Instructions For Filing Earned Income/net Profits Tax And Flat Rate Occupation Tax

ADVERTISEMENT

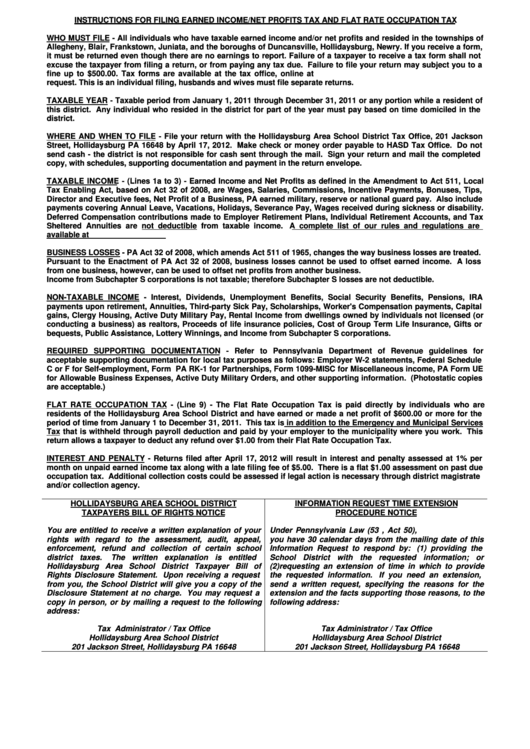

INSTRUCTIONS FOR FILING EARNED INCOME/NET PROFITS TAX AND FLAT RATE OCCUPATION TAX

WHO MUST FILE - All individuals who have taxable earned income and/or net profits and resided in the townships of

Allegheny, Blair, Frankstown, Juniata, and the boroughs of Duncansville, Hollidaysburg, Newry. If you receive a form,

it must be returned even though there are no earnings to report. Failure of a taxpayer to receive a tax form shall not

excuse the taxpayer from filing a return, or from paying any tax due. Failure to file your return may subject you to a

fine up to $500.00. Tax forms are available at the tax office, online at or can be mailed upon

request. This is an individual filing, husbands and wives must file separate returns.

TAXABLE YEAR - Taxable period from January 1, 2011 through December 31, 2011 or any portion while a resident of

this district. Any individual who resided in the district for part of the year must pay based on time domiciled in the

district.

WHERE AND WHEN TO FILE - File your return with the Hollidaysburg Area School District Tax Office, 201 Jackson

Street, Hollidaysburg PA 16648 by April 17, 2012. Make check or money order payable to HASD Tax Office. Do not

send cash - the district is not responsible for cash sent through the mail. Sign your return and mail the completed

copy, with schedules, supporting documentation and payment in the return envelope.

TAXABLE INCOME - (Lines 1a to 3) - Earned Income and Net Profits as defined in the Amendment to Act 511, Local

Tax Enabling Act, based on Act 32 of 2008, are Wages, Salaries, Commissions, Incentive Payments, Bonuses, Tips,

Director and Executive fees, Net Profit of a Business, PA earned military, reserve or national guard pay. Also include

payments covering Annual Leave, Vacations, Holidays, Severance Pay, Wages received during sickness or disability.

Deferred Compensation contributions made to Employer Retirement Plans, Individual Retirement Accounts, and Tax

Sheltered Annuities are not deductible from taxable income.

A complete list of our rules and regulations are

available at

BUSINESS LOSSES - PA Act 32 of 2008, which amends Act 511 of 1965, changes the way business losses are treated.

Pursuant to the Enactment of PA Act 32 of 2008, business losses cannot be used to offset earned income. A loss

from one business, however, can be used to offset net profits from another business.

Income from Subchapter S corporations is not taxable; therefore Subchapter S losses are not deductible.

NON-TAXABLE INCOME - Interest, Dividends, Unemployment Benefits, Social Security Benefits, Pensions, IRA

payments upon retirement, Annuities, Third-party Sick Pay, Scholarships, Worker's Compensation payments, Capital

gains, Clergy Housing, Active Duty Military Pay, Rental Income from dwellings owned by individuals not licensed (or

conducting a business) as realtors, Proceeds of life insurance policies, Cost of Group Term Life Insurance, Gifts or

bequests, Public Assistance, Lottery Winnings, and Income from Subchapter S corporations.

REQUIRED SUPPORTING DOCUMENTATION - Refer to Pennsylvania Department of Revenue guidelines for

acceptable supporting documentation for local tax purposes as follows: Employer W-2 statements, Federal Schedule

C or F for Self-employment, Form PA RK-1 for Partnerships, Form 1099-MISC for Miscellaneous income, PA Form UE

for Allowable Business Expenses, Active Duty Military Orders, and other supporting information. (Photostatic copies

are acceptable.)

FLAT RATE OCCUPATION TAX - (Line 9) - The Flat Rate Occupation Tax is paid directly by individuals who are

residents of the Hollidaysburg Area School District and have earned or made a net profit of $600.00 or more for the

period of time from January 1 to December 31, 2011. This tax is in addition to the Emergency and Municipal Services

Tax that is withheld through payroll deduction and paid by your employer to the municipality where you work. This

return allows a taxpayer to deduct any refund over $1.00 from their Flat Rate Occupation Tax.

INTEREST AND PENALTY - Returns filed after April 17, 2012 will result in interest and penalty assessed at 1% per

month on unpaid earned income tax along with a late filing fee of $5.00. There is a flat $1.00 assessment on past due

occupation tax. Additional collection costs could be assessed if legal action is necessary through district magistrate

and/or collection agency.

HOLLIDAYSBURG AREA SCHOOL DISTRICT

INFORMATION REQUEST TIME EXTENSION

TAXPAYERS BILL OF RIGHTS NOTICE

PROCEDURE NOTICE

You are entitled to receive a written explanation of your

Under Pennsylvania Law (53 P.S. Section 8424, Act 50),

rights with regard to the assessment, audit, appeal,

you have 30 calendar days from the mailing date of this

enforcement, refund and collection of certain school

Information Request to respond by:

(1) providing the

district taxes.

The written explanation is entitled

School District with the requested information; or

Hollidaysburg Area School District Taxpayer Bill of

(2)requesting an extension of time in which to provide

Rights Disclosure Statement. Upon receiving a request

the requested information.

If you need an extension,

from you, the School District will give you a copy of the

send a written request, specifying the reasons for the

Disclosure Statement at no charge. You may request a

extension and the facts supporting those reasons, to the

copy in person, or by mailing a request to the following

following address:

address:

Tax Administrator / Tax Office

Tax Administrator / Tax Office

Hollidaysburg Area School District

Hollidaysburg Area School District

201 Jackson Street, Hollidaysburg PA 16648

201 Jackson Street, Hollidaysburg PA 16648

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1