Form 31-113 - Iowa Sales Tax Exemption Certificate-Energy Used In Processing /agriculture

ADVERTISEMENT

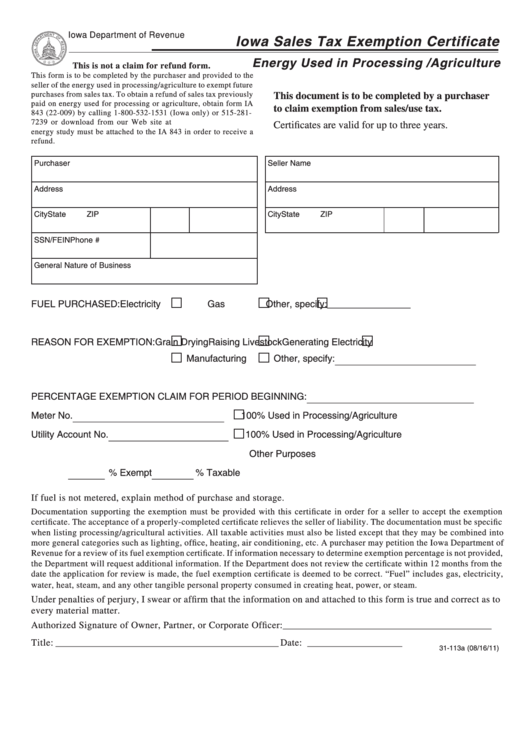

Iowa Department of Revenue

Iowa Sales Tax Exemption Certificate

Energy Used in Processing /Agriculture

This is not a claim for refund form.

This form is to be completed by the purchaser and provided to the

seller of the energy used in processing/agriculture to exempt future

purchases from sales tax. To obtain a refund of sales tax previously

This document is to be completed by a purchaser

paid on energy used for processing or agriculture, obtain form IA

to claim exemption from sales/use tax.

843 (22-009) by calling 1-800-532-1531 (Iowa only) or 515-281-

7239 or download from our Web site at . An

Certificates are valid for up to three years.

energy study must be attached to the IA 843 in order to receive a

refund.

Purchaser

Seller Name

Address

Address

City

State

ZIP

City

State

ZIP

SSN/FEIN

Phone #

General Nature of Business

FUEL PURCHASED:

Electricity

Gas

Other, specify: ________________

REASON FOR EXEMPTION:

Grain Drying

Raising Livestock

Generating Electricity

Manufacturing

Other, specify: ___________________________

PERCENTAGE EXEMPTION CLAIM FOR PERIOD BEGINNING: ________________________________

Meter No. _____________________________

100% Used in Processing/Agriculture

Utility Account No. _______________________

100% Used in Processing/Agriculture

Other Purposes

_______ % Exempt

________ % Taxable

If fuel is not metered, explain method of purchase and storage.

Documentation supporting the exemption must be provided with this certificate in order for a seller to accept the exemption

certificate. The acceptance of a properly-completed certificate relieves the seller of liability. The documentation must be specific

when listing processing/agricultural activities. All taxable activities must also be listed except that they may be combined into

more general categories such as lighting, office, heating, air conditioning, etc. A purchaser may petition the Iowa Department of

Revenue for a review of its fuel exemption certificate. If information necessary to determine exemption percentage is not provided,

the Department will request additional information. If the Department does not review the certificate within 12 months from the

date the application for review is made, the fuel exemption certificate is deemed to be correct. “Fuel” includes gas, electricity,

water, heat, steam, and any other tangible personal property consumed in creating heat, power, or steam.

Under penalties of perjury, I swear or affirm that the information on and attached to this form is true and correct as to

every material matter.

Authorized Signature of Owner, Partner, or Corporate Officer: ____________________________________________

Title: _______________________________________________ Date: ____________________

31-113a (08/16/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2