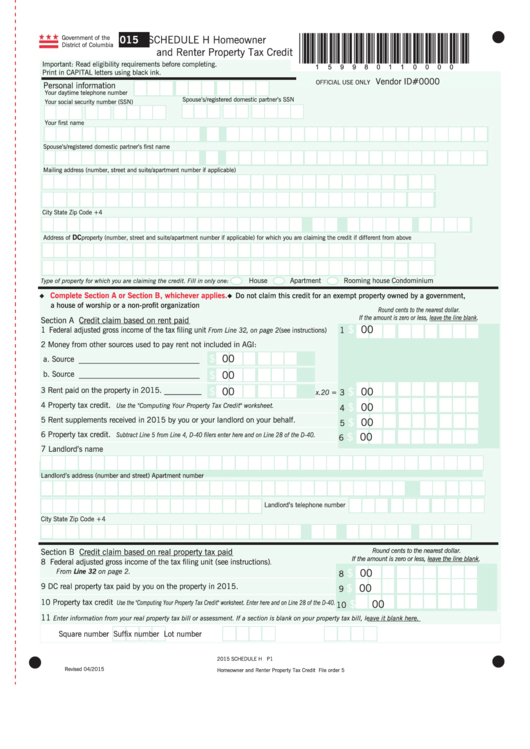

Schedule H Homeowner And Renter Property Tax Credit - Government Of The District Of Columbia - 2015

ADVERTISEMENT

l

2015

SCHEDULE H Homeowner

*159980110000*

Government of the

District of Columbia

and Renter Property Tax Credit

Important: Read eligibility requirements before completing.

Print in CAPITAL letters using black ink.

Vendor ID#0000

OFFICIAL USE ONLY

Personal information

Your daytime telephone number

Spouse’s/registered domestic partner’s SSN

Your social security number (SSN)

Your first name

M.I.

Last name

Spouse’s/registered domestic partner’s first name

M.I.

Last name

Mailing address (number, street and suite/apartment number if applicable)

City

State

Zip Code +4

DC

Address of

property (number, street and suite/apartment number if applicable) for which you are claiming the credit if different from above

House

Apartment

Rooming house

Condominium

Type of property for which you are claiming the credit. Fill in only one:

Complete Section A or Section B, whichever applies.

Do not claim this credit for an exempt property owned by a government,

u

u

a house of worship or a non-profit organization

Round cents to the nearest dollar.

If the amount is zero or less, leave the line blank.

Section A Credit claim based on rent paid

.

$

00

1 Federal adjusted gross income of the tax filing unit

1

From Line 32, on page 2 (see instructions)

2 Money from other sources used to pay rent not included in AGI:

.

$

00

a. Source _______________________________

.

b. Source _______________________________

$

00

.

.

_________

$

00

$

00

3 Rent paid on the property in 2015.

3

x.20 =

.

4 Property tax credit.

$

00

Use the "Computing Your Property Tax Credit" worksheet.

4

.

5 Rent supplements received in 2015 by you or your landlord on your behalf.

$

00

5

.

6 Property tax credit.

$

00

Subtract Line 5 from Line 4, D-40 filers enter here and on Line 28 of the D-40.

6

7

Landlord’s name

Landlord’s address (number and street)

Apartment number

Landlord’s telephone number

City

State

Zip Code +4

Round cents to the nearest dollar.

Section B Credit claim based on real property tax paid

If the amount is zero or less, leave the line blank.

8

Federal adjusted gross income of the tax filing unit (see instructions)

.

.

$

00

From Line 32 on page 2.

8

.

$

00

9

DC real property tax paid by you on the property in 2015.

9

.

10 Property tax credit

$

00

Use the "Computing Your Property Tax Credit" worksheet. Enter here and on Line 28 of the D-40.

10

11

Enter information from your real property tax bill or assessment. If a section is blank on your property tax bill, leave it blank here.

Square number

Suffix number

Lot number

l

l

2015 SCHEDULE H P1

Revised 04/2015

Homeowner and Renter Property Tax Credit

File order 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4