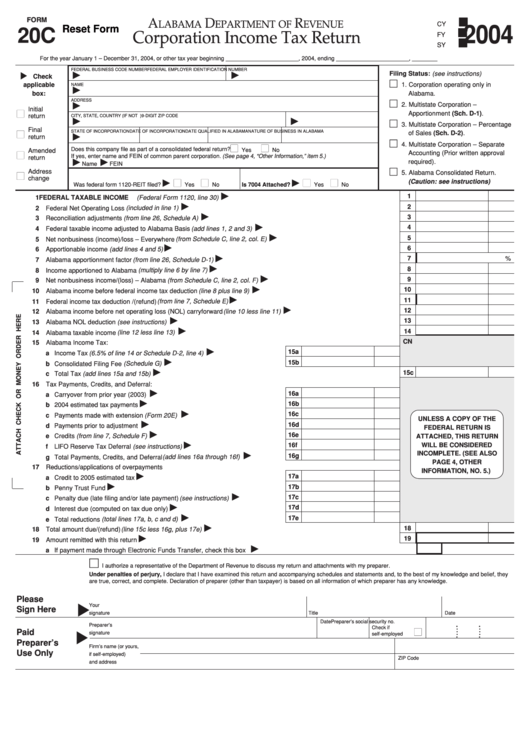

FORM

A

D

R

LABAMA

EPARTMENT OF

EVENUE

CY

2004

20C

Reset Form

Corporation Income Tax Return

FY

SY

For the year January 1 – December 31, 2004, or other tax year beginning _______________________, 2004, ending _______________________, ________

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

Filing Status: (see instructions)

Check

applicable

1. Corporation operating only in

NAME

box:

Alabama.

ADDRESS

2. Multistate Corporation –

Initial

Apportionment (Sch. D-1).

return

CITY, STATE, COUNTRY (IF NOT U.S.)

9-DIGIT ZIP CODE

3. Multistate Corporation – Percentage

Final

STATE OF INCORPORATION

DATE OF INCORPORATION

DATE QUALIFIED IN ALABAMA

NATURE OF BUSINESS IN ALABAMA

of Sales (Sch. D-2).

return

4. Multistate Corporation – Separate

Does this company file as part of a consolidated federal return?

Amended

Yes

No

Accounting (Prior written approval

If yes, enter name and FEIN of common parent corporation. (See page 4, “Other Information,” item 5.)

return

required).

Name

FEIN

Address

5. Alabama Consolidated Return.

change

(Caution: see instructions)

Was federal form 1120-REIT filed?

Yes

No

Is 7004 Attached?

Yes

No

1

1 FEDERAL TAXABLE INCOME (Federal Form 1120, line 30) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Federal Net Operating Loss (included in line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Reconciliation adjustments (from line 26, Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Federal taxable income adjusted to Alabama Basis (add lines 1, 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Net nonbusiness (income)/loss – Everywhere (from Schedule C, line 2, col. E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Apportionable income (add lines 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

%

7 Alabama apportionment factor (from line 26, Schedule D-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8 Income apportioned to Alabama (multiply line 6 by line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Net nonbusiness income/(loss) – Alabama (from Schedule C, line 2, col. F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Alabama income before federal income tax deduction (line 8 plus line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Federal income tax deduction /(refund) (from line 7, Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12 Alabama income before net operating loss (NOL) carryforward (line 10 less line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13 Alabama NOL deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14 Alabama taxable income (line 12 less line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CN

15 Alabama Income Tax:

15a

a Income Tax (6.5% of line 14 or Schedule D-2, line 4) . . . . . . . . . . . . . . . . . . . . . . . .

15b

b Consolidated Filing Fee (Schedule G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15c

c Total Tax (add lines 15a and 15b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Tax Payments, Credits, and Deferral:

16a

a Carryover from prior year (2003) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

b 2004 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16c

c Payments made with extension (Form 20E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

UNLESS A COPY OF THE

16d

d Payments prior to adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FEDERAL RETURN IS

16e

e Credits (from line 7, Schedule F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ATTACHED, THIS RETURN

WILL BE CONSIDERED

16f

f LIFO Reserve Tax Deferral (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INCOMPLETE. (SEE ALSO

16g

g Total Payments, Credits, and Deferral (add lines 16a through 16f) . . . . . . . . . . .

PAGE 4, OTHER

17 Reductions/applications of overpayments

INFORMATION, NO. 5.)

17a

a Credit to 2005 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17b

b Penny Trust Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

c Penalty due (late filing and/or late payment) (see instructions) . . . . . . . . . . . . . . .

17d

d Interest due (computed on tax due only). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17e

e Total reductions (total lines 17a, b, c and d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18 Total amount due/(refund) (line 15c less 16g, plus 17e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19 Amount remitted with this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a If payment made through Electronic Funds Transfer, check this box . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and, to the best of my knowledge and belief, they

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Your

Sign Here

signature

Title

Date

Date

Preparer’s social security no.

Preparer’s

Check if

Paid

signature

self-employed

Preparer’s

E.I. No.

Firm’s name (or yours,

Use Only

if self-employed)

ZIP Code

and address

1

1 2

2 3

3 4

4