Form St-134 - Exemption Certificate For Construction Contractors - 2005

ADVERTISEMENT

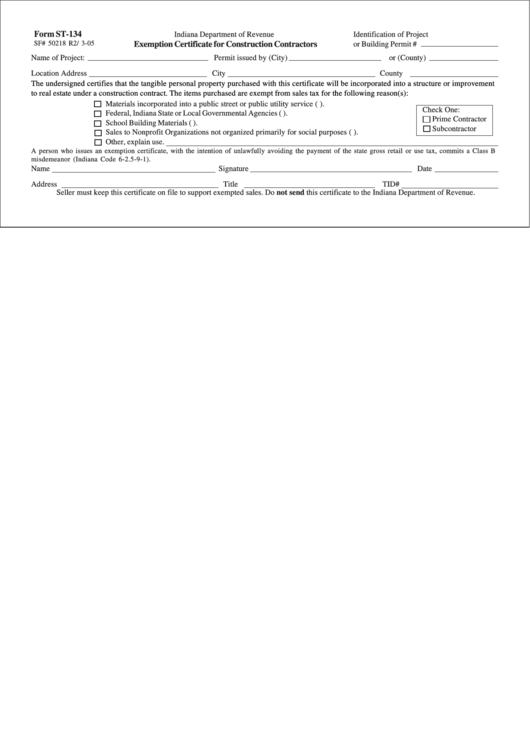

Form ST-134

Indiana Department of Revenue

Identification of Project

Exemption Certificate for Construction Contractors

or Building Permit #

SF# 50218 R2/ 3-05

Name of Project:

Permit issued by (City)

or (County)

Location Address

City

County

The undersigned certifies that the tangible personal property purchased with this certificate will be incorporated into a structure or improvement

to real estate under a construction contract. The items purchased are exempt from sales tax for the following reason(s):

Materials incorporated into a public street or public utility service (I.C. 6-2.5-5-7).

Check One:

Federal, Indiana State or Local Governmental Agencies (I.C. 6-2.5-5-16).

Prime Contractor

School Building Materials (I.C. 6-2.5-5-23).

Subcontractor

Sales to Nonprofit Organizations not organized primarily for social purposes (I.C. 6-2.5-5-25).

Other, explain use.

A person who issues an exemption certificate, with the intention of unlawfully avoiding the payment of the state gross retail or use tax, commits a Class B

misdemeanor (Indiana Code 6-2.5-9-1).

Name

Signature

Date

Address

Title

TID#

Seller must keep this certificate on file to support exempted sales. Do not send this certificate to the Indiana Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1