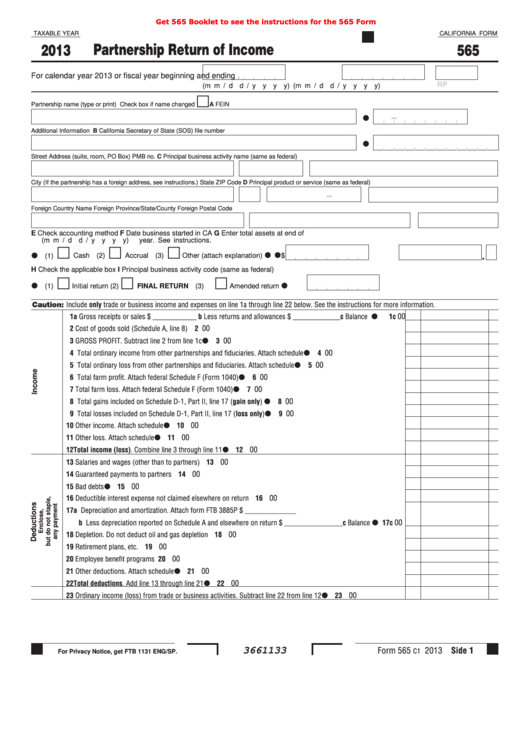

Get 565 Booklet to see the instructions for the 565 Form

TAXABLE YEAR

CALIFORNIA FORM

Partnership Return of Income

2013

565

For calendar year 2013 or fiscal year beginning

and ending

.

RP

(m m / d d / y y y y)

(m m / d d / y y y y)

m

Partnership name (type or print) Check box if name changed

A FEIN

Additional Information

B California Secretary of State (SOS) file number

Street Address (suite, room, PO Box)

PMB no.

C Principal business activity name (same as federal)

City (If the partnership has a foreign address, see instructions.)

State

ZIP Code

D Principal product or service (same as federal)

Foreign Country Name

Foreign Province/State/County

Foreign Postal Code

E Check accounting method

F Date business started in CA

G

Enter total assets at end of

(m m / d d / y y y y)

year. See instructions.

m

m

m

$

.

(1)

Cash (2)

Accrual (3)

Other (attach explanation)

H Check the applicable box

I

Principal business activity code (same as federal)

m

m

m

(1)

Initial return (2)

FINAL RETURN (3)

Amended return

Caution: Include only trade or business income and expenses on line 1a through line 22 below . See the instructions for more information .

00

1 a Gross receipts or sales $ ____________ b Less returns and allowances $ _____________ . . . . . c Balance

1c

00

2 Cost of goods sold (Schedule A, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 GROSS PROFIT . Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Total ordinary income from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Total ordinary loss from other partnerships and fiduciaries . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

6 Total farm profit . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Total farm loss . Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Total gains included on Schedule D-1, Part II, line 17 (gain only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

00

9 Total losses included on Schedule D-1, Part II, line 17 (loss only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Other income . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Other loss . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Total income (loss) . Combine line 3 through line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13 Salaries and wages (other than to partners) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

14 Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

00

16 Deductible interest expense not claimed elsewhere on return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 a Depreciation and amortization . Attach form FTB 3885P $ ______________

b Less depreciation reported on Schedule A and elsewhere on return $ ________________ . . . . . c Balance

17c

00

00

18 Depletion . Do not deduct oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 Retirement plans, etc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

21 Other deductions . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Total deductions . Add line 13 through line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Ordinary income (loss) from trade or business activities . Subtract line 22 from line 12 . . . . . . . . . . . . . . . . . .

23

Form 565

2013 Side 1

C1

3661133

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4 5

5