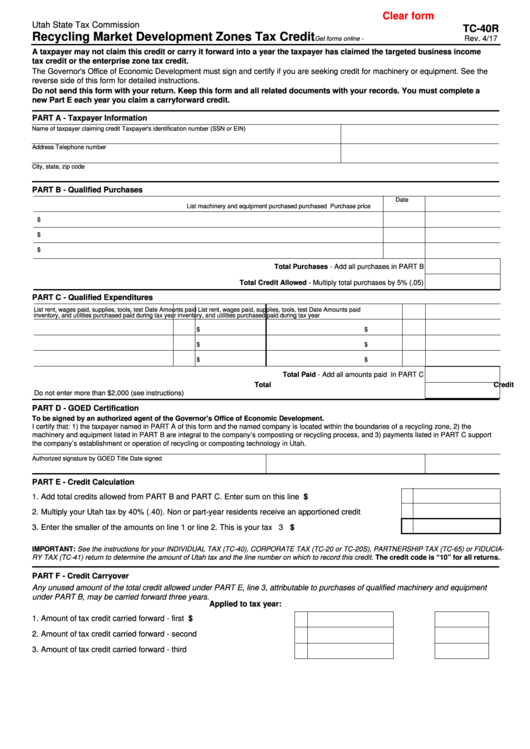

Clear form

Utah State Tax Commission

TC-40R

Recycling Market Development Zones Tax Credit

Rev. 4/17

Get forms online - tax.utah.gov

A taxpayer may not claim this credit or carry it forward into a year the taxpayer has claimed the targeted business income

tax credit or the enterprise zone tax credit.

The Governor's Office of Economic Development must sign and certify if you are seeking credit for machinery or equipment. See the

reverse side of this form for detailed instructions.

Do not send this form with your return. Keep this form and all related documents with your records. You must complete a

new Part E each year you claim a carryforward credit.

PART A - Taxpayer Information

Name of taxpayer claiming credit

Taxpayer's identification number (SSN or EIN)

Address

Telephone number

City, state, zip code

PART B - Qualified Purchases

Date

List machinery and equipment purchased

purchased

Purchase price

$

$

$

Total Purchases - Add all purchases in PART B

Total Credit Allowed - Multiply total purchases by 5% (.05)

PART C - Qualified Expenditures

List rent, wages paid, supplies, tools, test

Date

Amounts paid

List rent, wages paid, supplies, tools, test

Date

Amounts paid

inventory, and utilities purchased

paid

during tax year

inventory, and utilities purchased

paid

during tax year

$

$

$

$

$

$

Total Paid - Add all amounts paid in PART C

Total Credit Allowed - Multiply total paid by 20% (.20)

Do not enter more than $2,000 (see instructions)

PART D - GOED Certification

To be signed by an authorized agent of the Governor's Office of Economic Development.

I certify that: 1) the taxpayer named in PART A of this form and the named company is located within the boundaries of a recycling zone, 2) the

machinery and equipment listed in PART B are integral to the company’s composting or recycling process, and 3) payments listed in PART C support

the company’s establishment or operation of recycling or composting technology in Utah.

Authorized signature by GOED

Title

Date signed

PART E - Credit Calculation

1. Add total credits allowed from PART B and PART C. Enter sum on this line ............................................. 1 $

2. Multiply your Utah tax by 40% (.40). Non or part-year residents receive an apportioned credit ................ 2

3. Enter the smaller of the amounts on line 1 or line 2. This is your tax credit ............................................... 3 $

IMPORTANT: See the instructions for your INDIVIDUAL TAX (TC-40), CORPORATE TAX (TC-20 or TC-20S), PARTNERSHIP TAX (TC-65) or FIDUCIA-

RY TAX (TC-41) return to determine the amount of Utah tax and the line number on which to record this credit. The credit code is “10” for all returns.

PART F - Credit Carryover

Any unused amount of the total credit allowed under PART E, line 3, attributable to purchases of qualified machinery and equipment

under PART B, may be carried forward three years.

Applied to tax year:

1. Amount of tax credit carried forward - first year.......................................... 1 $

................

2. Amount of tax credit carried forward - second year.................................... 2

................

3. Amount of tax credit carried forward - third year ........................................ 3

................

1

1 2

2