Schedule Ge-1 Instructions - Survey Of General Excise/use Tax Exemptions And Deductions - 2011

ADVERTISEMENT

Schedule GE-1

STATE OF HAWAII – DEPARTMENT OF TAXATION

SURVEY OF GENERAL EXCISE/USE TAX

Instructions

EXEMPTIONS AND DEDUCTIONS

(2011)

General Instructions:

Act 105, Session Law of Hawaii 2011, requires the Director of Taxation to collect information

on

all exclusions or exemptions of all amounts, persons, or transactions from general excise and

use

tax.

Who Must File

Schedule GE-1 must be filed by all taxpayers claiming any general excise and/or use tax

exemption(s) and/or deduction(s) for tax years 2010, 2011, and 2012, except for certain nonprofit

organizations that have applied for and received approval from the Department of Taxation for

an exemption from the general excise tax.

Where and How to File

Schedule GE-1 must be filed electronically on the Department of Taxation's Electronic Services

website at https:// To file this form, a taxpayer must first register and

create an account at the Electronic Services website. Please be sure to register ALL of the

Hawaii Tax I.D. Numbers registered to you. If you have already registered and created an

account, log in, select the Hawaii Tax I.D. Number you are filing for, and click on the Schedule

GE-1 under the Business Taxes section to begin the survey.

Taxpayers with Multiple General Excise/Use Tax Hawaii Tax I.D. Numbers – If you have

more than one GE Hawaii Tax I.D. number, you must file a Schedule GE-1 for each Hawaii Tax

I.D. number. Do NOT combine the information into one filing. If you haven't done so, please be

sure to register ALL of the Hawaii Tax I.D. numbers registered to you.

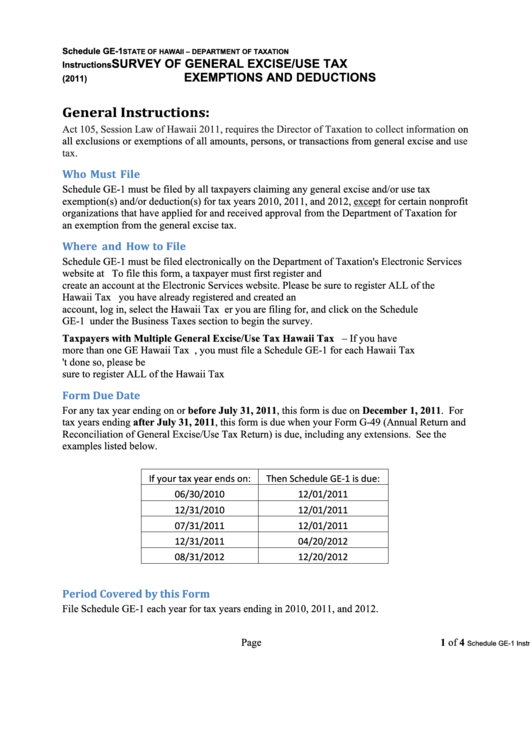

Form Due Date

For any tax year ending on or before July 31, 2011, this form is due on December 1, 2011. For

tax years ending after July 31, 2011, this form is due when your Form G-49 (Annual Return and

Reconciliation of General Excise/Use Tax Return) is due, including any extensions. See the

examples listed below.

If your tax year ends on: Then Schedule GE‐1 is due:

06/30/2010

12/01/2011

12/31/2010

12/01/2011

07/31/2011

12/01/2011

12/31/2011

04/20/2012

08/31/2012

12/20/2012

Period Covered by this Form

File Schedule GE-1 each year for tax years ending in 2010, 2011, and 2012.

Page 1 of 4

Schedule GE-1 Instructions (2011)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4