Form Pit-S - New Mexico Supplemental Schedule For Dependent Exemptions In Excess Of Five - 2012

ADVERTISEMENT

*120260200*

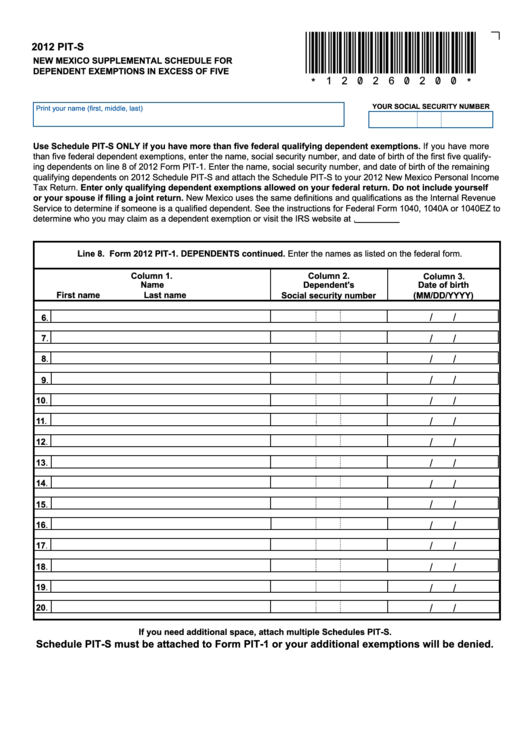

2012 PIT-S

NEW MEXICO SUPPLEMENTAL SCHEDULE FOR

DEPENDENT EXEMPTIONS IN EXCESS OF FIVE

YOUR SOCIAL SECURITY NUMbER

Print your name (first, middle, last)

Use Schedule PIT-S ONLY if you have more than five federal qualifying dependent exemptions. If you have more

than five federal dependent exemptions, enter the name, social security number, and date of birth of the first five qualify-

ing dependents on line 8 of 2012 Form PIT-1. Enter the name, social security number, and date of birth of the remaining

qualifying dependents on 2012 Schedule PIT-S and attach the Schedule PIT-S to your 2012 New Mexico Personal Income

Tax Return. Enter only qualifying dependent exemptions allowed on your federal return. Do not include yourself

or your spouse if filing a joint return. New Mexico uses the same definitions and qualifications as the Internal Revenue

Service to determine if someone is a qualified dependent. See the instructions for Federal Form 1040, 1040A or 1040EZ to

determine who you may claim as a dependent exemption or visit the IRS website at

Line 8. Form 2012 PIT-1. DEPENDENTS continued. Enter the names as listed on the federal form.

Column 2.

Column 1.

Column 3.

Name

Dependent's

Date of birth

First name

Last name

Social security number

(MM/DD/YYYY)

/

/

6.

/

/

7.

/

/

8.

/

/

9.

/

/

10.

/

/

11.

/

/

12.

/

/

13.

14.

/

/

/

/

15.

/

/

16.

/

/

17

.

/

/

18.

/

/

19.

20.

/

/

If you need additional space, attach multiple Schedules PIT-S.

Schedule PIT-S must be attached to Form PIT-1 or your additional exemptions will be denied.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1