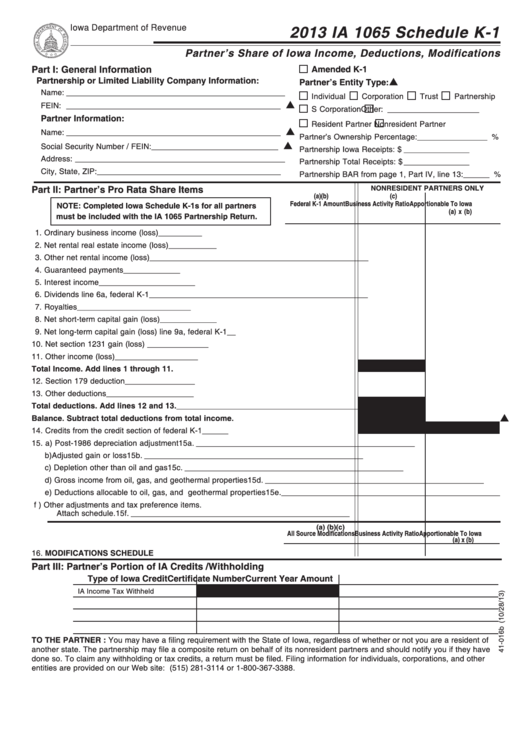

2013 IA 1065 Schedule K-1

Iowa Department of Revenue

Partner’s Share of Iowa Income, Deductions, Modifications

Part I: General Information

Amended K-1

Partnership or Limited Liability Company Information:

Partner’s Entity Type:

Name: __________________________________________________

Individual

Corporation

Trust

Partnership

FEIN: _________________________________________________

S Corporation

Other: _____________________

Partner Information:

Resident Partner

Nonresident Partner

Name: _________________________________________________

Partner’s Ownership Percentage: ________________ %

Social Security Number / FEIN: _____________________________

Partnership Iowa Receipts: $ _______________

Address: ________________________________________________

Partnership Total Receipts: $ _______________

City, State, ZIP: __________________________________________

Partnership BAR from page 1, Part IV, line 13: ______ %

Part II: Partner’s Pro Rata Share Items

NONRESIDENT PARTNERS ONLY

(a)

(b)

(c)

Federal K-1 Amount

Business Activity Ratio Apportionable To Iowa

NOTE: Completed Iowa Schedule K-1s for all partners

(a) x (b)

must be included with the IA 1065 Partnership Return.

1. Ordinary business income (loss) ................................................... 1. __________________________________________________

2. Net rental real estate income (loss) ............................................... 2. __________________________________________________

3. Other net rental income (loss) ........................................................ 3. __________________________________________________

4. Guaranteed payments .................................................................. 4. __________________________________________________

5. Interest income ............................................................................... 5. __________________________________________________

6. Dividends line 6a, federal K-1 ........................................................ 6. __________________________________________________

7. Royalties ......................................................................................... 7. __________________________________________________

8. Net short-term capital gain (loss) ................................................... 8. __________________________________________________

9. Net long-term capital gain (loss) line 9a, federal K-1 .................... 9. __________________________________________________

10. Net section 1231 gain (loss) ........................................................ 10. __________________________________________________

11. Other income (loss) ...................................................................... 11. __________________________________________________

Total Income. Add lines 1 through 11. .............................................

__________________________________________________

12. Section 179 deduction ................................................................. 12. __________________________________________________

13. Other deductions .......................................................................... 13. __________________________________________________

Total deductions. Add lines 12 and 13. ...........................................

__________________________________________________

Balance. Subtract total deductions from total income. .................

__________________________________________________

14. Credits from the credit section of federal K-1 .............................. 14. __________________________________________________

15. a) Post-1986 depreciation adjustment ....................................... 15a. __________________________________________________

b) Adjusted gain or loss ............................................................. 15b. __________________________________________________

c) Depletion other than oil and gas ........................................... 15c. __________________________________________________

d) Gross income from oil, gas, and geothermal properties ....... 15d. __________________________________________________

e) Deductions allocable to oil, gas, and geothermal properties15e. __________________________________________________

f ) Other adjustments and tax preference items.

Attach schedule. ..................................................................... 15f. __________________________________________________

(a)

(b)

(c)

All Source Modifications Business Activity Ratio

Apportionable To Iowa

(a) x (b)

16. MODIFICATIONS SCHEDULE .................................................... 16. __________________________________________________

Part III: Partner’s Portion of IA Credits /Withholding

Type of Iowa Credit

Certificate Number

Current Year Amount

IA Income Tax Withheld

TO THE PARTNER : You may have a filing requirement with the State of Iowa, regardless of whether or not you are a resident of

another state. The partnership may file a composite return on behalf of its nonresident partners and should notify you if they have

done so. To claim any withholding or tax credits, a return must be filed. Filing information for individuals, corporations, and other

entities are provided on our Web site: or by calling (515) 281-3114 or 1-800-367-3388.

1

1 2

2