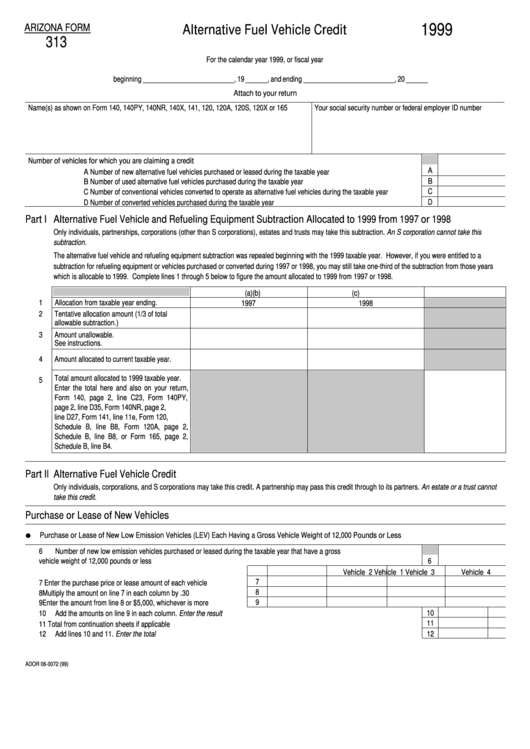

1999

Alternative Fuel Vehicle Credit

ARIZONA FORM

313

For the calendar year 1999, or fiscal year

beginning _________________________, 19 ______, and ending _________________________, 20 ______

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 141, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

Number of vehicles for which you are claiming a credit

A

A Number of new alternative fuel vehicles purchased or leased during the taxable year ...............................................

B

B Number of used alternative fuel vehicles purchased during the taxable year .............................................................

C Number of conventional vehicles converted to operate as alternative fuel vehicles during the taxable year ..............

C

D

D Number of converted vehicles purchased during the taxable year ..............................................................................

Part I Alternative Fuel Vehicle and Refueling Equipment Subtraction Allocated to 1999 from 1997 or 1998

Only individuals, partnerships, corporations (other than S corporations), estates and trusts may take this subtraction. An S corporation cannot take this

subtraction.

The alternative fuel vehicle and refueling equipment subtraction was repealed beginning with the 1999 taxable year. However, if you were entitled to a

subtraction for refueling equipment or vehicles purchased or converted during 1997 or 1998, you may still take one-third of the subtraction from those years

which is allocable to 1999. Complete lines 1 through 5 below to figure the amount allocated to 1999 from 1997 or 1998.

(a)

(b)

(c)

Allocation from taxable year ending.

1

1997

1998

2

Tentative allocation amount (1/3 of total

allowable subtraction.)

3

Amount unallowable.

See instructions.

4

Amount allocated to current taxable year.

Total amount allocated to 1999 taxable year.

5

Enter the total here and also on your return,

Form 140, page 2, line C23, Form 140PY,

page 2, line D35, Form 140NR, page 2,

line D27, Form 141, line 11e, Form 120,

Schedule B, line B8, Form 120A, page 2,

Schedule B, line B8, or Form 165, page 2,

Schedule B, line B4.

Part II Alternative Fuel Vehicle Credit

Only individuals, corporations, and S corporations may take this credit. A partnership may pass this credit through to its partners. An estate or a trust cannot

take this credit.

Purchase or Lease of New Vehicles

Purchase or Lease of New Low Emission Vehicles (LEV) Each Having a Gross Vehicle Weight of 12,000 Pounds or Less

6

Number of new low emission vehicles purchased or leased during the taxable year that have a gross

vehicle weight of 12,000 pounds or less ............................................................................................................................................

6

Vehicle 1

Vehicle 2

Vehicle 3

Vehicle 4

7

7

Enter the purchase price or lease amount of each vehicle .............

8

8

Multiply the amount on line 7 in each column by .30 ......................

9

9

Enter the amount from line 8 or $5,000, whichever is more ...........

10

Add the amounts on line 9 in each column. Enter the result .............................................................................................................

10

11

11

Total from continuation sheets if applicable .......................................................................................................................................

12

12

Add lines 10 and 11. Enter the total ...................................................................................................................................................

ADOR 06-0072 (99)

1

1 2

2 3

3 4

4 5

5