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE )

10.

10.

.......................

DECLARATIONS WITH REMITTANCES

ALL OTHERS

M A I L I N G

Make remittance payable to the order of:

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

UNINCORPORATED BUSINESS TAX

UNINCORPORATED BUSINESS TAX

INSTRUCTIONS

Payment must be made in U.S.

P. O. BOX 5070

P. O. BOX 5080

dollars, drawn on a U.S. bank.

KINGSTON, NY 12402-5070

KINGSTON, NY 12402-5080

NYC-5UB 2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2