Instructions For Form 807 - Composite Individual Income Tax Return

ADVERTISEMENT

2016 807, Page 6

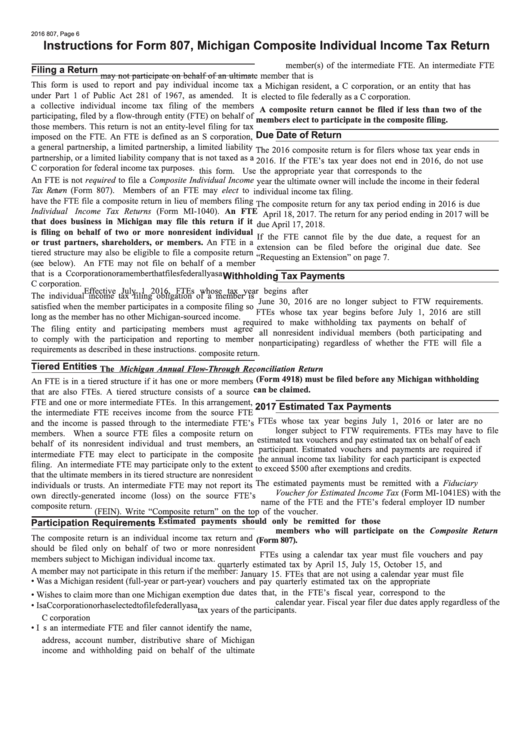

Instructions for Form 807, Michigan Composite Individual Income Tax Return

member(s) of the intermediate FTE. An intermediate FTE

Filing a Return

may not participate on behalf of an ultimate member that is

This form is used to report and pay individual income tax

a Michigan resident, a C corporation, or an entity that has

under Part 1 of Public Act 281 of 1967, as amended. It is

elected to file federally as a C corporation.

a collective individual income tax filing of the members

A composite return cannot be filed if less than two of the

participating, filed by a flow-through entity (FTE) on behalf of

members elect to participate in the composite filing.

those members. This return is not an entity-level filing for tax

Due Date of Return

imposed on the FTE. An FTE is defined as an S corporation,

a general partnership, a limited partnership, a limited liability

The 2016 composite return is for filers whose tax year ends in

partnership, or a limited liability company that is not taxed as a

2016. If the FTE’s tax year does not end in 2016, do not use

C corporation for federal income tax purposes.

this form. Use the appropriate year that corresponds to the

An FTE is not required to file a Composite Individual Income

year the ultimate owner will include the income in their federal

Tax Return (Form 807). Members of an FTE may elect to

individual income tax filing.

have the FTE file a composite return in lieu of members filing

The composite return for any tax period ending in 2016 is due

Individual Income Tax Returns (Form MI-1040). An FTE

April 18, 2017. The return for any period ending in 2017 will be

that does business in Michigan may file this return if it

due April 17, 2018.

is filing on behalf of two or more nonresident individual

If the FTE cannot file by the due date, a request for an

or trust partners, shareholders, or members. An FTE in a

extension can be filed before the original due date. See

tiered structure may also be eligible to file a composite return

“Requesting an Extension” on page 7.

(see below). An FTE may not file on behalf of a member

that is a C corporation or a member that files federally as a

Withholding Tax Payments

C corporation.

Effective July 1 2016, FTEs whose tax year begins after

The individual income tax filing obligation of a member is

June 30, 2016 are no longer subject to FTW requirements.

satisfied when the member participates in a composite filing so

FTEs whose tax year begins before July 1, 2016 are still

long as the member has no other Michigan-sourced income.

required to make withholding tax payments on behalf of

The filing entity and participating members must agree

all nonresident individual members (both participating and

to comply with the participation and reporting to member

nonparticipating) regardless of whether the FTE will file a

requirements as described in these instructions.

composite return.

Tiered Entities

The Michigan Annual Flow-Through Reconciliation Return

(Form 4918) must be filed before any Michigan withholding

An FTE is in a tiered structure if it has one or more members

can be claimed.

that are also FTEs. A tiered structure consists of a source

FTE and one or more intermediate FTEs. In this arrangement,

2017 Estimated Tax Payments

the intermediate FTE receives income from the source FTE

FTEs whose tax year begins July 1, 2016 or later are no

and the income is passed through to the intermediate FTE’s

longer subject to FTW requirements. FTEs may have to file

members. When a source FTE files a composite return on

estimated tax vouchers and pay estimated tax on behalf of each

behalf of its nonresident individual and trust members, an

participant. Estimated vouchers and payments are required if

intermediate FTE may elect to participate in the composite

the annual income tax liability for each participant is expected

filing. An intermediate FTE may participate only to the extent

to exceed $500 after exemptions and credits.

that the ultimate members in its tiered structure are nonresident

The estimated payments must be remitted with a Fiduciary

individuals or trusts. An intermediate FTE may not report its

Voucher for Estimated Income Tax (Form MI-1041ES) with the

own directly-generated income (loss) on the source FTE’s

name of the FTE and the FTE’s federal employer ID number

composite return.

(FEIN). Write “Composite return” on the top of the voucher.

Estimated payments should only be remitted for those

Participation Requirements

members who will participate on the Composite Return

The composite return is an individual income tax return and

(Form 807).

should be filed only on behalf of two or more nonresident

FTEs using a calendar tax year must file vouchers and pay

members subject to Michigan individual income tax.

quarterly estimated tax by April 15, July 15, October 15, and

A member may not participate in this return if the member:

January 15. FTEs that are not using a calendar year must file

• Was a Michigan resident (full-year or part-year)

vouchers and pay quarterly estimated tax on the appropriate

due dates that, in the FTE’s fiscal year, correspond to the

• Wishes to claim more than one Michigan exemption

calendar year. Fiscal year filer due dates apply regardless of the

• Is a C corporation or has elected to file federally as a

tax years of the participants.

C corporation

• I s an intermediate FTE and filer cannot identify the name,

address, account number, distributive share of Michigan

income and withholding paid on behalf of the ultimate

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4