California Schedule B (100s) Draft - S Corporation Depreciation And Amortization/california Schedule D (100s) Draft - S Corporation Capital Gains And Losses And Built-In Gains/etc. - 2013

ADVERTISEMENT

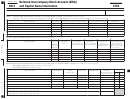

S Corporation Depreciation

TAXABLE YEAR

CALIFORNIA SCHEDULE

and Amortization

B (100S)

2013

For use by S corporations only. Attach to Form 100S.

Corporation name

California corporation number

Part I

Depreciation. Use additional sheets if necessary.

1 Enter federal depreciation from federal Form 4562, line 22.

00

IRC Section 179 expense deduction is not included on this line. Get federal Form 4562 instructions . . . . . . . . . . . . . . . . . . . .

1

California depreciation:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Depreciation allowed or

Life or

Depreciation

Date acquired

Cost or other basis

Method of

allowable in earlier years

rate

for this year

(mm/dd/yyyy)

figuring dep.

2

00

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Subtract line 3 from line 1. If negative, use brackets. Enter here and on the applicable line of Form 100S, Side 6, Schedule K

4

00

5 Enter IRC Section 179 expense deduction here and on Form 100S, Side 1, line 13. Do not enter more than $25,000 . . . . . . .

5

Part II Amortization. Use additional sheets if necessary.

00

1 Enter federal amortization from federal Form 4562, line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

California amortization:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Description of property

Amortization allowed or

Period or

Amortization

Date acquired

Cost or other basis

R&TC Section

allowable in earlier years

percentage

for this year

(mm/dd/yyyy)

(See instructions)

2

3 Add the amounts on line 2, column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 California amortization adjustment. Subtract line 3 from line 1. If negative, use brackets. Enter here and on the

00

applicable line of Form 100S, Side 6, Schedule K . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Part III Depreciation and Amortization Adjustment

1

Combine the amounts on Part I, line 4, and Part II, line 4. Enter here (if negative, use brackets) and on

00

Form 100S, Side 1, line 5. For passive activities, see instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

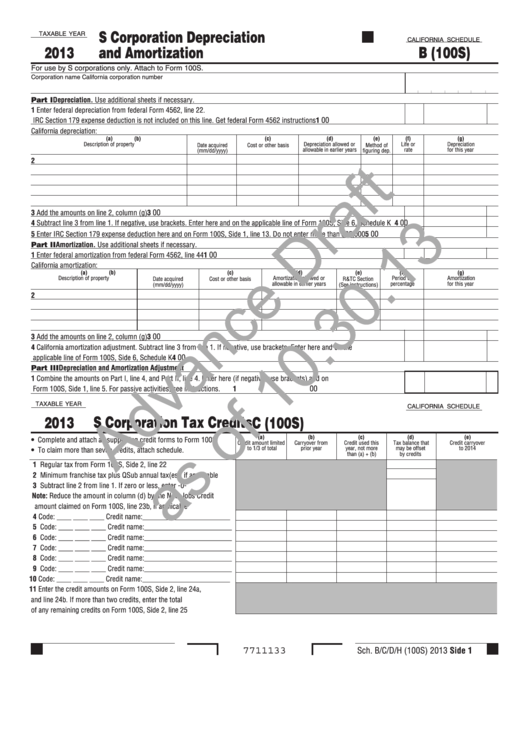

TAXABLE YEAR

CALIFORNIA SCHEDULE

S Corporation Tax Credits

2013

C (100S)

(a)

(b)

(c)

(d)

(e)

• Complete and attach all supporting credit forms to Form 100S.

Credit amount limited

Carryover from

Credit used this

Tax balance that

Credit carryover

to 1/3 of total

prior year

year, not more

may be offset

to 2014

• To claim more than seven credits, attach schedule.

than (a) + (b)

by credits

1 Regular tax from Form 100S, Side 2, line 22 . . . . . . . . . . . . . . . . . .

2 Minimum franchise tax plus QSub annual tax(es), if applicable. . . .

3 Subtract line 2 from line 1. If zero or less, enter -0-

Note: Reduce the amount in column (d) by the New Jobs Credit

amount claimed on Form 100S, line 23b, if applicable. . . . . . . . . . .

4 Code: ____ ____ ____ Credit name:________________________

5 Code: ____ ____ ____ Credit name:________________________

6 Code: ____ ____ ____ Credit name:________________________

7 Code: ____ ____ ____ Credit name:________________________

8 Code: ____ ____ ____ Credit name:________________________

9 Code: ____ ____ ____ Credit name:________________________

10 Code: ____ ____ ____ Credit name:________________________

11 Enter the credit amounts on Form 100S, Side 2, line 24a,

and line 24b. If more than two credits, enter the total

of any remaining credits on Form 100S, Side 2, line 25 . . . . . . . . .

Sch. B/C/D/H (100S) 2013 Side 1

7711133

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3