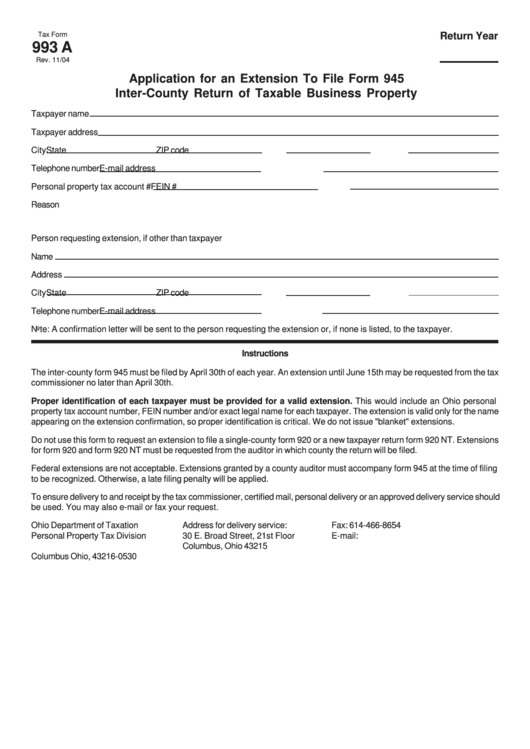

Tax Form

Return Year

993 A

Rev. 11/04

Application for an Extension To File Form 945

Inter-County Return of Taxable Business Property

Taxpayer name

Taxpayer address

City

State

ZIP code

Telephone number

E-mail address

Personal property tax account #

FEIN #

Reason

Person requesting extension, if other than taxpayer

Name

Address

City

State

ZIP code

Telephone number

E-mail address

Note: A confirmation letter will be sent to the person requesting the extension or, if none is listed, to the taxpayer.

Instructions

The inter-county form 945 must be filed by April 30th of each year. An extension until June 15th may be requested from the tax

commissioner no later than April 30th.

Proper identification of each taxpayer must be provided for a valid extension. This would include an Ohio personal

property tax account number, FEIN number and/or exact legal name for each taxpayer. The extension is valid only for the name

appearing on the extension confirmation, so proper identification is critical. We do not issue "blanket" extensions.

Do not use this form to request an extension to file a single-county form 920 or a new taxpayer return form 920 NT. Extensions

for form 920 and form 920 NT must be requested from the auditor in which county the return will be filed.

Federal extensions are not acceptable. Extensions granted by a county auditor must accompany form 945 at the time of filing

to be recognized. Otherwise, a late filing penalty will be applied.

To ensure delivery to and receipt by the tax commissioner, certified mail, personal delivery or an approved delivery service should

be used. You may also e-mail or fax your request.

Ohio Department of Taxation

Address for delivery service:

Fax: 614-466-8654

Personal Property Tax Division

30 E. Broad Street, 21st Floor

E-mail: extensions@tax.state.oh.us

P.O. Box 530

Columbus, Ohio 43215

Columbus Ohio, 43216-0530

1

1