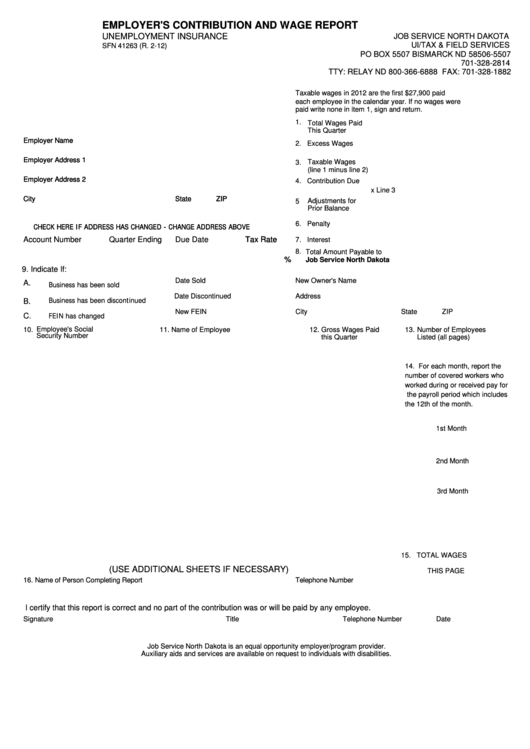

EMPLOYER'S CONTRIBUTION AND WAGE REPORT

UNEMPLOYMENT INSURANCE

JOB SERVICE NORTH DAKOTA

UI/TAX & FIELD SERVICES

SFN 41263 (R. 2-12)

PO BOX 5507 BISMARCK ND 58506-5507

701-328-2814

TTY: RELAY ND 800-366-6888 FAX: 701-328-1882

Taxable wages in 2012 are the first $27,900 paid

each employee in the calendar year. If no wages were

paid write none in item 1, sign and return.

1. Total Wages Paid

This Quarter

Employer Name

Employer Name

2. Excess Wages

Employer Address 1

Employer Address 1

3. Taxable Wages

(line 1 minus line 2)

Employer Address 2

Employer Address 2

4. Contribution Due

x Line 3

City

City

State

State

ZIP

ZIP

Adjustments for

5

Prior Balance

6. Penalty

CHECK HERE IF ADDRESS HAS CHANGED - CHANGE ADDRESS ABOVE

CHECK HERE IF ADDRESS HAS CHANGED - CHANGE ADDRESS ABOVE

Account Number

Quarter Ending

Due Date

Tax Rate

Tax Rate

7. Interest

8. Total Amount Payable to

%

%

Job Service North Dakota

9. Indicate If:

Date Sold

New Owner's Name

A.

Business has been sold

Date Discontinued

Address

Business has been discontinued

B.

New FEIN

City

State

ZIP

C.

FEIN has changed

10. Employee's Social

11. Name of Employee

12. Gross Wages Paid

13. Number of Employees

Security Number

this Quarter

Listed (all pages)

14. For each month, report the

number of covered workers who

worked during or received pay for

the payroll period which includes

the 12th of the month.

1st Month

2nd Month

3rd Month

15. TOTAL WAGES

(USE ADDITIONAL SHEETS IF NECESSARY)

THIS PAGE

16. Name of Person Completing Report

Telephone Number

I certify that this report is correct and no part of the contribution was or will be paid by any employee.

Signature

Title

Telephone Number

Date

Job Service North Dakota is an equal opportunity employer/program provider.

Auxiliary aids and services are available on request to individuals with disabilities.

1

1