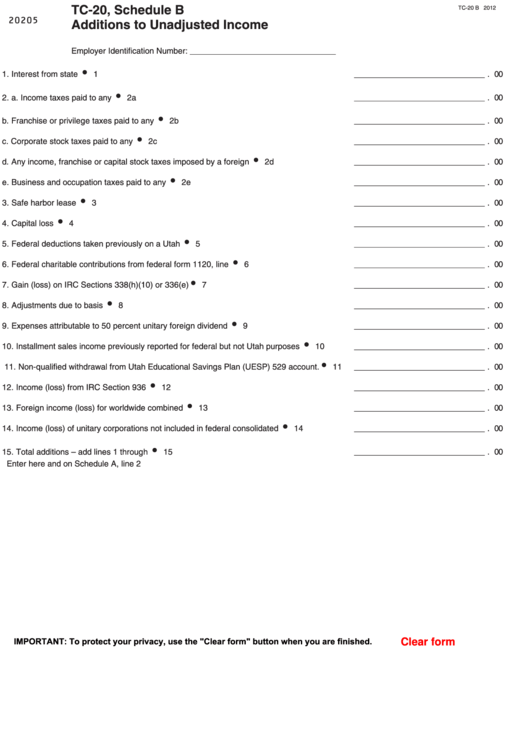

TC-20, Schedule B

TC-20 B 2012

20205

Additions to Unadjusted Income

Employer Identification Number: ___________________

1. Interest from state obligations.....................................................................................

1 ___________ _ __ _ __ . 00

2. a.

Income taxes paid to any state ............................................................................

2a ___________ __ _ __ _ . 00

b.

Franchise or privilege taxes paid to any state ......................................................

2b _____________ _ __ _ . 00

c.

Corporate stock taxes paid to any state...............................................................

2c ___________ __ _ __ _ . 00

d.

Any income, franchise or capital stock taxes imposed by a foreign country ........

2d ____________ _ __ _ _ . 00

e.

Business and occupation taxes paid to any state ................................................

2e ___________ _ __ _ __ . 00

3. Safe harbor lease adjustments ...................................................................................

3 ___________ __ _ __ _ . 00

4. Capital loss carryover .................................................................................................

4 ____________ _ __ _ _ . 00

5. Federal deductions taken previously on a Utah return................................................

5 ____________ _ __ _ _ . 00

6. Federal charitable contributions from federal form 1120, line 19 ................................

6 ____________ _ __ _ _ . 00

7. Gain (loss) on IRC Sections 338(h)(10) or 336(e) ......................................................

7 ____________ __ _ __ . 00

8. Adjustments due to basis difference ...........................................................................

8 ___________ __ _ __ _ . 00

9. Expenses attributable to 50 percent unitary foreign dividend exclusion .....................

9 ____________ __ _ __ . 00

10. Installment sales income previously reported for federal but not Utah purposes .......

10 ____________ __ _ __ . 00

11. Non-qualified withdrawal from Utah Educational Savings Plan (UESP) 529 account.

11 _____________ _ __ _ . 00

12. Income (loss) from IRC Section 936 corporations ......................................................

12 _____________ _ __ _ . 00

13. Foreign income (loss) for worldwide combined filers ..................................................

13 ____________ __ _ __ . 00

14. Income (loss) of unitary corporations not included in federal consolidated return......

14 _____________ _ __ _ . 00

15. Total additions – add lines 1 through 14 .....................................................................

15 ___________ _ __ _ __ . 00

Enter here and on Schedule A, line 2

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2 3

3