Instructions For Form It 2210-1040 - 2006

ADVERTISEMENT

IT 2210-1040

Rev. 11/07

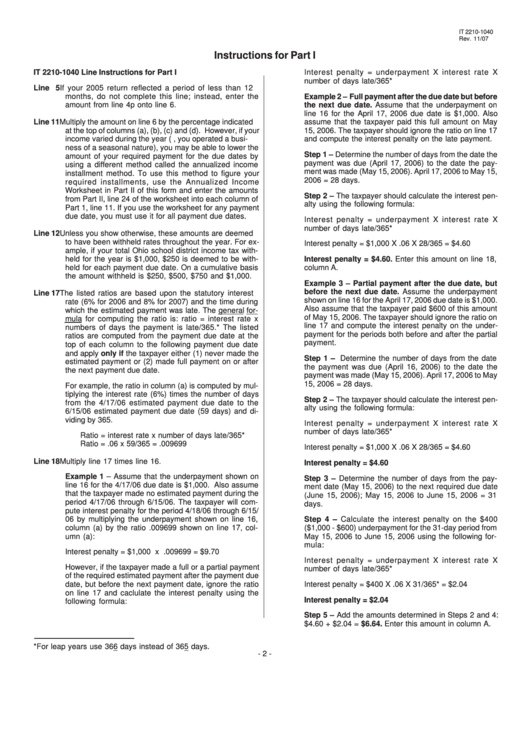

Instructions for Part I

IT 2210-1040 Line Instructions for Part I

Interest penalty = underpayment X interest rate X

number of days late/365*

Line 5 If your 2005 return reflected a period of less than 12

months, do not complete this line; instead, enter the

Example 2 – Full payment after the due date but before

amount from line 4p onto line 6.

the next due date. Assume that the underpayment on

line 16 for the April 17, 2006 due date is $1,000. Also

Line 11 Multiply the amount on line 6 by the percentage indicated

assume that the taxpayer paid this full amount on May

at the top of columns (a), (b), (c) and (d). However, if your

15, 2006. The taxpayer should ignore the ratio on line 17

income varied during the year (e.g., you operated a busi-

and compute the interest penalty on the late payment.

ness of a seasonal nature), you may be able to lower the

Step 1 – Determine the number of days from the date the

amount of your required payment for the due dates by

payment was due (April 17, 2006) to the date the pay-

using a different method called the annualized income

ment was made (May 15, 2006). April 17, 2006 to May 15,

installment method. To use this method to figure your

2006 = 28 days.

required installments, use the Annualized Income

Worksheet in Part II of this form and enter the amounts

Step 2 – The taxpayer should calculate the interest pen-

from Part II, line 24 of the worksheet into each column of

alty using the following formula:

Part 1, line 11. If you use the worksheet for any payment

due date, you must use it for all payment due dates.

Interest penalty = underpayment X interest rate X

number of days late/365*

Line 12 Unless you show otherwise, these amounts are deemed

to have been withheld rates throughout the year. For ex-

Interest penalty = $1,000 X .06 X 28/365 = $4.60

ample, if your total Ohio school district income tax with-

held for the year is $1,000, $250 is deemed to be with-

Interest penalty = $4.60. Enter this amount on line 18,

held for each payment due date. On a cumulative basis

column A.

the amount withheld is $250, $500, $750 and $1,000.

Example 3 – Partial payment after the due date, but

before the next due date. Assume the underpayment

Line 17 The listed ratios are based upon the statutory interest

shown on line 16 for the April 17, 2006 due date is $1,000.

rate (6% for 2006 and 8% for 2007) and the time during

Also assume that the taxpayer paid $600 of this amount

which the estimated payment was late. The general for-

of May 15, 2006. The taxpayer should ignore the ratio on

mula for computing the ratio is: ratio = interest rate x

line 17 and compute the interest penalty on the under-

numbers of days the payment is late/365.* The listed

payment for the periods both before and after the partial

ratios are computed from the payment due date at the

payment.

top of each column to the following payment due date

and apply only if the taxpayer either (1) never made the

Step 1 – Determine the number of days from the date

estimated payment or (2) made full payment on or after

the payment was due (April 16, 2006) to the date the

the next payment due date.

payment was made (May 15, 2006). April 17, 2006 to May

15, 2006 = 28 days.

For example, the ratio in column (a) is computed by mul-

tiplying the interest rate (6%) times the number of days

Step 2 – The taxpayer should calculate the interest pen-

from the 4/17/06 estimated payment due date to the

alty using the following formula:

6/15/06 estimated payment due date (59 days) and di-

viding by 365.

Interest penalty = underpayment X interest rate X

number of days late/365*

Ratio = interest rate x number of days late/365*

Ratio = .06 x 59/365 = .009699

Interest penalty = $1,000 X .06 X 28/365 = $4.60

Line 18 Multiply line 17 times line 16.

Interest penalty = $4.60

Example 1 – Assume that the underpayment shown on

Step 3 – Determine the number of days from the pay-

line 16 for the 4/17/06 due date is $1,000. Also assume

ment date (May 15, 2006) to the next required due date

that the taxpayer made no estimated payment during the

(June 15, 2006); May 15, 2006 to June 15, 2006 = 31

period 4/17/06 through 6/15/06. The taxpayer will com-

days.

pute interest penalty for the period 4/18/06 through 6/15/

06 by multiplying the underpayment shown on line 16,

Step 4 – Calculate the interest penalty on the $400

column (a) by the ratio .009699 shown on line 17, col-

($1,000 - $600) underpayment for the 31-day period from

umn (a):

May 15, 2006 to June 15, 2006 using the following for-

mula:

Interest penalty = $1,000 x .009699 = $9.70

Interest penalty = underpayment X interest rate X

However, if the taxpayer made a full or a partial payment

number of days late/365*

of the required estimated payment after the payment due

date, but before the next payment date, ignore the ratio

Interest penalty = $400 X .06 X 31/365* = $2.04

on line 17 and caclulate the interest penalty using the

Interest penalty = $2.04

following formula:

Step 5 – Add the amounts determined in Steps 2 and 4:

$4.60 + $2.04 = $6.64. Enter this amount in column A.

*For leap years use 366 days instead of 365 days.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5