Form 2101 - W-2 Withholding Declaration

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

MONTANA

4

2101

5

5

Rev 02 12

6

6

7

7

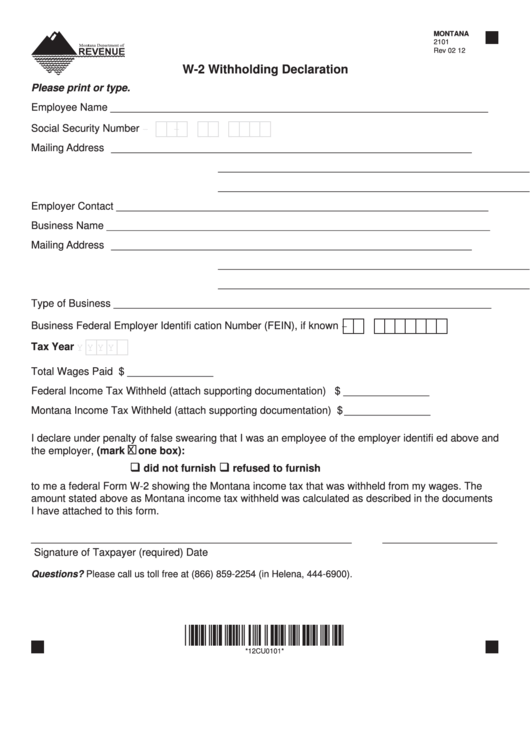

W-2 Withholding Declaration

8

8

9

9

Please print or type.

10

10

Employee Name __________________________________________________________________

11

11

12

12

13

Social Security Number

13

-

-

14

14

Mailing Address

_______________________________________________________________

15

15

16

16

_______________________________________________________________

17

17

18

18

_______________________________________________________________

19

19

20

20

Employer Contact _________________________________________________________________

21

21

22

22

Business Name ___________________________________________________________________

23

23

24

24

Mailing Address

_______________________________________________________________

25

25

26

26

_______________________________________________________________

27

27

_______________________________________________________________

28

28

29

29

Type of Business __________________________________________________________________

30

30

31

31

32

Business Federal Employer Identifi cation Number (FEIN), if known

32

-

33

33

34

Tax Year

34

Y Y Y Y

35

35

36

36

Total Wages Paid ................................................................................................... $ _______________

37

37

38

38

Federal Income Tax Withheld (attach supporting documentation) ....................... $ _______________

39

39

40

40

Montana Income Tax Withheld (attach supporting documentation) ...................... $ _______________

41

41

42

42

I declare under penalty of false swearing that I was an employee of the employer identifi ed above and

43

43

44

X

44

the employer, (mark

one box):

45

45

did not furnish

refused to furnish

46

46

47

47

to me a federal Form W-2 showing the Montana income tax that was withheld from my wages. The

48

48

amount stated above as Montana income tax withheld was calculated as described in the documents

49

49

I have attached to this form.

50

50

51

51

52

52

________________________________________________________

____________________

53

53

Signature of Taxpayer (required)

Date

54

54

55

55

56

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

56

57

57

58

58

59

59

60

60

61

61

*12CU0101*

62

62

63

63

*12CU0101*

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1