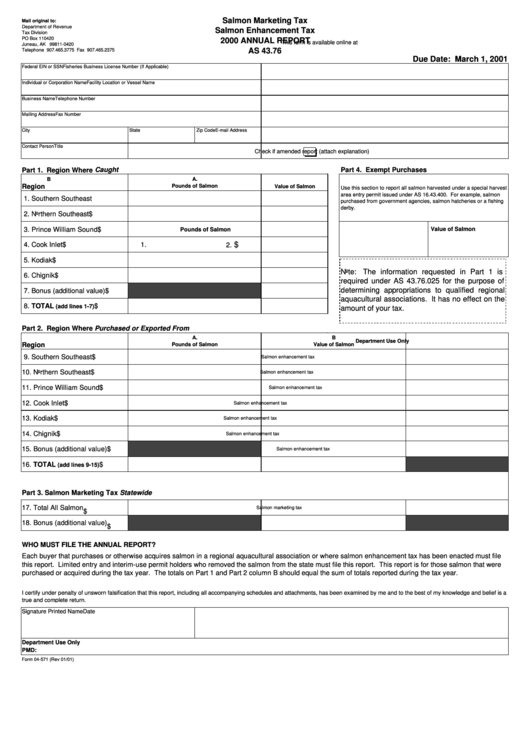

Form 04-571 - Annual Report - 2000

ADVERTISEMENT

Salmon Marketing Tax

Mail original to:

Department of Revenue

Salmon Enhancement Tax

Tax Division

PO Box 110420

2000 ANNUAL REPORT

This form is available online at

Juneau, AK 99811-0420

AS 43.76

Telephone 907.465.3775 Fax 907.465.2375

Due Date: March 1, 2001

Federal EIN or SSN

Fisheries Business License Number (If Applicable)

Individual or Corporation Name

Facility Location or Vessel Name

Business Name

Telephone Number

Mailing Address

Fax Number

City

State

Zip Code

E-mail Address

Contact Person

Title

Check if amended report (attach explanation)

Part 1. Region Where Caught

Part 4. Exempt Purchases

A.

B

Region

Pounds of Salmon

Value of Salmon

Use this section to report all salmon harvested under a special harvest

area entry permit issued under AS 16.43.400. For example, salmon

1. Southern Southeast

purchased from government agencies, salmon hatcheries or a fishing

derby.

2. Northern Southeast

$

3. Prince William Sound

$

Value of Salmon

Pounds of Salmon

$

4. Cook Inlet

$

1.

2.

5. Kodiak

$

Note: The information requested in Part 1 is

6. Chignik

$

required under AS 43.76.025 for the purpose of

determining appropriations to qualified regional

7. Bonus (additional value)

$

aquacultural associations. It has no effect on the

8. TOTAL

$

(add lines 1-7)

amount of your tax.

Part 2. Region Where Purchased or Exported From

A.

B

Department Use Only

Region

Pounds of Salmon

Value of Salmon

9. Southern Southeast

$

Salmon enhancement tax

10. Northern Southeast

$

Salmon enhancement tax

11. Prince William Sound

$

Salmon enhancement tax

12. Cook Inlet

$

Salmon enhancement tax

13. Kodiak

$

Salmon enhancement tax

14. Chignik

$

Salmon enhancement tax

15. Bonus (additional value)

$

Salmon enhancement tax

16. TOTAL

$

(add lines 9-15)

Part 3. Salmon Marketing Tax Statewide

17. Total All Salmon

Salmon marketing tax

$

18. Bonus (additional value)

$

WHO MUST FILE THE ANNUAL REPORT?

Each buyer that purchases or otherwise acquires salmon in a regional aquacultural association or where salmon enhancement tax has been enacted must file

this report. Limited entry and interim-use permit holders who removed the salmon from the state must file this report. This report is for those salmon that were

purchased or acquired during the tax year. The totals on Part 1 and Part 2 column B should equal the sum of totals reported during the tax year.

I certify under penalty of unsworn falsification that this report, including all accompanying schedules and attachments, has been examined by me and to the best of my knowledge and belief is a

true and complete return.

Signature

Printed Name

Date

Department Use Only

PMD:

Form 04-571 (Rev 01/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1