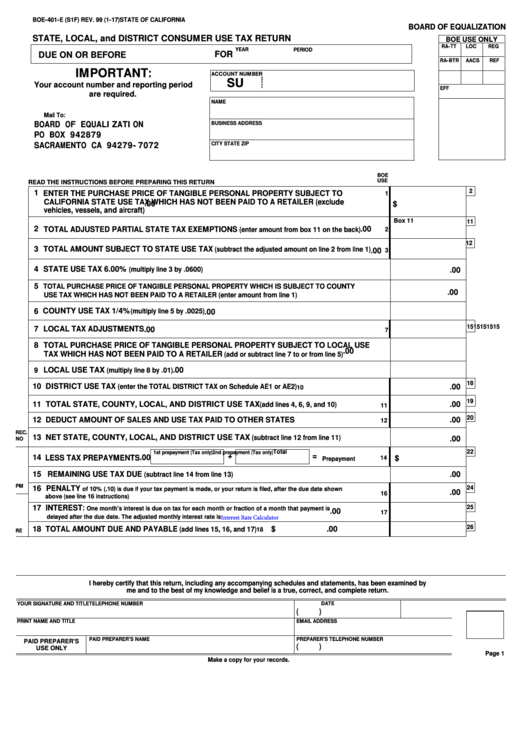

BOE-401-E (S1F) REV. 99 (1-17)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

STATE, LOCAL, and DISTRICT CONSUMER USE TAX RETURN

BOE USE ONLY

LOC

RA-TT

REG

YEAR

PERIOD

FOR

DUE ON OR BEFORE

RA-BTR

REF

AACS

IMPORTANT:

ACCOUNT NUMBER

SU

Your account number and reporting period

EFF

are required.

NAME

Mail To:

BOARD OF EQUALIZATION

BUSINESS ADDRESS

PO BOX 942879

SACRAMENTO CA 94279-7072

CITY

STATE

ZIP

BOE

USE

READ THE INSTRUCTIONS BEFORE PREPARING THIS RETURN

2

1 ENTER THE PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY SUBJECT TO

1

CALIFORNIA STATE USE TAX WHICH HAS NOT BEEN PAID TO A RETAILER (exclude

$

.00

vehicles, vessels, and aircraft)

Box 11

11

.00

2 TOTAL ADJUSTED PARTIAL STATE TAX EXEMPTIONS

(enter amount from box 11 on the back)

2

12

3 TOTAL AMOUNT SUBJECT TO STATE USE TAX

(subtract the adjusted amount on line 2 from line 1)

.00

3

4 STATE USE TAX 6.00%

.00

(multiply line 3 by .0600)

5

TOTAL PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY WHICH IS SUBJECT TO COUNTY

.00

USE TAX WHICH HAS NOT BEEN PAID TO A RETAILER (enter amount from line 1)

6 COUNTY USE TAX 1/4%

.00

(multiply line 5 by .0025)

15

15

15

15

15

7 LOCAL TAX ADJUSTMENTS

.00

7

8 TOTAL PURCHASE PRICE OF TANGIBLE PERSONAL PROPERTY SUBJECT TO LOCAL USE

.00

TAX WHICH HAS NOT BEEN PAID TO A RETAILER

(add or subtract line 7 to or from line 5)

.00

9

LOCAL USE TAX

(multiply line 8 by .01)

18

10 DISTRICT USE TAX

.00

(enter the TOTAL DISTRICT TAX on Schedule AE1 or AE2)

10

19

.00

11 TOTAL STATE, COUNTY, LOCAL, AND DISTRICT USE TAX

(add lines 4, 6, 9, and 10)

11

20

12 DEDUCT AMOUNT OF SALES AND USE TAX PAID TO OTHER STATES

.00

12

REC.

13 NET STATE, COUNTY, LOCAL, AND DISTRICT USE TAX

(subtract line 12 from line 11)

.00

NO

Total

22

1st prepayment (Tax only)

2nd prepayment (Tax only)

+

=

.00

14

LESS TAX PREPAYMENTS

$

14

Prepayment

15 REMAINING USE TAX DUE

.00

(subtract line 14 from line 13)

PM

16 PENALTY

24

of 10% (.10) is due if your tax payment is made, or your return is filed, after the due date shown

.00

16

above (see line 16 instructions)

25

17 INTEREST:

One month's interest is due on tax for each month or fraction of a month that payment is

.00

17

Interest Rate Calculator

delayed after the due date. The adjusted monthly interest rate is

26

18 TOTAL AMOUNT DUE AND PAYABLE

$

.00

(add lines 15, 16, and 17)

18

RE

I hereby certify that this return, including any accompanying schedules and statements, has been examined by

me and to the best of my knowledge and belief is a true, correct, and complete return.

YOUR SIGNATURE AND TITLE

TELEPHONE NUMBER

DATE

(

)

PRINT NAME AND TITLE

EMAIL ADDRESS

PAID PREPARER'S NAME

PREPARER'S TELEPHONE NUMBER

PAID PREPARER'S

(

)

USE ONLY

Page 1

Make a copy for your records.

1

1 2

2