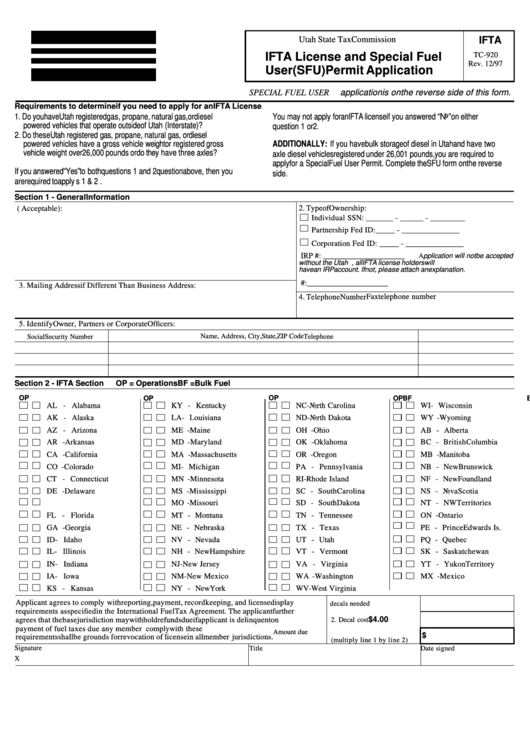

IFTA

Utah State Tax Commission

IFTA License and Special Fuel

TC-920

Rev. 12/97

User (SFU) Permit Application

application is on the reverse side of this form.

SPECIAL FUEL USER

Requirements to determine if you need to apply for an IFTA License

1. Do you have Utah registered gas, propane, natural gas, or diesel

You may not apply for an IFTA license if you answered “ N o”on either

powered vehicles that operate outside of Utah (Interstate)?

question 1 or 2.

2. Do these Utah registered gas, propane, natural gas, or diesel

ADDITIONALLY:

powered vehicles have a gross vehicle weight or registered gross

If you have bulk storage of diesel in Utah and have two

vehicle weight over 26,000 pounds or do they have three axles?

axle diesel vehicles registered under 26,001 pounds, you are required to

apply for a Special Fuel User Permit. Complete the SFU form on the reverse

If you answered “ Y es”to both questions 1 and 2 question above, then you

side.

are required to apply for a IFTA License. Complete Sections 1 & 2.

Section 1 - General Information

2. Type of Ownership:

1. Business Name and Address (P.O. Box Not Acceptable):

Individual SSN: _______ - ______ - _________

Partnership Fed ID: _____ - _______________

Corporation Fed ID: _____ - _______________

IRP #: _____________________

A pplication will not be accepted

without the Utah IRP number. Normally, all IFTA license holders will

have an IRP account. If not, please attach an explanation.

U.S. DOT #: _____________________

3. Mailing Address if Different Than Business Address:

Fax telephone number

4. Telephone Number

5. Identify Owner, Partners or Corporate Officers:

Name, Address, City, State, ZIP Code

Telephone

Social Security Number

OP = Operations

BF = Bulk Fuel

Section 2 - IFTA Section

OP

OP

BF

BF

OP

BF

OP

BF

AL - Alabama

KY - Kentucky

NC - North Carolina

WI - Wisconsin

AK - Alaska

LA - Louisiana

ND - North Dakota

WY - Wyoming

AZ - Arizona

ME - Maine

OH - Ohio

AB - Alberta

AR - Arkansas

MD - Maryland

OK - Oklahoma

BC - British Columbia

CA - California

MA - Massachusetts

OR - Oregon

MB - Manitoba

CO - Colorado

MI - Michigan

PA - Pennsylvania

NB - New Brunswick

CT - Connecticut

MN - Minnesota

RI - Rhode Island

NF - New Foundland

DE - Delaware

MS - Mississippi

SC - South Carolina

NS - Nova Scotia

DC - Dist. of Col.

MO - Missouri

SD - South Dakota

NT - N W Territories

FL - Florida

MT - Montana

TN - Tennessee

ON - Ontario

GA - Georgia

NE - Nebraska

TX - Texas

PE - Prince Edwards Is.

ID - Idaho

NV - Nevada

UT - Utah

PQ - Quebec

IL

- Illinois

NH - New Hampshire

VT - Vermont

SK - Saskatchewan

IN - Indiana

NJ - New Jersey

VA - Virginia

YT - Yukon Territory

IA

- Iowa

NM - New Mexico

WA - Washington

MX - Mexico

KS - Kansas

NY - New York

WV - West Virginia

Applicant agrees to comply with reporting, payment, record keeping, and license display

1. Number of decals needed

requirements as specified in the International Fuel Tax Agreement. The applicant further

$4.00

agrees that the base jurisdiction may withhold refunds due if applicant is delinquent on

2. Decal cost

payment of fuel taxes due any member jurisdiction. Failure to comply with these

Amount due

$

requirements shall be grounds for revocation of license in all member jurisdictions.

(multiply line 1 by line 2)

Signature

Date signed

Title

X

1

1 2

2