Form Wh-4852 - Indiana Substitute For Form W-2 Or Form 1099-R

ADVERTISEMENT

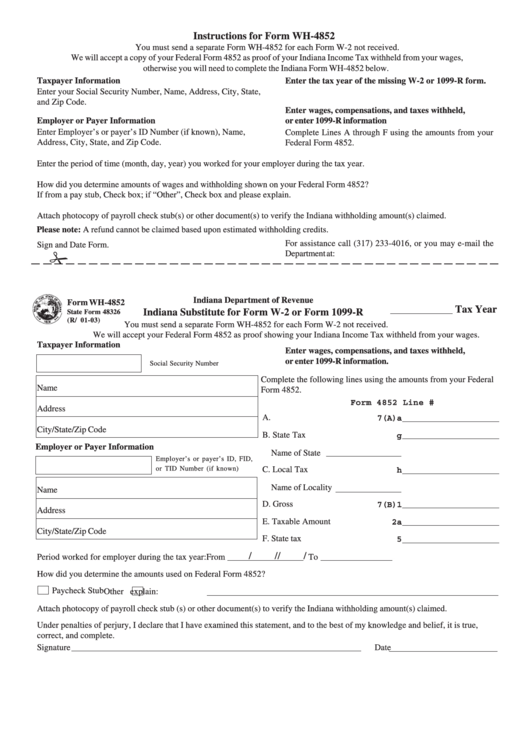

Instructions for Form WH-4852

You must send a separate Form WH-4852 for each Form W-2 not received.

We will accept a copy of your Federal Form 4852 as proof of your Indiana Income Tax withheld from your wages,

otherwise you will need to complete the Indiana Form WH-4852 below.

Taxpayer Information

Enter the tax year of the missing W-2 or 1099-R form.

Enter your Social Security Number, Name, Address, City, State,

and Zip Code.

Enter wages, compensations, and taxes withheld,

Employer or Payer Information

or enter 1099-R information

Enter Employer’s or payer’s ID Number (if known), Name,

Complete Lines A through F using the amounts from your

Address, City, State, and Zip Code.

Federal Form 4852.

Enter the period of time (month, day, year) you worked for your employer during the tax year.

How did you determine amounts of wages and withholding shown on your Federal Form 4852?

If from a pay stub, Check box; if “Other”, Check box and please explain.

Attach photocopy of payroll check stub(s) or other document(s) to verify the Indiana withholding amount(s) claimed.

Please note: A refund cannot be claimed based upon estimated withholding credits.

For assistance call (317) 233-4016, or you may e-mail the

Sign and Date Form.

Department at:

gov/dor/contact/email.html

Indiana Department of Revenue

Form WH-4852

Tax Year

Indiana Substitute for Form W-2 or Form 1099-R

State Form 48326

(R/ 01-03)

You must send a separate Form WH-4852 for each Form W-2 not received.

We will accept your Federal Form 4852 as proof showing your Indiana Income Tax withheld from your wages.

Taxpayer Information

Enter wages, compensations, and taxes withheld,

or enter 1099-R information.

Social Security Number

Complete the following lines using the amounts from your Federal

Name

Form 4852.

Form 4852 Line #

Address

A. Wages ....................................

7(A)a

City/State/Zip Code

B. State Tax Withheld .........................

g

Employer or Payer Information

Name of State

Employer’s or payer’s ID, FID,

or TID Number (if known)

C. Local Tax Withheld .......................

h

Name of Locality

Name

D. Gross Distribution .................

7(B)1

Address

E. Taxable Amount ...........................

2a

City/State/Zip Code

F. State tax withheld ..........................

5

/

/

/

/

Period worked for employer during the tax year: From

To

How did you determine the amounts used on Federal Form 4852?

Paycheck Stub

Other explain:

Attach photocopy of payroll check stub (s) or other document(s) to verify the Indiana withholding amount(s) claimed.

Under penalties of perjury, I declare that I have examined this statement, and to the best of my knowledge and belief, it is true,

correct, and complete.

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1