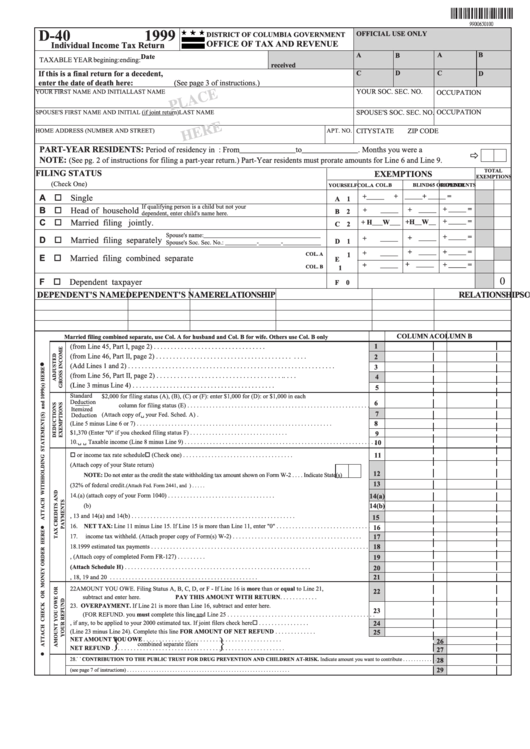

Form D-40 - Individual Income Tax Return - 1999

ADVERTISEMENT

D-40

1999

OFFICIAL USE ONLY

DISTRICT OF COLUMBIA GOVERNMENT

OFFICE OF TAX AND REVENUE

Individual Income Tax Return

A

A

B

B

Date

TAXABLE YEAR begining:

ending:

received

D

If this is a final return for a decedent,

C

C

D

(See page 3 of instructions.)

enter the date of death here:

YOUR FIRST NAME AND INITIAL

LAST NAME

YOUR SOC. SEC. NO.

OCCUPATION

OCCUPATION

SPOUSE'S FIRST NAME AND INITIAL (if joint return)

LAST NAME

SPOUSE'S SOC. SEC. NO.

HOME ADDRESS (NUMBER AND STREET)

APT. NO.

CITY

STATE

ZIP CODE

PART-YEAR RESIDENTS:

Period of residency in D.C.: From______________to______________. Months you were a D.C. resident

NOTE:

(See pg. 2 of instructions for filing a part-year return.) Part-Year residents must prorate amounts for Line 6 and Line 9.

TOTAL

FILING STATUS

EXEMPTIONS

EXEMPTIONS

(Check One)

65 OR OLDER

BLIND

COL.A COL.B

YOURSELF

DEPENDENTS

+

_____

+ _____

+ _____ =

A

Single

A 1

If qualifying person is a child but not your

+ _____ =

B

Head of household

+

_____

+ _____

B 2

dependent, enter child's name here.

+ _____ =

C

Married filing jointly.

+ H___W___

+H__W__

C 2

Spouse's name:_____________________________________

+ _____ =

+ _____

+

_____

D

Married filing separately

D 1

Spouse's Soc. Sec. No.: __________-_______-____________

+ _____ =

+ _____

+

_____

COL. A

1

E

Married filing combined separate

E

+ _____

+

_____

+ _____ =

COL. B

1

0

F

Dependent taxpayer

F 0

DEPENDENT'S NAME

RELATIONSHIP

SOC. SEC. NO.

DEPENDENT'S NAME

RELATIONSHIP

SOC. SEC. NO.

COLUMN A

COLUMN B

Married filing combined separate, use Col. A for husband and Col. B for wife. Others use Col. B only

1. Federal adjusted gross income (from Line 45, Part I, page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Total additions (from Line 46, Part II, page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Total (Add Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4. Total Subtractions (from Line 56, Part II, page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. D.C. adjusted gross income (Line 3 minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Standard

6. Enter $2,000 for filing status (A), (B), (C) or (F): enter $1,000 for (D): or $1,000 in each

Deduction

6

column for filing status (E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Itemized

7

7. Total itemized D.C. deductions. Enter amount from Line 61 pg. 2 (Attach copy of your Fed. Sched. A) .

Deduction

8. Net income (Line 5 minus Line 6 or 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Multiply total exemptions by $1,370 (Enter "0" if you checked filing status F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Taxable income (Line 8 minus Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Tax from either tax tables

or income tax rate schedule

(Check one) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12. Out-of-State tax credit see pg. 6 of instructions (Attach copy of your State return)

12

NOTE: Do not enter as the credit the state withholding tax amount shown on Form W-2 . . . . Indicate State(s)

13

13. Child and dependent care credit (32% of federal credit.

(Attach Fed. Form 2441, and D.C. Form 2441 if part-year filer) . . . . .

14. (a) D.C. low income credit (attach copy of your Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14(a)

(b) D.C. Metropolitan Police Department housing income tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14(b)

15. Total credit. Add Lines 12, 13 and 14(a) and 14(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16. NET TAX: Line 11 minus Line 15. If Line 15 is more than Line 11, enter "0" . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. D.C. income tax withheld. (Attach proper copy of Form(s) W-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. 1999 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Payments submitted with request for extension of time to file, (Attach copy of completed Form FR-127) . . . . . . . . .

19

20. Property tax credit. (Attach Schedule H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21. Total payments and credits. Add Lines 17, 18, 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 AMOUNT YOU OWE. Filing Status A, B, C, D, or F - If Line 16 is more than or equal to Line 21,

22

subtract and enter here.

PAY THIS AMOUNT WITH RETURN. . . . . . . . . . . .

23. OVERPAYMENT. If Line 21 is more than Line 16, subtract and enter here.

23

(FOR REFUND. you must complete this line and Line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24. Amount of Line 23, if any, to be applied to your 2000 estimated tax. If joint filers check here

. . . . . . . . . . . . . . . .

24

25. Refund amount (Line 23 minus Line 24). Complete this line FOR AMOUNT OF NET REFUND . . . . . . . . . . . . .

25

}

26. Status E

}

NET AMOUNT YOU OWE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

combined separate filers

27. Filers Only

NET REFUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

. . . . . .

28. CONTRIBUTION TO THE PUBLIC TRUST FOR DRUG PREVENTION AND CHILDREN AT-RISK. Indicate amount you want to contribute . . . . . . . . . . . . .

28

29

29. Enter amount of refund or payment due after your contribution (see page 7 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2