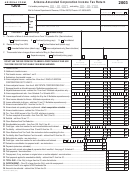

Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2001 Page 2

ADVERTISEMENT

AZ Form 120X (2001) Page 2

Schedule C - Apportionment Formula (Multistate Corporations Only)

See instruction pages 5 and 6

NOTE: Qualifying air carriers must use Schedule ACA

C1 Property Factor

Column A

Column B

Column C

Value of real and tangible personal property (by averaging the value of

Total

Total Within

Ratio Within

owned property used at the beginning and end of the tax period; rented

Within

and

Arizona

property at capitalized value)

Arizona

Without Arizona

A ÷ B

a. Owned property (at original cost):

Inventories ............................................................................................

Depreciable assets ...............................................................................

Land......................................................................................................

Other assets - (describe) ___________________________________

Minus: Construction in progress (if included in above totals) ...............

(

)

(

)

Minus: Nonbusiness property (if included in above totals) ...................

(

)

(

)

Total of section a...................................................................................

b. Rented property (capitalize at 8 times net rental paid) .........................

c. Total owned and rented property (section a total plus section b)..........

•

C2 Payroll Factor

Total wages, salaries, commissions and other compensation to employees

(per federal Form 1120 or payroll reports) ...................................................

•

C3 Sales Factor

a. Sales delivered or shipped to Arizona purchasers................................

b. Other gross receipts .............................................................................

c. Total sales and other gross receipts .....................................................

d. Double weight Arizona sales and gross receipts ..................................

X 2

e. Sales factor (for column A - multiply item c by item d; for column B -

enter amount from item c).....................................................................

•

C4 Total ratio - add C1(c), C2 and C3(e) in column C............................................................................................................................

•

C5 Average apportionment ratio - divide C4 by four (4). Enter the result in column C and on page 1, line 9(c)..................................

•

Schedule D - Schedule of Payments (List payment date and amount).

1

Payment with original return _______________________________

2

Payment after original return led____________________________

3

Payment after original return led ___________________________

4

Total - add lines 1, 2 and 3 _________________________________

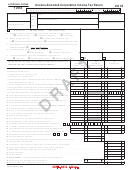

Schedule E - Explanation of Changes (See instruction page 6)

____________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

Certication

The following certication must be signed by one or more of the following ofcers (president, treasurer, or any other principal ofcer).

Under penalties of perjury, I (we), the undersigned ofcer(s) authorized to sign this return, declare that I (we) have examined this return, including the

accompanying schedules and statements, and to the best of my (our) knowledge and belief, it is a true, correct and complete return, made in good faith, for

the taxable year stated pursuant to the income tax laws of the State of Arizona.

___________________________________________________________________________________________________________________________________

Please

Ofcer’s signature

Title

Date

Sign

Here

___________________________________________________________________________________________________________________________________

Ofcer’s signature

Title

Date

____________________________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________

Paid

Preparer’s signature

Date

Preparer’s

___________________________________________________________________________________________________________________________________

Use Only

Firm’s name (or preparer’s, if self-employed)

Preparer’s TIN

___________________________________________________________________________________________________________________________________

Firm’s address

Zip code

ADOR 91-0029 (01) rj

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2