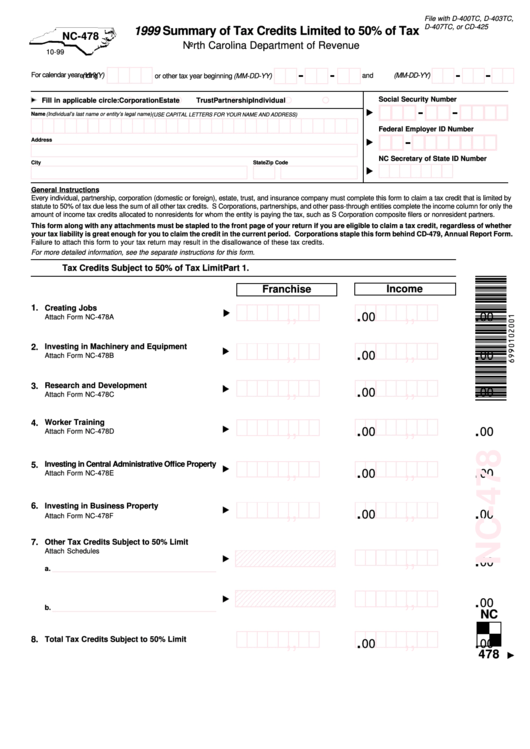

Form Nc-478 - Summary Of Tax Credits Limited To 50% Of Tax - 1999

ADVERTISEMENT

File with D-400TC, D-403TC,

D-407TC, or CD-425

1999 Summary of Tax Credits Limited to 50% of Tax

NC-478

North Carolina Department of Revenue

10-99

For calendar year

(YYYY)

ending (MM-DD-YY)

or other tax year beginning (MM-DD-YY)

and

Social Security Number

Fill in applicable circle:

Individual

Partnership

Corporation

Estate

Trust

Name (Individual’s last name or entity’s legal name) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Federal Employer ID Number

Address

NC Secretary of State ID Number

City

State

Zip Code

General Instructions

Every individual, partnership, corporation (domestic or foreign), estate, trust, and insurance company must complete this form to claim a tax credit that is limited by

statute to 50% of tax due less the sum of all other tax credits. S Corporations, partnerships, and other pass-through entities complete the income column for only the

amount of income tax credits allocated to nonresidents for whom the entity is paying the tax, such as S Corporation composite filers or nonresident partners.

This form along with any attachments must be stapled to the front page of your return if you are eligible to claim a tax credit, regardless of whether

your tax liability is great enough for you to claim the credit in the current period. Corporations staple this form behind CD-479, Annual Report Form.

Failure to attach this form to your tax return may result in the disallowance of these tax credits.

For more detailed information, see the separate instructions for this form.

Part 1.

Tax Credits Subject to 50% of Tax Limit

Franchise

Income

1.

Creating Jobs

,

,

.

,

,

.

00

00

Attach Form NC-478A

Investing in Machinery and Equipment

2.

,

,

.

,

,

.

00

00

Attach Form NC-478B

,

,

.

,

,

.

3.

Research and Development

00

00

Attach Form NC-478C

4.

Worker Training

,

,

.

,

,

.

00

00

Attach Form NC-478D

Investing in Central Administrative Office Property

5.

,

,

.

,

,

.

00

00

Attach Form NC-478E

6.

Investing in Business Property

,

,

.

,

,

.

00

00

Attach Form NC-478F

7.

Other Tax Credits Subject to 50% Limit

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

Attach Schedules

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

,

,

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

a.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

,

,

.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3

b.

NC

,

,

.

,

,

.

8.

Total Tax Credits Subject to 50% Limit

00

00

478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2