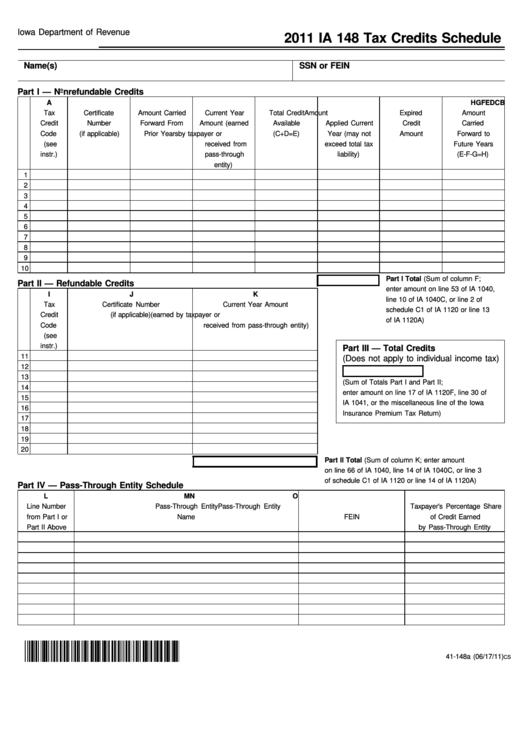

Form Ia 148 - Tax Credits Schedule -2011

ADVERTISEMENT

Iowa Department of Revenue

2011 IA 148 Tax Credits Schedule

Name(s)

SSN or FEIN

Part I — Nonrefundable Credits

A

B

C

D

E

F

G

H

Tax

Certificate

Amount Carried

Current Year

Total Credit

Amount

Expired

Amount

Credit

Number

Forward From

Amount (earned

Available

Applied Current

Credit

Carried

Code

(if applicable)

Prior Years

by taxpayer or

(C+D=E)

Year (may not

Amount

Forward to

(see

received from

exceed total tax

Future Years

instr.)

pass-through

liability)

(E-F-G=H)

entity)

1

2

3

4

5

6

7

8

9

10

Part I Total (Sum of column F;

Part II — Refundable Credits

enter amount on line 53 of IA 1040,

I

J

K

line 10 of IA 1040C, or line 2 of

Tax

Certificate Number

Current Year Amount

schedule C1 of IA 1120 or line 13

Credit

(if applicable)

(earned by taxpayer or

of IA 1120A)

Code

received from pass-through entity)

(see

instr.)

Part III — Total Credits

11

(Does not apply to individual income tax)

12

13

(Sum of Totals Part I and Part II;

14

enter amount on line 17 of IA 1120F, line 30 of

15

IA 1041, or the miscellaneous line of the Iowa

16

Insurance Premium Tax Return)

17

18

19

20

Part II Total (Sum of column K; enter amount

on line 66 of IA 1040, line 14 of IA 1040C, or line 3

of schedule C1 of IA 1120 or line 14 of IA 1120A)

Part IV — Pass-Through Entity Schedule

L

M

N

O

Line Number

Pass-Through Entity

Pass-Through Entity

Taxpayer's Percentage Share

from Part I or

Name

FEIN

of Credit Earned

Part II Above

by Pass-Through Entity

41-148a (06/17/11)

CS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1