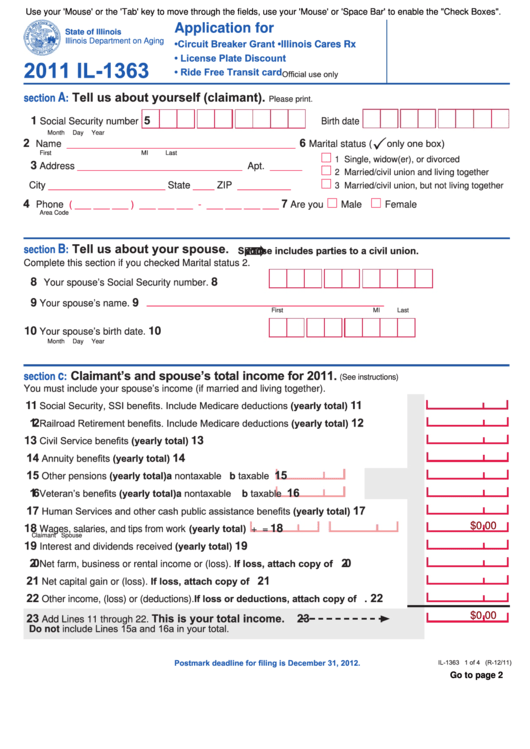

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Application for

State of Illinois

Illinois Department on Aging

• Circuit Breaker Grant

• Illinois Cares Rx

• License Plate Discount

2011 IL-1363

• Ride Free Transit card

Official use only

A

section

:

Tell us about yourself (claimant).

Please print.

5

1

Social Security number

Birth date

Month

Day

Year

2

6

only one box)

Name

___________________________________________

Marital status (

First

MI

Last

1 Single, widow(er), or divorced

3

Address

_______________________________

Apt.

______

2 Married/civil union and living together

City

______________________

State

____

ZIP

__________

3 Married/civil union, but not living together

4

7

Phone

( ___ ___ ___ ) ___ ___ ___ - ___ ___ ___ ___

Are you

Male

Female

Area Code

B

Tell us about your spouse.

section

:

Spouse includes parties to a civil union.

Complete this section if you checked Marital status 2.

8

8

Your spouse’s Social Security number. ..............

________________________________________________

9

9

Your spouse’s name. ..........................................

First

MI

Last

10

10

Your spouse’s birth date. .................................

Month

Day

Year

c

section

:

Claimant’s and spouse’s total income for 2011.

(See instructions)

You must include your spouse’s income (if married and living together).

Social Security, SSI benefits. Include Medicare deductions (yearly total) .....................

11

11

12

12

Railroad Retirement benefits. Include Medicare deductions (yearly total) .....................

Civil Service benefits (yearly total) .................................................................................

13

13

14

14

Annuity benefits (yearly total) .........................................................................................

15

15

Other pensions (yearly total) .................. a nontaxable

...... b taxable

16

16

Veteran’s benefits (yearly total) .............. a nontaxable

..... b taxable

17

17

Human Services and other cash public assistance benefits (yearly total) .....................

$0.00

Wages, salaries, and tips from work (yearly total)

18

18

+

=

Claimant

Spouse

Interest and dividends received (yearly total) ................................................................

19

19

20

20

Net farm, business or rental income or (loss). If loss, attach copy of U.S. 1040. .........

21

21

Net capital gain or (loss). If loss, attach copy of U.S. 1040 and Schedule D. .............

22

22

Other income, (loss) or (deductions). If loss or deductions, attach copy of U.S. 1040. .

23

This is your total income.

23

$0.00

Add Lines 11 through 22.

Do not include Lines 15a and 16a in your total.

Postmark deadline for filing is December 31, 2012.

IL-1363 1 of 4 (R-12/11)

Go to page 2

1

1 2

2 3

3 4

4