Reset Form

Michigan Department of Treasury

2007

(Rev. 10-07)

C-8044

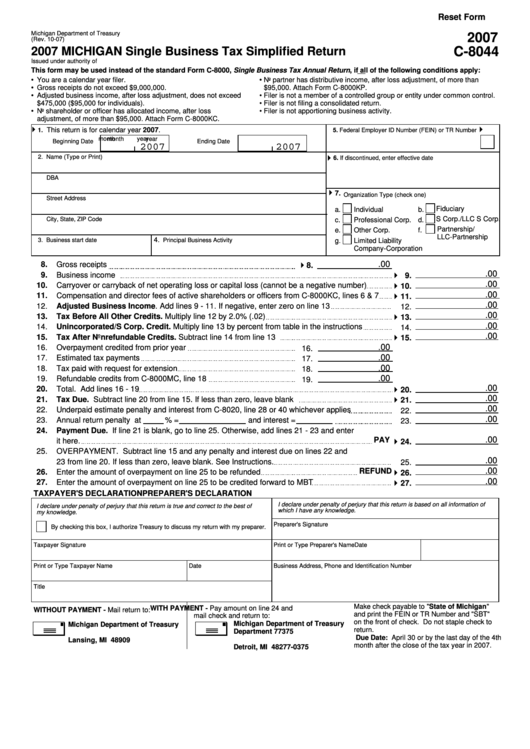

2007 MICHIGAN Single Business Tax Simplified Return

Issued under authority of P.A. 228 of 1975.

This form may be used instead of the standard Form C-8000, Single Business Tax Annual Return, if all of the following conditions apply:

•

You are a calendar year filer.

•

No partner has distributive income, after loss adjustment, of more than

Gross receipts do not exceed $9,000,000.

$95,000. Attach Form C-8000KP.

•

Adjusted business income, after loss adjustment, does not exceed

•

Filer is not a member of a controlled group or entity under common control.

•

$475,000 ($95,000 for individuals).

•

Filer is not filing a consolidated return.

•

No shareholder or officer has allocated income, after loss

•

Filer is not apportioning business activity.

adjustment, of more than $95,000. Attach Form C-8000KC.

This return is for calendar year 2007.

1.

5. Federal Employer ID Number (FEIN) or TR Number

month

year

month

year

Beginning Date

Ending Date

2007

2007

2. Name (Type or Print)

6. If discontinued, enter effective date

DBA

7.

Organization Type (check one)

Street Address

Fiduciary

a.

Individual

b.

S Corp./LLC S Corp.

City, State, ZIP Code

c.

Professional Corp.

d.

Partnership/

e.

Other Corp.

f.

LLC-Partnership

4.

3. Business start date

Principal Business Activity

g.

Limited Liability

Company-Corporation

.00

8.

Gross receipts

8.

.00

9.

Business income

9.

.00

10.

Carryover or carryback of net operating loss or capital loss (cannot be a negative number)

10.

.00

11.

Compensation and director fees of active shareholders or officers from C-8000KC, lines 6 & 7

11.

.00

12.

Adjusted Business Income. Add lines 9 - 11. If negative, enter zero on line 13

12.

.00

13.

Tax Before All Other Credits. Multiply line 12 by 2.0% (.02)

13.

.00

14.

Unincorporated/S Corp. Credit. Multiply line 13 by percent from table in the instructions

14.

.00

15.

Tax After Nonrefundable Credits. Subtract line 14 from line 13

15.

.00

16.

Overpayment credited from prior year

16.

.00

17.

Estimated tax payments

17.

.00

18.

Tax paid with request for extension

18.

.00

19.

Refundable credits from C-8000MC, line 18

19.

.00

20.

Total. Add lines 16 - 19

20.

.00

21.

Tax Due. Subtract line 20 from line 15. If less than zero, leave blank

21.

.00

22.

Underpaid estimate penalty and interest from C-8020, line 28 or 40 whichever applies

22.

.00

23.

Annual return penalty at

% =

and interest =

23.

24.

Payment Due. If line 21 is blank, go to line 25. Otherwise, add lines 21 - 23 and enter

.00

PAY

it here.

24.

25.

OVERPAYMENT. Subtract line 15 and any penalty and interest due on lines 22 and

.00

23 from line 20. If less than zero, leave blank. See Instructions.

25.

.00

REFUND

26.

Enter the amount of overpayment on line 25 to be refunded

26.

.00

27.

Enter the amount of overpayment on line 25 to be credited forward to MBT

27.

TAXPAYER'S DECLARATION

PREPARER'S DECLARATION

I declare under penalty of perjury that this return is based on all information of

I declare under penalty of perjury that this return is true and correct to the best of

which I have any knowledge.

my knowledge.

Preparer's Signature

By checking this box, I authorize Treasury to discuss my return with my preparer.

Taxpayer Signature

Print or Type Preparer's Name

Date

Print or Type Taxpayer Name

Date

Business Address, Phone and Identification Number

Title

Make check payable to "State of Michigan"

WITH PAYMENT - Pay amount on line 24 and

WITHOUT PAYMENT - Mail return to:

and print the FEIN or TR Number and "SBT"

mail check and return to:

on the front of check. Do not staple check to

Michigan Department of Treasury

Michigan Department of Treasury

return.

Department 77375

P.O. Box 30059

Due Date: April 30 or by the last day of the 4th

P.O. Box 77000

Lansing, MI 48909

month after the close of the tax year in 2007.

Detroit, MI 48277-0375

1

1