Form Ar1000anr - Amended Individual Income Tax Return - 2003

ADVERTISEMENT

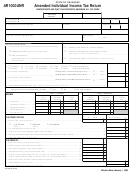

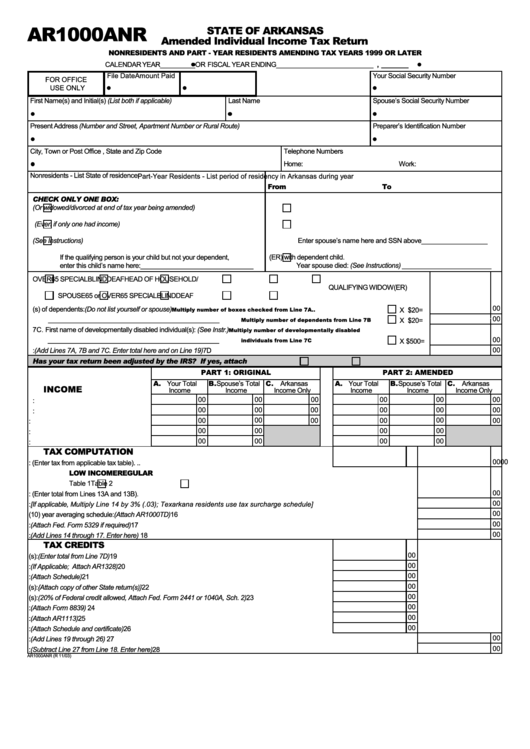

AR1000ANR

STATE OF ARKANSAS

Amended Individual Income Tax Return

NONRESIDENTS AND PART - YEAR RESIDENTS AMENDING TAX YEARS 1999 OR LATER

CALENDAR YEAR _________ OR FISCAL YEAR ENDING _________________________ , _______

File Date

Amount Paid

Your Social Security Number

FOR OFFICE

USE ONLY

First Name(s) and Initial(s) (List both if applicable)

Last Name

Spouse’s Social Security Number

Present Address (Number and Street, Apartment Number or Rural Route)

Preparer’s Identification Number

City, Town or Post Office , State and Zip Code

Telephone Numbers

Home:

Work:

Nonresidents - List State of residence

Part-Year Residents - List period of residency in Arkansas during year

From

To

CHECK ONLY ONE BOX:

1.

SINGLE (Or widowed/divorced at end of tax year being amended)

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

2.

MARRIED FILING JOINT (Even if only one had income)

5.

MARRIED FILING SEPARATELY ON DIFFERENT RETURNS

Enter spouse’s name here and SSN above _________________

3.

HEAD OF HOUSEHOLD (See Instructions)

If the qualifying person is your child but not your dependent,

6.

QUALIFYING WIDOW(ER) with dependent child.

enter this child’s name here: _____________________________

Year spouse died: (See Instructions) _______________________

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/

QUALIFYING WIDOW(ER)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

00

7B. First name(s) of dependents: (Do not list yourself or spouse)

Multiply number of boxes checked from Line 7A ..

X $20 =

00

____________________________________________

Multiply number of dependents from Line 7B .......

X $20 =

7C. First name of developmentally disabled individual(s): (See Instr.)

Multiply number of developmentally disabled

00

____________________________________________

individuals from Line 7C .........................................

X $500 =

00

7D.TOTAL PERSONAL CREDITS: (Add Lines 7A, 7B and 7C. Enter total here and on Line 19) ......................................................... 7D

Has your tax return been adjusted by the IRS? If yes, attach reports.

Yes

No

PART 1: ORIGINAL

PART 2: AMENDED

A.

B.

C.

A.

B.

C.

Your Total

Spouse’s Total

Arkansas

Your Total

Spouse’s Total

Arkansas

INCOME

Income

Income

Income Only

Income

Income

Income Only

00

00

00

00

00

00

8. Total Income: ................................ 8

8

00

00

00

00

00

00

9. Adjustments to Income: ................. 9

9

00

00

00

00

00

00

10. Adjusted Gross Income: .............. 10

10

00

00

00

00

11. Itemized/Standard Deductions: .... 11

11

00

00

00

00

12. Net Taxable Income: ................... 12

12

TAX COMPUTATION

00

00

13. Select tax table: (Enter tax from applicable tax table). ................................................................... 13

LOW INCOME

REGULAR

Table 1

Table 2

00

14. Combined Tax: (Enter total from Lines 13A and 13B). .............................................................................................................. 14

00

15. Income Tax Surcharge: [If applicable, Multiply Line 14 by 3% (.03); Texarkana residents use tax surcharge schedule] .... 15

00

16. Enter tax from ten (10) year averaging schedule: (Attach AR1000TD) ....................................................................................... 16

00

17. IRA and qualified plan withdrawal and overpayment penalties: (Attach Fed. Form 5329 if required) ............................................ 17

00

18. Total Tax: (Add Lines 14 through 17. Enter here) ...................................................................................................................... 18

TAX CREDITS

00

19. Personal Tax Credit(s): (Enter total from Line 7D) ......................................................................... 19

00

20. Working Taxpayer Credit: (If Applicable; Attach AR1328) ............................................................. 20

00

21. State Political Contributions Credit: (Attach Schedule) .................................................................. 21

00

22. Other State Tax Credit(s): {Attach copy of other State return(s)} ..................................................... 22

00

23. Child Care Credit(s): (20% of Federal credit allowed, Attach Fed. Form 2441 or 1040A, Sch. 2) ..... 23

00

24. Credit for Adoption Expenses: (Attach Form 8839) ....................................................................... 24

00

25. Phenylketonuria Disorder Credit: (Attach AR1113) ....................................................................... 25

00

26. Business and Incentive Tax Credits: (Attach Schedule and certificate) ........................................... 26

00

27. TOTAL CREDITS: (Add Lines 19 through 26) .......................................................................................................................... 27

00

28. NET TAX: (Subtract Line 27 from Line 18. Enter here) ............................................................................................................. 28

AR1000ANR (R 11/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2