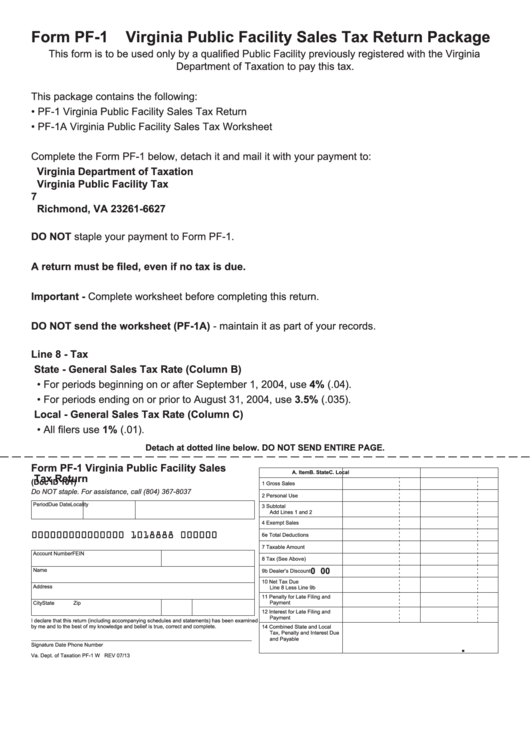

Form PF-1 Virginia Public Facility Sales Tax Return Package

This form is to be used only by a qualified Public Facility previously registered with the Virginia

Department of Taxation to pay this tax.

This package contains the following:

• PF-1

Virginia Public Facility Sales Tax Return

• PF-1A

Virginia Public Facility Sales Tax Worksheet

Complete the Form PF-1 below, detach it and mail it with your payment to:

Virginia Department of Taxation

Virginia Public Facility Tax

P.O. Box 26627

Richmond, VA 23261-6627

DO NOT staple your payment to Form PF-1.

A return must be filed, even if no tax is due.

Important - Complete worksheet before completing this return.

DO NOT send the worksheet (PF-1A) - maintain it as part of your records.

Line 8 - Tax

State - General Sales Tax Rate (Column B)

•

For periods beginning on or after September 1, 2004, use 4% (.04).

•

For periods ending on or prior to August 31, 2004, use 3.5% (.035).

Local - General Sales Tax Rate (Column C)

•

All filers use 1% (.01).

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Form PF-1

Virginia Public Facility Sales

A. Item

B. State

C. Local

Tax Return

(Doc ID 101)

1 Gross Sales

Do NOT staple.

For assistance, call (804) 367-8037

2 Personal Use

Period

Due Date

Locality

3 Subtotal

Add Lines 1 and 2

4 Exempt Sales

000000000000000 1018888 000000

6e Total Deductions

7 Taxable Amount

Account Number

FEIN

8 Tax (See Above)

0 00

Name

9b Dealer’s Discount

10 Net Tax Due

Address

Line 8 Less Line 9b

11 Penalty for Late Filing and

City

State

Zip

Payment

12 Interest for Late Filing and

Payment

I declare that this return (including accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is true, correct and complete.

14 Combined State and Local

Tax, Penalty and Interest Due

and Payable

.

Signature

Date

Phone Number

Va. Dept. of Taxation PF-1 W REV 07/13

1

1 2

2 3

3