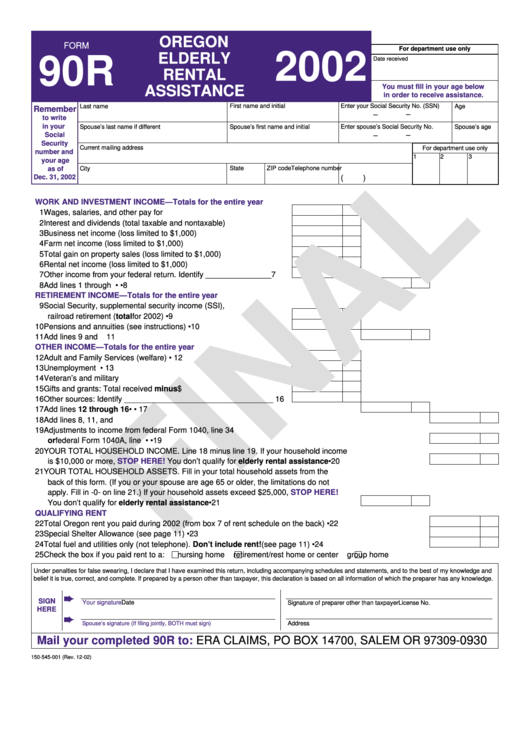

Form 90r Draft - Oregon Elderly Rental Assistance - 2002

ADVERTISEMENT

OREGON

FORM

For department use only

2002

ELDERLY

90R

Date received

RENTAL

You must fill in your age below

ASSISTANCE

in order to receive assistance.

Last name

First name and initial

Enter your Social Security No. (SSN)

Age

Remember

–

–

to write

in your

Spouse’s first name and initial

Enter spouse’s Social Security No.

Spouse’s last name if different

Spouse’s age

–

Social

–

Security

Current mailing address

For department use only

number and

1

2

3

your age

State

ZIP code

Telephone number

as of

City

(

)

Dec. 31, 2002

WORK AND INVESTMENT INCOME—Totals for the entire year

1 Wages, salaries, and other pay for work .........................................

1

2 Interest and dividends (total taxable and nontaxable) .....................

2

3 Business net income (loss limited to $1,000) ..................................

3

4 Farm net income (loss limited to $1,000) ........................................

4

5 Total gain on property sales (loss limited to $1,000) .......................

5

6 Rental net income (loss limited to $1,000) ......................................

6

7 Other income from your federal return. Identify _______________

7

8 Add lines 1 through 7 ..................................................................... • ............................. • 8

RETIREMENT INCOME—Totals for the entire year

9 Social Security, supplemental security income (SSI),

railroad retirement (total for 2002) ................................................. • 9

10 Pensions and annuities (see instructions) ...................................... • 10

11 Add lines 9 and 10 ........................................................................................................... 11

OTHER INCOME—Totals for the entire year

12 Adult and Family Services (welfare) ............................................... • 12

13 Unemployment benefits .................................................................. • 13

14 Veteran’s and military benefits ........................................................ 14

15 Gifts and grants: Total received minus $500 .................................. 15

16 Other sources: Identify __________________________________ 16

17 Add lines 12 through 16 ................................................................ • ............................. • 17

18 Add lines 8, 11, and 17 .................................................................................................................................... 18

19 Adjustments to income from federal Form 1040, line 34

or federal Form 1040A, line 20 ...................................................... • ............................................................ • 19

20 YOUR TOTAL HOUSEHOLD INCOME. Line 18 minus line 19. If your household income

is $10,000 or more,

STOP HERE!

You don’t qualify for elderly rental assistance ..................................... • 20

21 YOUR TOTAL HOUSEHOLD ASSETS. Fill in your total household assets from the

back of this form. (If you or your spouse are age 65 or older, the limitations do not

apply. Fill in -0- on line 21.) If your household assets exceed $25,000,

STOP HERE!

You don’t qualify for elderly rental assistance ............................................................. • 21

QUALIFYING RENT

22 Total Oregon rent you paid during 2002 (from box 7 of rent schedule on the back) ..................................... • 22

23 Special Shelter Allowance (see page 11) ...................................................................................................... • 23

24 Total fuel and utilities only (not telephone). Don’t include rent! (see page 11) ........................................... • 24

25 Check the box if you paid rent to a:

nursing home

retirement/rest home or center

group home

Under penalties for false swearing, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all information of which the preparer has any knowledge.

SIGN

Your signature

Date

Signature of preparer other than taxpayer

License No.

HERE

Address

Spouse’s signature (If filing jointly, BOTH must sign)

Mail your completed 90 R to:

ERA CLAIMS, PO BOX 14700, SALEM OR 97309- 0930

150-545-001 (Rev. 12-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2