Form Rp-305-Pr - Agricultural Payment Report - 1998

ADVERTISEMENT

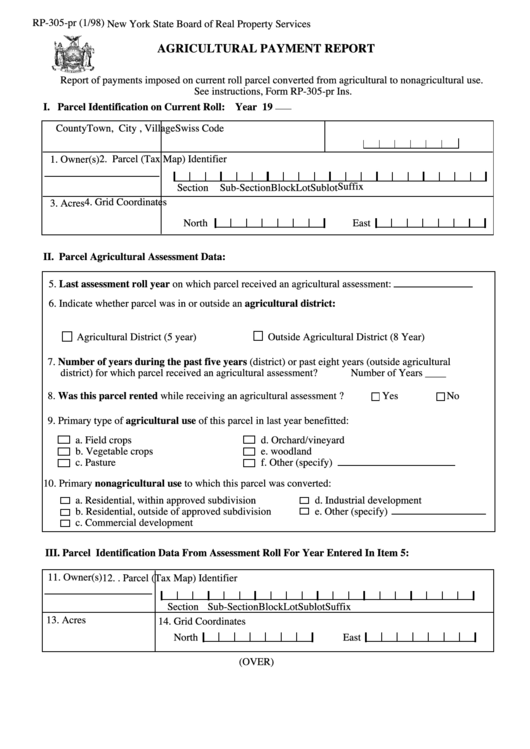

RP-305-pr (1/98)

New York State Board of Real Property Services

AGRICULTURAL PAYMENT REPORT

Report of payments imposed on current roll parcel converted from agricultural to nonagricultural use.

See instructions, Form RP-305-pr Ins.

I. Parcel Identification on Current Roll: Year 19

County

Town, City , Village

Swiss Code

2. Parcel (Tax Map) Identifier

1. Owner(s)

Suffix

Section

Sub-Section

Block

Lot

Sublot

4. Grid Coordinates

3. Acres

North

East

II. Parcel Agricultural Assessment Data:

5. Last assessment roll year on which parcel received an agricultural assessment:

6. Indicate whether parcel was in or outside an agricultural district:

Agricultural District (5 year)

Outside Agricultural District (8 Year)

7. Number of years during the past five years (district) or past eight years (outside agricultural

district) for which parcel received an agricultural assessment?

Number of Years ____

8. Was this parcel rented while receiving an agricultural assessment ?

Yes

No

9. Primary type of agricultural use of this parcel in last year benefitted:

a. Field crops

d. Orchard/vineyard

b. Vegetable crops

e. woodland

c. Pasture

f. Other (specify)

10. Primary nonagricultural use to which this parcel was converted:

a. Residential, within approved subdivision

d. Industrial development

b. Residential, outside of approved subdivision

e. Other (specify)

c. Commercial development

III. Parcel Identification Data From Assessment Roll For Year Entered In Item 5:

11. Owner(s)

12. . Parcel (Tax Map) Identifier

Section Sub-Section

Block

Lot

Sublot

Suffix

13. Acres

14. Grid Coordinates

North

East

(OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2