Form Rc-6-A - Out-Of-State Cigarette Revenue Return - 2000

ADVERTISEMENT

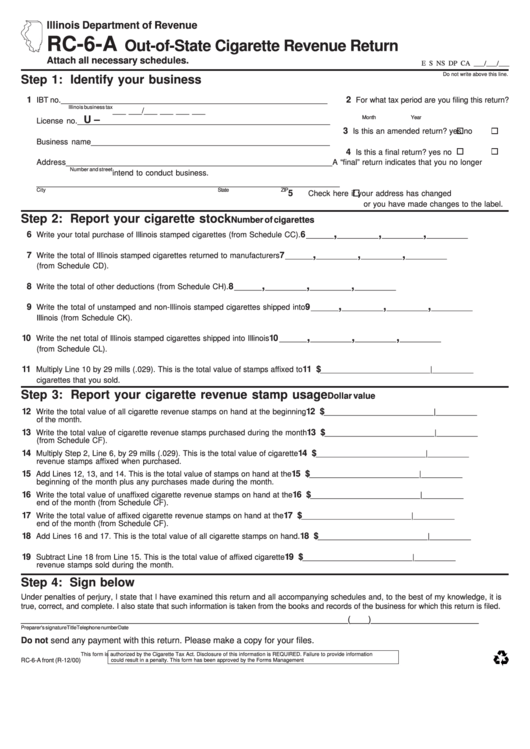

Illinois Department of Revenue

RC-6-A

Out-of-State Cigarette Revenue Return

Attach all necessary schedules.

E S NS DP CA ___/___/___

Do not write above this line.

Step 1: Identify your business

1

2

IBT no.__________________________________________________________

For what tax period are you filing this return?

Illinois business tax

___ ___/___ ___ ___ ___

Month

Year

U –

License no._______________________________________________________

3

Is this an amended return?

yes

no

Business name____________________________________________________

4

Is this a final return?

yes

no

Address__________________________________________________________

A “final” return indicates that you no longer

Number and street

intend to conduct business.

__________________________________________________________________

City

State

ZIP

5

Check here if your address has changed

or you have made changes to the label.

Step 2: Report your cigarette stock

Number of cigarettes

,

,

,

6

6

Write your total purchase of Illinois stamped cigarettes (from Schedule CC).

______

_________

_________

_________

,

,

,

7

7

Write the total of Illinois stamped cigarettes returned to manufacturers

______

_________

_________

_________

(from Schedule CD).

,

,

,

8

8

Write the total of other deductions (from Schedule CH).

______

_________

_________

_________

,

,

,

9

9

Write the total of unstamped and non-Illinois stamped cigarettes shipped into

______

_________

_________

_________

Illinois (from Schedule CK).

,

,

,

10

10

Write the net total of Illinois stamped cigarettes shipped into Illinois

______

_________

_________

_________

(from Schedule CL).

11

11 $

Multiply Line 10 by 29 mills (.029). This is the total value of stamps affixed to

________________________|_________

cigarettes that you sold.

Step 3: Report your cigarette revenue stamp usage

Dollar value

12

12 $

Write the total value of all cigarette revenue stamps on hand at the beginning

________________________|_________

of the month.

13

13 $

Write the total value of cigarette revenue stamps purchased during the month

________________________|_________

(from Schedule CF).

14

14 $

Multiply Step 2, Line 6, by 29 mills (.029). This is the total value of cigarette

________________________|_________

revenue stamps affixed when purchased.

15

15 $

Add Lines 12, 13, and 14. This is the total value of stamps on hand at the

________________________|_________

beginning of the month plus any purchases made during the month.

16

16 $

Write the total value of unaffixed cigarette revenue stamps on hand at the

________________________|_________

end of the month (from Schedule CF).

17

17 $

Write the total value of affixed cigarette revenue stamps on hand at the

________________________|_________

end of the month (from Schedule CF).

18

18 $

Add Lines 16 and 17. This is the total value of all cigarette stamps on hand.

________________________|_________

19

19 $

Subtract Line 18 from Line 15. This is the total value of affixed cigarette

________________________|_________

revenue stamps sold during the month.

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and all accompanying schedules and, to the best of my knowledge, it is

true, correct, and complete. I also state that such information is taken from the books and records of the business for which this return is filed.

_________________________________________________________________________(____)________________________

Preparer's signature

Title

Telephone number

Date

Do not send any payment with this return. Please make a copy for your files.

This form is authorized by the Cigarette Tax Act. Disclosure of this information is REQUIRED. Failure to provide information

RC-6-A front (R-12/00)

could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1