Form Nh-1120-We - Combined Business Profits Tax Return - New Hampshire Department Of Revenue Administration 2000

ADVERTISEMENT

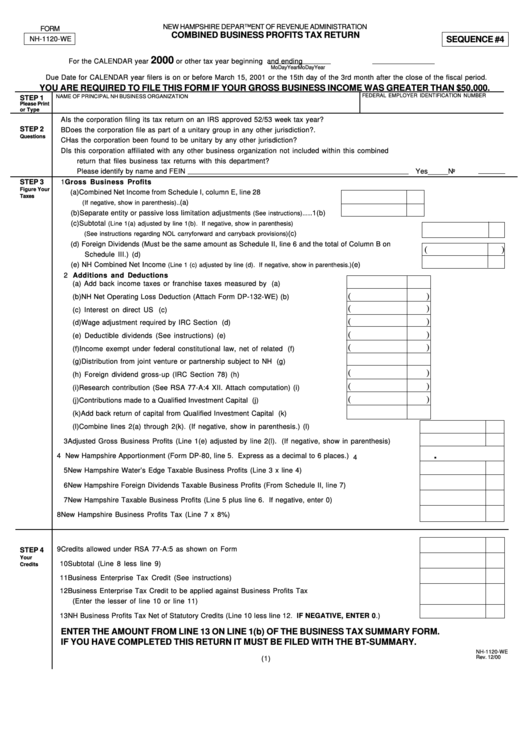

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

COMBINED BUSINESS PROFITS TAX RETURN

NH-1120-WE

SEQUENCE #4

2000

For the CALENDAR year

or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Due Date for CALENDAR year filers is on or before March 15, 2001 or the 15th day of the 3rd month after the close of the fiscal period.

YOU ARE REQUIRED TO FILE THIS FORM IF YOUR GROSS BUSINESS INCOME WAS GREATER THAN $50,000.

FEDERAL EMPLOYER IDENTIFICATION NUMBER

NAME OF PRINCIPAL NH BUSINESS ORGANIZATION

STEP 1

Please Print

or Type

A

Is the corporation filing its tax return on an IRS approved 52/53 week tax year? .......................................

Yes ______

No _______

STEP 2

B

Does the corporation file as part of a unitary group in any other jurisdiction?. ...........................................

Yes ______

No _______

Questions

C

Has the corporation been found to be unitary by any other jurisdiction? ..................................................... Yes ______

No _______

D

Is this corporation affiliated with any other business organization not included within this combined

return that files business tax returns with this department?

Please identify by name and FEIN

Yes _____

No

STEP 3

1

Gross Business Profits

Figure Your

(a) Combined Net Income from Schedule I, column E, line 28

Taxes

.................................................................1(a)

(If negative, show in parenthesis)..

(b) Separate entity or passive loss limitation adjustments

...1(b)

(See instructions)..

(c) Subtotal

(Line 1(a) adjusted by line 1(b). If negative, show in parenthesis)

.......................................................1(c)

(See instructions regarding NOL carryforward and carryback provisions)

(d) Foreign Dividends (Must be the same amount as Schedule II, line 6 and the total of Column B on

(

)

Schedule III.)......................................................................................................................................1(d)

(e) NH Combined Net Income

.........................1(e)

(Line 1 (c) adjusted by line (d). If negative, show in parenthesis.)

2 Additions and Deductions

(a) Add back income taxes or franchise taxes measured by income.................2(a)

(

)

(b) NH Net Operating Loss Deduction (Attach Form DP-132-WE)........................2(b)

(

)

(c) Interest on direct US Obligations...................................................................2(c)

(

)

(d) Wage adjustment required by IRC Section 280C............................................2(d)

(

)

(e) Deductible dividends (See instructions)........................................................2(e)

(

)

(f) Income exempt under federal constitutional law, net of related expenses.....2(f)

(g) Distribution from joint venture or partnership subject to NH taxation.............2(g)

(

)

(h) Foreign dividend gross-up (IRC Section 78)..................................................2(h)

(

)

(i) Research contribution (See RSA 77-A:4 XII. Attach computation).................2(i)

(

)

(j) Contributions made to a Qualified Investment Capital Company.....................2(j)

(k) Add back return of capital from Qualified Investment Capital Company.........2(k)

(l) Combine lines 2(a) through 2(k). (If negative, show in parenthesis.)................................................ 2(l)

3 Adjusted Gross Business Profits (Line 1(e) adjusted by line 2(l). (If negative, show in parenthesis).... 3

.

4 New Hampshire Apportionment (Form DP-80, line 5. Express as a decimal to 6 places.)........................ 4

5 New Hampshire Water’s Edge Taxable Business Profits (Line 3 x line 4)............................................... 5

6 New Hampshire Foreign Dividends Taxable Business Profits (From Schedule II, line 7).......................... 6

7 New Hampshire Taxable Business Profits (Line 5 plus line 6. If negative, enter 0)................................ 7

8 New Hampshire Business Profits Tax (Line 7 x 8%) .............................................................................. 8

9 Credits allowed under RSA 77-A:5 as shown on Form DP-160-WE........................................................ 9

STEP 4

Your

10 Subtotal (Line 8 less line 9).....................................................................................................................10

Credits

11 Business Enterprise Tax Credit (See instructions)..................................................................................11

12 Business Enterprise Tax Credit to be applied against Business Profits Tax

(Enter the lesser of line 10 or line 11).....................................................................................................12

13 NH Business Profits Tax Net of Statutory Credits (Line 10 less line 12. IF NEGATIVE, ENTER 0.)..........13

ENTER THE AMOUNT FROM LINE 13 ON LINE 1(b) OF THE BUSINESS TAX SUMMARY FORM.

IF YOU HAVE COMPLETED THIS RETURN IT MUST BE FILED WITH THE BT-SUMMARY.

NH-1120-WE

Rev. 12/00

(1)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2