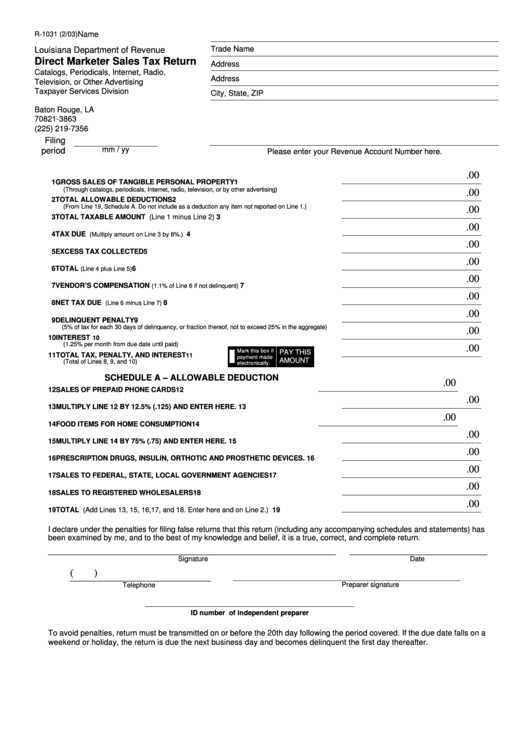

Name

R-1031 (2/03)

Trade Name

Louisiana Department of Revenue

Direct Marketer Sales Tax Return

Address

Catalogs, Periodicals, Internet, Radio,

Address

Television, or Other Advertising

Taxpayer Services Division

City, State, ZIP

P.O. Box 3863

Baton Rouge, LA

70821-3863

(225) 219-7356

Filing

mm / yy

period

Please enter your Revenue Account Number here.

.00

1

GROSS SALES OF TANGIBLE PERSONAL PROPERTY ............................................. 1

(Through catalogs, periodicals, Internet, radio, television, or by other advertising)

.00

2

TOTAL ALLOWABLE DEDUCTIONS ............................................................................. 2

(From Line 19, Schedule A. Do not include as a deduction any item not reported on Line 1.)

.00

3

TOTAL TAXABLE AMOUNT (Line 1 minus Line 2) ........................................................ 3

.00

4

TAX DUE

4

(Multiply amount on Line 3 by 8%.) ..................................................................................

.00

5

EXCESS TAX COLLECTED

5

.........................................................................................................

.00

6

TOTAL

.................................................................................................. 6

(Line 4 plus Line 5)

.00

7

VENDOR’S COMPENSATION

7

(1.1% of Line 6 if not delinquent) .................................................

.00

8

NET TAX DUE

8

(Line 6 minus Line 7) ..............................................................................................

.00

9 DELINQUENT PENALTY

9

................................................................................................................

(5% of tax for each 30 days of delinquency, or fraction thereof, not to exceed 25% in the aggregate)

.00

10

INTEREST

....................................................................................................................................... 10

(1.25% per month from due date until paid)

.00

Mark this box if

PAY THIS

11

TOTAL TAX, PENALTY, AND INTEREST

.............................................................................. 11

payment made

AMOUNT

(Total of Lines 8, 9, and 10)

electronically.

SCHEDULE A – ALLOWABLE DEDUCTION

.00

PAY THIS

12 SALES OF PREPAID PHONE CARDS

12

......................................................................

AMOUNT

.00

13 MULTIPLY LINE 12 BY 12.5% (.125) AND ENTER HERE. ........................................... 13

.00

14 FOOD ITEMS FOR HOME CONSUMPTION ..................................................... 14

.00

15 MULTIPLY LINE 14 BY 75% (.75) AND ENTER HERE. ................................................ 15

.00

16 PRESCRIPTION DRUGS, INSULIN, ORTHOTIC AND PROSTHETIC DEVICES. ........ 16

.00

17 SALES TO FEDERAL, STATE, LOCAL GOVERNMENT AGENCIES .......................... 17

.00

18 SALES TO REGISTERED WHOLESALERS .................................................................. 18

.00

19 TOTAL (Add Lines 13, 15, 16,17, and 18. Enter here and on Line 2.) ........................... 19

I declare under the penalties for filing false returns that this return (including any accompanying schedules and statements) has

been examined by me, and to the best of my knowledge and belief, it is a true, correct, and complete return.

__________________________________________________________________________________________

___________________________________________

Signature

Date

(

)

_______________________________________________________________________

____________________________________________

Telephone

Preparer signature

ID number of independent preparer

To avoid penalties, return must be transmitted on or before the 20th day following the period covered. If the due date falls on a

weekend or holiday, the return is due the next business day and becomes delinquent the first day thereafter.

1

1