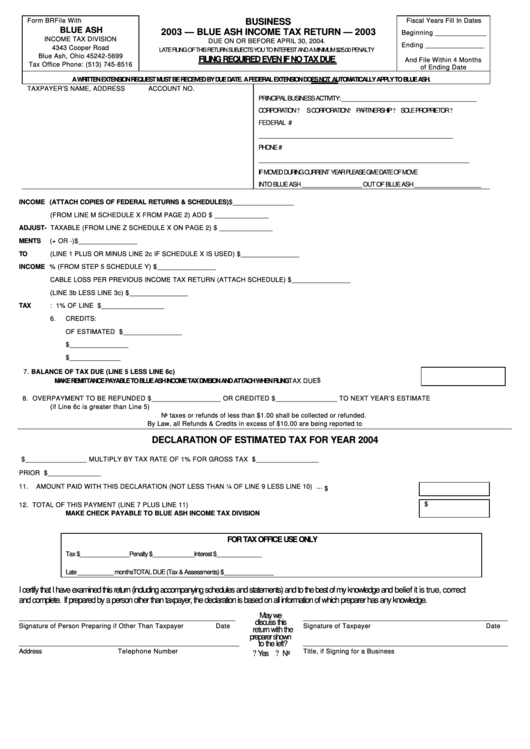

Form Br - Blue Ash Income Tax Return - 2003

ADVERTISEMENT

Form BR

File With

BUSINESS

Fiscal Years Fill In Dates

BLUE ASH

2003 — BLUE ASH INCOME TAX RETURN — 2003

Beginning _____________

INCOME TAX DIVISION

DUE ON OR BEFORE APRIL 30, 2004.

Ending _______________

4343 Cooper Road

LATE FILING OF THIS RETURN SUBJECTS YOU TO INTEREST AND A MINIMUM $25.00 PENALTY

Blue Ash, Ohio 45242-5699

FILING REQUIRED EVEN IF NO TAX DUE

And File Within 4 Months

Tax Office Phone: (513) 745-8516

of Ending Date

A WRITTEN EXTENSION REQUEST MUST BE RECEIVED BY DUE DATE. A FEDERAL EXTENSIONDOES NOT AUTOMATICALLY APPLY TO BLUE ASH.

TAXPAYER’S NAME, ADDRESS

ACCOUNT NO.

PRINCIPAL BUSINESS ACTIVITY: ___________________________________________

CORPORATION? S CORPORATION ? PARTNERSHIP ? SOLE PROPRIETOR ?

FEDERAL I.D. #

___________________________________________________________

PHONE #

________________________________________________________________

IF MOVED DURING CURRENT YEAR PLEASE GIVE DATE OF MOVE

INTO BLUE ASH ___________________ OUT OF BLUE ASH _____________________

INCOME 1.

TOTAL INCOME FROM PAGE 2 (ATTACH COPIES OF FEDERAL RETURNS & SCHEDULES) .................................$________________

2a. ITEMS NOT DEDUCTIBLE (FROM LINE M SCHEDULE X FROM PAGE 2)

............. ADD $ ______________

ADJUST-

b. ITEMS NOT TAXABLE (FROM LINE Z SCHEDULE X ON PAGE 2)...........................DEDUCT $ ______________

MENTS

c. DIFFERENCE BETWEEN LINES 2a AND 2b TO BE ADDED TO OR SUBTRACTED FROM LINE 1....... (+ OR -)

$ _______________

TO

3a. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2c IF SCHEDULE X IS USED)......................................

$ _______________

INCOME

b. AMOUNT OF LINE 3a ALLOCABLE _________% (FROM STEP 5 SCHEDULE Y)...................................................

$ _______________

c. LESS ALLOCABLE LOSS PER PREVIOUS INCOME TAX RETURN (ATTACH SCHEDULE).................................

$ _______________

4.

AMOUNT SUBJECT TO BLUE ASH EARNINGS TAX (LINE 3b LESS LINE 3c).......................................................

$ _______________

TAX

5.

TAX: 1% OF LINE 4...................................................................................................................................................... $________________

6.

CREDITS:

a. PAYMENTS AND CREDITS ON 2003 DECLARATION OF ESTIMATED TAX...................

$ _______________

b. PRIOR YEAR OVERPAYMENT............................................................................................

$ _______________

c. TOTAL CREDITS ALLOWABLE............................................................................................................................. $ _____________

7. BALANCE OF TAX DUE (LINE 5 LESS LINE 6c)

$

MAKE REMITTANCE PAYABLE TO BLUE ASH INCOME TAX DIVISION AND ATTACH WHEN FILING....... ...... ..... ....2003 TAX DUE

8. OVERPAYMENT TO BE REFUNDED $__________________ OR CREDITED $________________ TO NEXT YEAR’S ESTIMATE

(if Line 6c is greater than Line 5)

No taxes or refunds of less than $1.00 shall be collected or refunded.

By Law, all Refunds & Credits in excess of $10.00 are being reported to I.R.S.

DECLARATION OF ESTIMATED TAX FOR YEAR 2004

9.

TOTAL INCOME SUBJECT TO TAX $________________ MULTIPLY BY TAX RATE OF 1% FOR GROSS TAX OF..............

$________________

10. LESS OVERPAYMENT FROM PRIOR YEAR................................................................................................ .....................................$______________

11.

AMOUNT PAID WITH THIS DECLARATION (NOT LESS THAN ¼ OF LINE 9 LESS LINE 10) ................... ................... ........

$

$

12. TOTAL OF THIS PAYMENT (LINE 7 PLUS LINE 11) .................................................................................. ...............................

MAKE CHECK PAYABLE TO BLUE ASH INCOME TAX DIVISION

FOR TAX OFFICE USE ONLY

Tax $_______________

Penalty $_____________

Interest $______________

Late ___________ months

TOTAL DUE (Tax & Assessments) ............................. .............................$_____________

I certify that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct

and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which preparer has any knowledge.

May we

_______________________________________________________

____________________________________________________

discuss this

Signature of Person Preparing if Other Than Taxpayer

Date

Signature of Taxpayer

Date

return with the

preparer shown

________________________________________________________

____________________________________________________

to the left?

?

?

Address

Telephone Number

Title, if Signing for a Business

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3