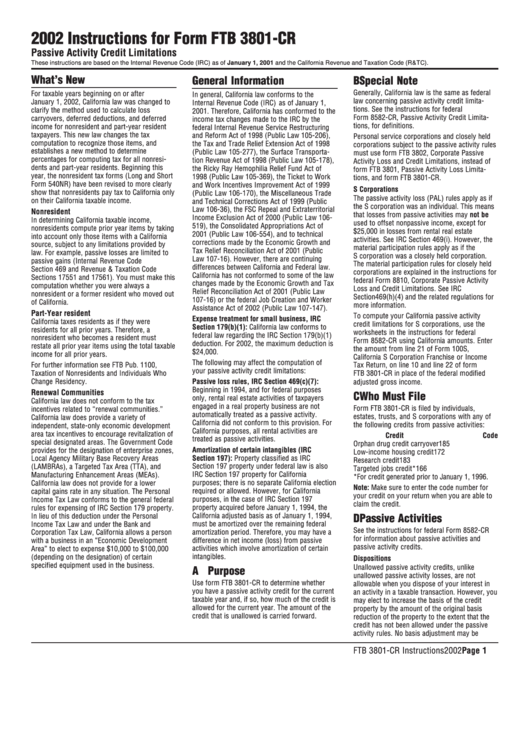

Instructions For Form Ftb 3801-Cr - Passive Activity Credit Limitations - 2002

ADVERTISEMENT

2002 Instructions for Form FTB 3801-CR

Passive Activity Credit Limitations

These instructions are based on the Internal Revenue Code (IRC) as of January 1, 2001 and the California Revenue and Taxation Code (R&TC).

What’s New

General Information

B Special Note

Generally, California law is the same as federal

For taxable years beginning on or after

In general, California law conforms to the

law concerning passive activity credit limita-

January 1, 2002, California law was changed to

Internal Revenue Code (IRC) as of January 1,

tions. See the instructions for federal

clarify the method used to calculate loss

2001. Therefore, California has conformed to the

Form 8582-CR, Passive Activity Credit Limita-

carryovers, deferred deductions, and deferred

income tax changes made to the IRC by the

tions, for definitions.

income for nonresident and part-year resident

federal Internal Revenue Service Restructuring

taxpayers. This new law changes the tax

and Reform Act of 1998 (Public Law 105-206),

Personal service corporations and closely held

computation to recognize those items, and

the Tax and Trade Relief Extension Act of 1998

corporations subject to the passive activity rules

establishes a new method to determine

(Public Law 105-277), the Surface Transporta-

must use form FTB 3802, Corporate Passive

percentages for computing tax for all nonresi-

tion Revenue Act of 1998 (Public Law 105-178),

Activity Loss and Credit Limitations, instead of

dents and part-year residents. Beginning this

the Ricky Ray Hemophilia Relief Fund Act of

form FTB 3801, Passive Activity Loss Limita-

year, the nonresident tax forms (Long and Short

1998 (Public Law 105-369), the Ticket to Work

tions, and form FTB 3801-CR.

Form 540NR) have been revised to more clearly

and Work Incentives Improvement Act of 1999

S Corporations

show that nonresidents pay tax to California only

(Public Law 106-170), the Miscellaneous Trade

The passive activity loss (PAL) rules apply as if

on their California taxable income.

and Technical Corrections Act of 1999 (Public

the S corporation was an individual. This means

Law 106-36), the FSC Repeal and Extraterritorial

Nonresident

that losses from passive activities may not be

Income Exclusion Act of 2000 (Public Law 106-

In determining California taxable income,

used to offset nonpassive income, except for

519), the Consolidated Appropriations Act of

nonresidents compute prior year items by taking

$25,000 in losses from rental real estate

2001 (Public Law 106-554), and to technical

into account only those items with a California

activities. See IRC Section 469(i). However, the

corrections made by the Economic Growth and

source, subject to any limitations provided by

material participation rules apply as if the

Tax Relief Reconciliation Act of 2001 (Public

law. For example, passive losses are limited to

S corporation was a closely held corporation.

Law 107-16). However, there are continuing

passive gains (Internal Revenue Code

The material participation rules for closely held

differences between California and Federal law.

Section 469 and Revenue & Taxation Code

corporations are explained in the instructions for

California has not conformed to some of the law

Sections 17551 and 17561). You must make this

federal Form 8810, Corporate Passive Activity

changes made by the Economic Growth and Tax

computation whether you were always a

Loss and Credit Limitations. See IRC

Relief Reconciliation Act of 2001 (Public Law

nonresident or a former resident who moved out

Section469(h)(4) and the related regulations for

107-16) or the federal Job Creation and Worker

of California.

more information.

Assistance Act of 2002 (Public Law 107-147).

Part-Year resident

To compute your California passive activity

Expense treatment for small business, IRC

California taxes residents as if they were

credit limitations for S corporations, use the

Section 179(b)(1): California law conforms to

residents for all prior years. Therefore, a

worksheets in the instructions for federal

federal law regarding the IRC Section 179(b)(1)

nonresident who becomes a resident must

Form 8582-CR using California amounts. Enter

deduction. For 2002, the maximum deduction is

restate all prior year items using the total taxable

the amount from line 21 of Form 100S,

$24,000.

income for all prior years.

California S Corporation Franchise or Income

The following may affect the computation of

For further information see FTB Pub. 1100,

Tax Return, on line 10 and line 22 of form

your passive activity credit limitations:

Taxation of Nonresidents and Individuals Who

FTB 3801-CR in place of the federal modified

Change Residency.

Passive loss rules, IRC Section 469(c)(7):

adjusted gross income.

Beginning in 1994, and for federal purposes

Renewal Communities

C Who Must File

only, rental real estate activities of taxpayers

California law does not conform to the tax

engaged in a real property business are not

Form FTB 3801-CR is filed by individuals,

incentives related to “renewal communities.”

automatically treated as a passive activity.

estates, trusts, and S corporations with any of

California law does provide a variety of

California did not conform to this provision. For

the following credits from passive activities:

independent, state-only economic development

California purposes, all rental activities are

area tax incentives to encourage revitalization of

Credit

Code

treated as passive activities.

special designated areas. The Government Code

Orphan drug credit carryover

185

Amortization of certain intangibles (IRC

provides for the designation of enterprise zones,

Low-income housing credit

172

Section 197): Property classified as IRC

Local Agency Military Base Recovery Areas

Research credit

183

Section 197 property under federal law is also

(LAMBRAs), a Targeted Tax Area (TTA), and

Targeted jobs credit*

166

Manufacturing Enhancement Areas (MEAs).

IRC Section 197 property for California

*For credit generated prior to January 1, 1996.

purposes; there is no separate California election

California law does not provide for a lower

Note: Make sure to enter the code number for

required or allowed. However, for California

capital gains rate in any situation. The Personal

your credit on your return when you are able to

purposes, in the case of IRC Section 197

Income Tax Law conforms to the general federal

claim the credit.

property acquired before January 1, 1994, the

rules for expensing of IRC Section 179 property.

In lieu of this deduction under the Personal

California adjusted basis as of January 1, 1994,

D Passive Activities

must be amortized over the remaining federal

Income Tax Law and under the Bank and

See the instructions for federal Form 8582-CR

amortization period. Therefore, you may have a

Corporation Tax Law, California allows a person

for information about passive activities and

difference in net income (loss) from passive

with a business in an “Economic Development

passive activity credits.

activities which involve amortization of certain

Area” to elect to expense $10,000 to $100,000

intangibles.

(depending on the designation) of certain

Dispositions

specified equipment used in the business.

Unallowed passive activity credits, unlike

A Purpose

unallowed passive activity losses, are not

Use form FTB 3801-CR to determine whether

allowable when you dispose of your interest in

you have a passive activity credit for the current

an activity in a taxable transaction. However, you

taxable year and, if so, how much of the credit is

may elect to increase the basis of the credit

allowed for the current year. The amount of the

property by the amount of the original basis

credit that is unallowed is carried forward.

reduction of the property to the extent that the

credit has not been allowed under the passive

activity rules. No basis adjustment may be

FTB 3801-CR Instructions 2002 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4