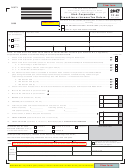

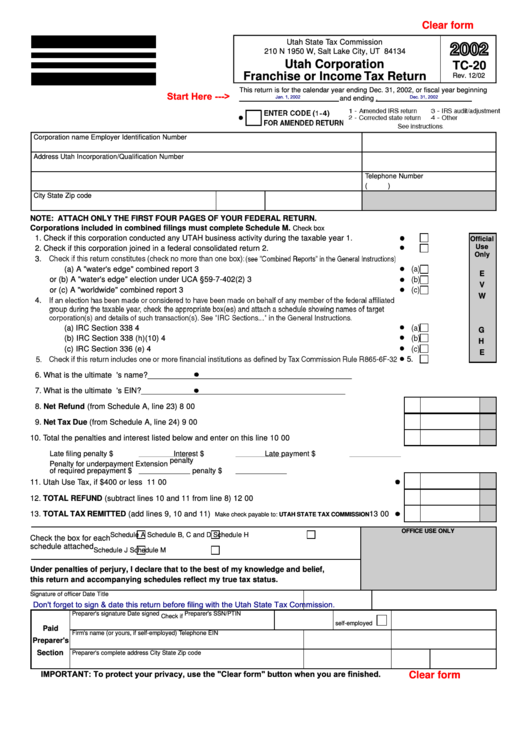

Form Tc-20 - Utah Corporation Franchise Or Income Tax Return - 2002

ADVERTISEMENT

Clear form

Utah State Tax Commission

210 N 1950 W, Salt Lake City, UT 84134

Utah Corporation

TC-20

Franchise or Income Tax Return

Rev. 12/02

This return is for the calendar year ending Dec. 31, 2002, or fiscal year beginning

Start Here --->

Jan. 1, 2002

Dec. 31, 2002

and ending

.

Corporation name

Employer Identification Number

Address

Utah Incorporation/Qualification Number

Telephone Number

(

)

City

State

Zip code

NOTE: ATTACH ONLY THE FIRST FOUR PAGES OF YOUR FEDERAL RETURN.

Corporations included in combined filings must complete Schedule M.

Check box

1. Check if this corporation conducted any UTAH business activity during the taxable year ....................

1.

Official

Use

2. Check if this corporation joined in a federal consolidated return

..........................................................

2.

Only

3.

(a) A "water's edge" combined report

............................................................................................

3

E

or (b) A "water's edge" election under UCA §59-7-402(2)

.................................................................

3

V

or (c) A "worldwide" combined report

............................................................................................

3

W

4.

(a) IRC Section 338

.......................................................................................................................

4

G

(b) IRC Section 338 (h)(10)

...........................................................................................................

4

H

(c) IRC Section 336 (e) ..................................................................................................................

4

E

5.

6. What is the ultimate U.S. parent's name?

______________________________________________

7. What is the ultimate U.S. parent's EIN?

______________________________________________

8. Net Refund (from Schedule A, line 23) .................................................................................................

8

00

9. Net Tax Due (from Schedule A, line 24) ...............................................................................................

9

00

10. Total the penalties and interest listed below and enter on this line

......................................................

10

00

Late filing penalty

$

Interest

$

Late payment $

penalty

Penalty for underpayment

Extension

of required prepayment

$

penalty

$

11. Utah Use Tax, if $400 or less ...............................................................................................................

11

00

12. TOTAL REFUND (subtract lines 10 and 11 from line 8) .......................................................................

12

00

13. TOTAL TAX REMITTED (add lines 9, 10 and 11)

......

13

00

Make check payable to: UTAH STATE TAX COMMISSION

OFFICE USE ONLY

Schedule A

Schedule B, C and D

Schedule H

Check the box for each

schedule attached

Schedule J

Schedule M

Under penalties of perjury, I declare that to the best of my knowledge and belief,

this return and accompanying schedules reflect my true tax status.

Signature of officer

Date

Title

Don't forget to sign & date this return before filing with the Utah State Tax Commission.

Preparer's signature

Date signed

Preparer's SSN/PTIN

Check if

self-employed

Paid

Firm's name (or yours, if self-employed)

Telephone

EIN

Preparer's

Section

Preparer's complete address

City

State

Zip code

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2