Reset Form

2002

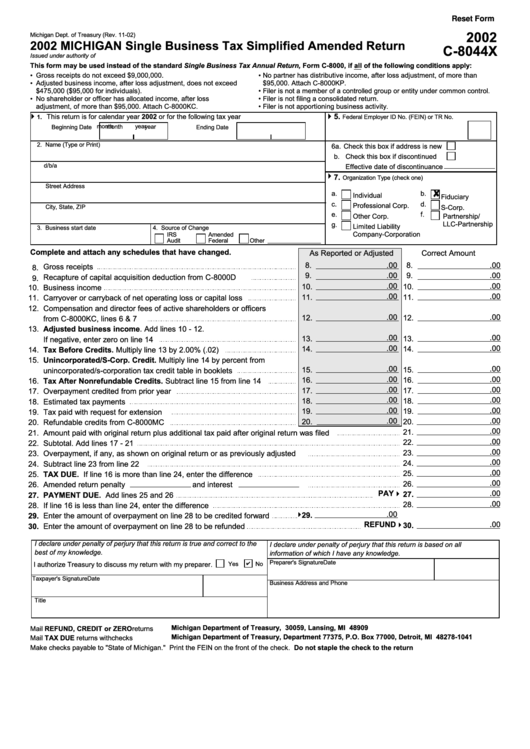

Michigan Dept. of Treasury (Rev. 11-02)

2002 MICHIGAN Single Business Tax Simplified Amended Return

C-8044X

Issued under authority of P.A. 228 of 1975.

This form may be used instead of the standard Single Business Tax Annual Return, Form C-8000, if all of the following conditions apply:

•

Gross receipts do not exceed $9,000,000.

•

No partner has distributive income, after loss adjustment, of more than

•

Adjusted business income, after loss adjustment, does not exceed

$95,000. Attach C-8000KP.

$475,000 ($95,000 for individuals).

•

Filer is not a member of a controlled group or entity under common control.

•

No shareholder or officer has allocated income, after loss

•

Filer is not filing a consolidated return.

adjustment, of more than $95,000. Attach C-8000KC.

•

Filer is not apportioning business activity.

4

4

5.

This return is for calendar year 2002 or for the following tax year

1.

Federal Employer ID No. (FEIN) or TR No.

month

year

month

year

Beginning Date

Ending Date

2. Name (Type or Print)

6a.

Check this box if address is new

b.

Check this box if discontinued

d/b/a

Effective date of discontinuance

4

7.

Organization Type (check one)

Street Address

a.

b.

Individual

Fiduciary

c.

d.

Professional Corp.

City, State, ZIP

S-Corp.

e.

f.

Other Corp.

Partnership/

LLC-Partnership

g.

Limited Liability

3. Business start date

4. Source of Change

Company-Corporation

IRS

Amended

Audit

Federal

Other

Complete and attach any schedules that have changed.

As Reported or Adjusted

Correct Amount

8.

.00

8.

.00

Gross receipts

8.

9.

.00

9.

.00

Recapture of capital acquisition deduction from C-8000D

9.

.00

.00

10.

10.

10.

Business income

.00

.00

11.

11.

11.

Carryover or carryback of net operating loss or capital loss

12.

Compensation and director fees of active shareholders or officers

.00

.00

12.

12.

from C-8000KC, lines 6 & 7

13.

Adjusted business income. Add lines 10 - 12.

.00

.00

13.

13.

If negative, enter zero on line 14

.00

.00

14.

14.

14.

Tax Before Credits. Multiply line 13 by 2.00% (.02)

15.

Unincorporated/S-Corp. Credit. Multiply line 14 by percent from

.00

.00

15.

15.

unincorporated/s-corporation tax credit table in booklets

.00

.00

16.

16.

16.

Tax After Nonrefundable Credits. Subtract line 15 from line 14

.00

.00

17.

17.

17.

Overpayment credited from prior year

.00

.00

18.

18.

18.

Estimated tax payments

.00

.00

19.

19.

19.

Tax paid with request for extension

.00

.00

20.

20.

20.

Refundable credits from C-8000MC

.00

21.

21.

Amount paid with original return plus additional tax paid after original return was filed

.00

22.

22.

Subtotal. Add lines 17 - 21

.00

23.

23.

Overpayment, if any, as shown on original return or as previously adjusted

.00

24.

24.

Subtract line 23 from line 22

.00

25.

25.

TAX DUE. If line 16 is more than line 24, enter the difference

.00

26.

26.

Amended return penalty

and interest

PAY

.00

4

27.

27.

PAYMENT DUE. Add lines 25 and 26

.00

28.

28.

If line 16 is less than line 24, enter the difference

.00

4

29.

29.

Enter the amount of overpayment on line 28 to be credited forward

REFUND

.00

4

30.

30.

Enter the amount of overpayment on line 28 to be refunded

I declare under penalty of perjury that this return is true and correct to the

I declare under penalty of perjury that this return is based on all

best of my knowledge.

information of which I have any knowledge.

Preparer's Signature

Date

I authorize Treasury to discuss my return with my preparer.

Yes

No

Taxpayer's Signature

Date

Business Address and Phone

Title

Michigan Department of Treasury, P.O. Box 30059, Lansing, MI 48909

Mail REFUND, CREDIT or ZERO returns to...

Michigan Department of Treasury, Department 77375, P.O. Box 77000, Detroit, MI 48278-1041

Mail TAX DUE returns with checks to.............

Make checks payable to "State of Michigan." Print the FEIN on the front of the check. Do not staple the check to the return

1

1