Clear form

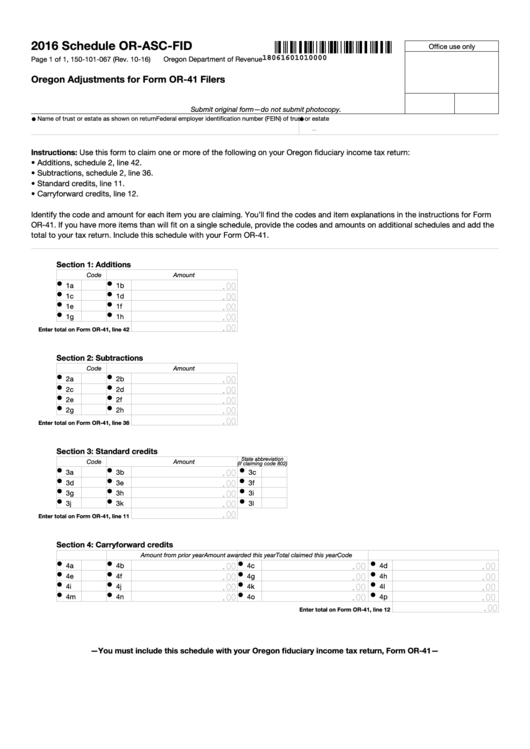

2016 Schedule OR-ASC-FID

Office use only

18061601010000

Page 1 of 1, 150‑101‑067 (Rev. 10‑16)

Oregon Department of Revenue

Oregon Adjustments for Form OR-41 Filers

Submit original form—do not submit photocopy.

•

•

Name of trust or estate as shown on return

Federal employer identification number (FEIN) of trust or estate

–

Instructions: Use this form to claim one or more of the following on your Oregon fiduciary income tax return:

• Additions, schedule 2, line 42.

• Subtractions, schedule 2, line 36.

• Standard credits, line 11.

• Carryforward credits, line 12.

Identify the code and amount for each item you are claiming. You’ll find the codes and item explanations in the instructions for Form

OR‑41. If you have more items than will fit on a single schedule, provide the codes and amounts on additional schedules and add the

total to your tax return. Include this schedule with your Form OR‑41.

Section 1: Additions

Code

Amount

•

•

.00

1a

1b

•

•

.00

1c

1d

•

•

.00

1e

1f

•

•

.00

1g

1h

.00

Enter total on Form OR-41, line 42

Section 2: Subtractions

Code

Amount

•

•

.00

2a

2b

•

•

.00

2c

2d

•

•

.00

2e

2f

•

•

.00

2g

2h

.00

Enter total on Form OR-41, line 36

Section 3: Standard credits

State abbreviation

Code

Amount

(if claiming code 802)

•

•

•

.00

3a

3b

3c

•

•

•

.00

3d

3e

3f

•

•

•

.00

3g

3h

3i

•

•

•

.00

3j

3k

3l

.00

Enter total on Form OR-41, line 11

Section 4: Carryforward credits

Code

Amount from prior year

Amount awarded this year

Total claimed this year

•

•

•

•

.00

.00

.00

4a

4b

4c

4d

•

•

•

•

.00

.00

.00

4e

4f

4g

4h

•

•

•

•

.00

.00

.00

4i

4j

4k

4l

•

•

•

•

.00

.00

.00

4m

4n

4o

4p

.00

Enter total on Form OR-41, line 12

—You must include this schedule with your Oregon fiduciary income tax return, Form OR-41—

1

1