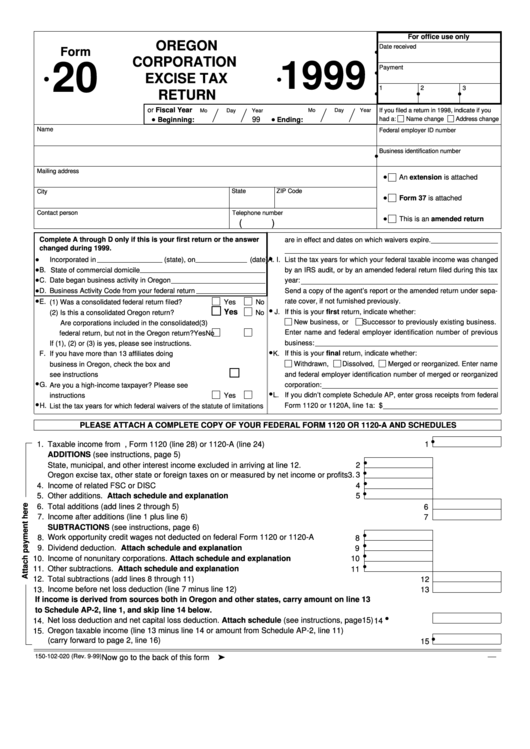

For office use only

OREGON

Date received

Form

•

CORPORATION

1999

20

Payment

•

•

EXCISE TAX

•

1

2

3

•

•

•

RETURN

or Fiscal Year

If you filed a return in 1998, indicate if you

Mo

Day

Year

Mo

Day

Year

•

•

99

had a:

Name change

Address change

Beginning:

Ending:

Name

Federal employer ID number

Business identification number

•

Mailing address

•

An extension is attached

City

State

ZIP Code

•

Form 37 is attached

Contact person

Telephone number

•

This is an amended return

(

)

Complete A through D only if this is your first return or the answer

are in effect and dates on which waivers expire.

changed during 1999.

•

•

A.

Incorporated in

(state), on

(date)

I.

List the tax years for which your federal taxable income was changed

•

B.

State of commercial domicile

by an IRS audit, or by an amended federal return filed during this tax

•

C.

Date began business activity in Oregon

year:

•

D.

Business Activity Code from your federal return

Send a copy of the agent’s report or the amended return under sepa-

•

rate cover, if not furnished previously.

E.

(1) Was a consolidated federal return filed?

.............

Yes

No

•

Yes

J.

If this is your first return, indicate whether:

(2) Is this a consolidated Oregon return?

.................

No

New business, or

Successor to previously existing business.

(3)

Are corporations included in the consolidated

Enter name and federal employer identification number of previous

federal return, but not in the Oregon return?

.......

Yes

No

business:

If (1), (2) or (3) is yes, please see instructions.

•

F.

K.

If this is your final return, indicate whether:

If you have more than 13 affiliates doing

business in Oregon, check the box and

Withdrawn,

Dissolved,

Merged or reorganized. Enter name

see instructions ...................................................................

and federal employer identification number of merged or reorganized

•

G.

Are you a high-income taxpayer? Please see

corporation:

•

L.

instructions

................................................................

Yes

No

If you didn’t complete Schedule AP, enter gross receipts from federal

•

H.

List the tax years for which federal waivers of the statute of limitations

Form 1120 or 1120A, line 1a: $

PLEASE ATTACH A COMPLETE COPY OF YOUR FEDERAL FORM 1120 OR 1120-A AND SCHEDULES

•

1.

Taxable income from U.S. corporation income tax return, Form 1120 (line 28) or 1120-A (line 24)

.............

1

ADDITIONS (see instructions, page 5)

•

2.

State, municipal, and other interest income excluded in arriving at line 1

..........................

2

•

3.

Oregon excise tax, other state or foreign taxes on or measured by net income or profits

3

•

4.

Income of related FSC or DISC

..................................................................................................

4

•

5.

Other additions. Attach schedule and explanation

5

............................................................

6.

Total additions (add lines 2 through 5)

......................................................................................................................

6

7.

Income after additions (line 1 plus line 6)

..................................................................................................................

7

SUBTRACTIONS (see instructions, page 6)

•

Work opportunity credit wages not deducted on federal Form 1120 or 1120-A

8.

................

8

•

9.

Dividend deduction. Attach schedule and explanation

.....................................................

9

•

10.

Income of nonunitary corporations. Attach schedule and explanation

...........................

10

•

11.

Other subtractions. Attach schedule and explanation

......................................................

11

12.

Total subtractions (add lines 8 through 11)

...............................................................................................................

12

Income before net loss deduction (line 7 minus line 12)

13.

.........................................................................................

13

If income is derived from sources both in Oregon and other states, carry amount on line 13

to Schedule AP-2, line 1, and skip line 14 below.

•

..................

14.

Net loss deduction and net capital loss deduction. Attach schedule (see instructions, page15)

14

15.

Oregon taxable income (line 13 minus line 14 or amount from Schedule AP-2, line 11)

•

(carry forward to page 2, line 16)

................................................................................................................................

15

150-102-020 (Rev. 9-99)

Now go to the back of this form

1

1 2

2 3

3 4

4